Is Catering A 1099 Service

For buffets and informal parties the caterer may send employees to set up chafing. If a vendor excluding foreign ven dors is incorporated other documentation is.

-blog-01-test.png) Law Firm Cfo 1099 Reporting Decision Flowchart

Law Firm Cfo 1099 Reporting Decision Flowchart

Form 1099 is used to report self-employed service related income.

Is catering a 1099 service. The total for the year is what counts so it doesnt matter whether you spend say 600 for a. April 8 2019 Introduction. When you purchase something and it is delivered and that is where the service ends there is NO 1099 requirement as.

A catering service may have its own cooks to prepare food or it may obtain food from a contractor or third party to deliver to the client. 1099Gs are available to view and print online through our Individual Online Services. In general a caterers charges for food beverages and any services provided for a customers event are subject to sales tax.

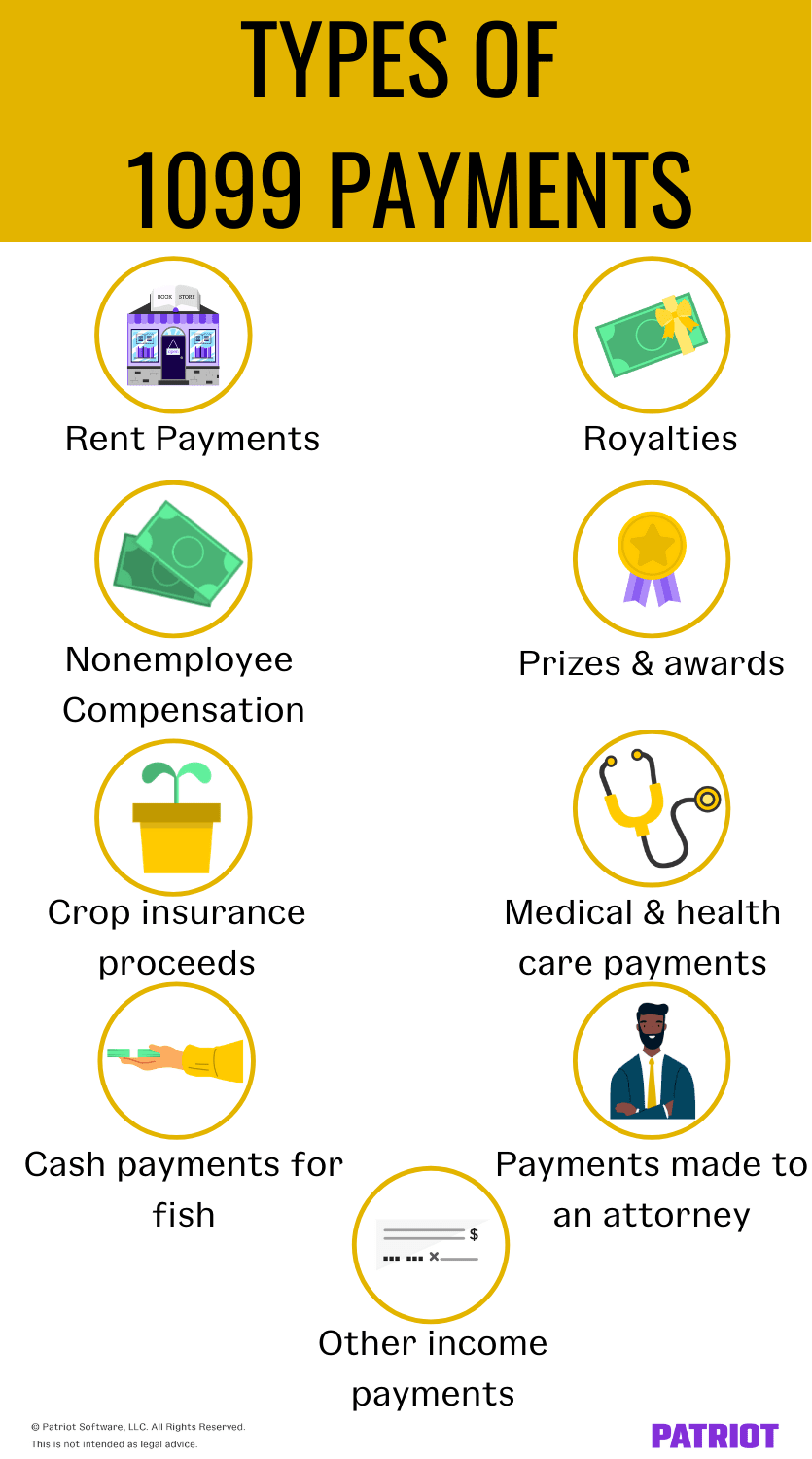

Various kinds of income other than wages and salaries are reported using Form 1099 but the most common use of the Form 1099 is for reporting earnings as an independent contractor. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. You can elect to be removed from the next years mailing by signing up for email notification.

