Where Do You Put Business Income On 1040

Form 1040 Form 1120 Schedule E Schedule K-1. Wages go on line 1 while interest and dividends go on lines 2.

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

Individual Income Tax Return or 1040-SR US.

Where do you put business income on 1040. Individual Income Tax Return is an IRS tax form used for personal federal income tax returns filed by United States residents. You would then enter the total amount of other income as calculated on Schedule 1 on Line 8 of Form 1040. The amount reported on Schedule E is taken from Schedule K-1 issued to you by the S corporation.

You would only report your share of business incomeexpenses by reporting Schedule K-1 on your personal return. If youre self-employed youll also need to complete Schedule SE Form 1040 Self-Employment Tax and pay self-employment tax on your net earnings from self-employment of 400 or more. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. You dont report your business income on your personal return. Entering the total on Line 8 separates it from any wages or salary you earned which are entered on Line 1 of the 2020 Form 1040.

For tax years 2016 and forward the first 250000 of business income earned by taxpayers filing Single or Married filing jointly and included in federal adjusted gross income is 100 deductible. The corporation itself pays tax on its profits. Filling out the Schedule C form consists of listing information about your business and business income as well as any expenses.

IF you are liable for. Your primary purpose for engaging in the activity is for income or profit. Line 9 of your 1040 is extremely important if youre planning to use the 1040 to file taxes for your business.

Sole proprietors use Schedule C to report all business income and expenses and partners use Schedule E. If your business is a partnership or a multiple-member LLC you get your business income on a Schedule K-1 for your 1040. Use Schedule C Form 1040 or 1040-SR to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

And Schedule C Form 1040 or 1040-SR Profit or Loss from Business. If it is capital gain many goes on Schedule D unless it is capital gains distributed from a fund and that it may go on Schedule B. 1040-ES Estimated Tax for Individuals.

Legitimate expenses include office supplies license fees business travel and employee. If you have a foreign business that qualifies as a sole proprietorship or disregarding the entity then it would be included on Schedule C along with other documents that would need to be filed. Income tax returns for individual calendar year taxpayers are due by Tax Day which is usually April 15.

In your case youll likely want to focus on business expenses you can deduct thereby. If your business is an S corporation you get your business income on a slightly different type of Schedule K-1 for your 1040. You can use line 9 to claim additional tax deductions if you have qualified business income Real Estate Investment Trust REIT dividends or income from Publicly Traded Partnerships PTPs.

Form 1040 officially the US. Taxpayers who earn income from a business from freelancing or from working as independent contractors are considered by the IRS to be self-employed and must fill out Schedule C on Form 1040. The first seven lines of the back page of the 1040 form are devoted to counting your income.

The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. Tax Return for Seniors. Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return the Ohio IT 1040.

An activity qualifies as a business if. Below are the details for each business type. In other words if you have S-corporation or Partnership you file that business using business software which I think you did since you have the K-1.

However if you have an S corporation in addition to reporting compensation and dividends you also report your share of corporate profits on Schedule E of Form 1040. If youre in a self-employed trade or business you must include payments for your services on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship. Schedule SE Form 1040 or 1040-SR Self-Employment Tax.

Dont worry all of this will be explained.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Tax Preparer Accountant Business Card Zazzle Com Tax Preparation Accounting Business

Tax Preparer Accountant Business Card Zazzle Com Tax Preparation Accounting Business

Https Apps Irs Gov App Vita Content Globalmedia Teacher 15 Otherincome Instructor Presentation Pdf

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

Standard Deduction Vs Itemized Deductions Tax Guide 1040 Com File Your Taxes Online Filing Taxes Standard Deduction Tax Deductions List

Standard Deduction Vs Itemized Deductions Tax Guide 1040 Com File Your Taxes Online Filing Taxes Standard Deduction Tax Deductions List

Understanding Income Taxes Visual Ly Income Tax Business Tax Tax Preparation

Understanding Income Taxes Visual Ly Income Tax Business Tax Tax Preparation

A Short Guide To Different Types Of Form 1040 Business Account Small Business Accounting Irs Tax Forms

A Short Guide To Different Types Of Form 1040 Business Account Small Business Accounting Irs Tax Forms

Irs Form 4606 T Irs Forms Irs Internal Revenue Service

Irs Form 4606 T Irs Forms Irs Internal Revenue Service

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

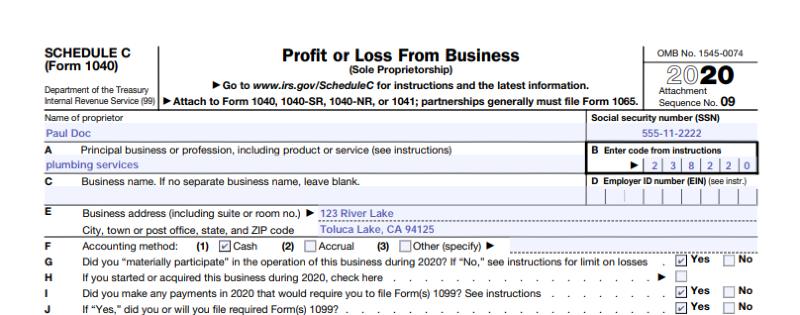

Step By Step Instructions To Fill Out Schedule C For 2020

Step By Step Instructions To Fill Out Schedule C For 2020

When Are Taxes Due Lovetoknow Income Tax Return Tax Time Business Questions

When Are Taxes Due Lovetoknow Income Tax Return Tax Time Business Questions

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

Http Www Dhs State Or Us Policy Selfsufficiency Publications Ss Im 19 006 Verifying Income Pdf

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Solution For Irs Tax Refund Tax Refund Filing Taxes Irs Taxes

Solution For Irs Tax Refund Tax Refund Filing Taxes Irs Taxes

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire U S Business Tax Irs Taxes Tax Debt

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire U S Business Tax Irs Taxes Tax Debt

What To Do When You Owe Back Taxes Infographic Business Tax Deductions Business Tax Bookkeeping Business

What To Do When You Owe Back Taxes Infographic Business Tax Deductions Business Tax Bookkeeping Business