Form 1099-MISC is used to report payments made to vendors that provide services to a business. If the company provided a service including parts and materials to your business that is 600 or more then you are required to send them a 1099 unless they are incorporated. That doesnt have to be a single 600 party.

The IRS refers to 1099s as information forms. You are running your own business to provide your catering services even if it was only one time. The Substitute Form W-9 is available on the Payables web page which is accessed through Contracting Purchasing Services web page at.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. If you are purchasing the food from the catering company and they are not serving it this is not a service so you wouldnt send them a 1099. If the company caters four quarterly parties and bills you.

A 1099 is an Internal Revenue Service IRS form that is used to report income received through sources other than employment. Usually the payer will provide a completed Form 1099 to the payment recipient as well as to the IRS. Caterers and Catering Services Tax Bulletin ST-110 TB-ST-110 Printer-Friendly Version PDF Issue Date.

In that statement alone there are some keys to what needs to be reported including. The cutoff for sending a 1099 for services rendered is 600. You dont send the restaurant a 1099-MISC unless you pay at least 600 for services rendered.

There are tax concerns in both of these areas. For sit-down dining events the service usually sends waiters waitresses and busboys to prepare tables and serve meals. This bulletin will explain.

When a business pays an independent contractor for services performed in the course of that business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation. However if the restaurant is a corporation. They serve as a record that reflects income given to someone by a person or organization that they are not formally employed by.

Therefore there is NOT a Form 1099 filing requirement. See the TurboTax articles below for more guidance. Employee meal taxation policies impact the catering industry in two different areas.

You only have to file a Form 1099 if someone performs services as the first expert said. 1 To a Business First the payments need to be made in a business so you dont have to prepare a 1099-MISC for the guy who cuts your home lawn. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISCBusinesses will need to.

If the following four conditions are met you must generally report a payment as nonemployee compensation. If you received a 1099-NEC it is entered under Personal Income Other Common IncomeYou will need to enter your business information which will create your business profile. If you received a Form 1099-MISC to report your income from your catering gig you are considered self-employed in the eyes of the IRS and your income and expenses must be reported on Schedule C.

Direct Sales The law requires information reporting on Form 1099 MISC for certain direct sellers. A restaurant would be considered a service provider under the IRS rules regarding filing a 1099-MISC. Who is a caterer how sales tax applies to sales by a.

These include the tax impact of caterers providing meals to their own employees as well as the business opportunities for those caterers in the contract foodservice and corporate delivery markets. If you pay that much money to your ad agency or the printer making your fliers the company gets a 1099-MISC.

New Year Special Offer Food Menu Food Food Poster

New Year Special Offer Food Menu Food Food Poster

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Business Management Degree Small Business Finance

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Business Management Degree Small Business Finance

10 Menu Design Hacks Restaurants Use To Make You Order More Healthy Meals For Two Menu Design Restaurant Menu Design

10 Menu Design Hacks Restaurants Use To Make You Order More Healthy Meals For Two Menu Design Restaurant Menu Design

-blog-test.png) Law Firm Cfo 1099 Reporting Decision Flowchart

Law Firm Cfo 1099 Reporting Decision Flowchart

Prospect Sheet Customer Call Follow Up Call Sheet Catering Intended For Customer Contact Report Template 10 P Sales Report Template How To Plan Sales Skills

Prospect Sheet Customer Call Follow Up Call Sheet Catering Intended For Customer Contact Report Template 10 P Sales Report Template How To Plan Sales Skills

How To Start A Monthly Subscription Service Business 1099 Subscription Box Business Diy Subscription Box Subscription Boxes

How To Start A Monthly Subscription Service Business 1099 Subscription Box Business Diy Subscription Box Subscription Boxes

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Seber Tans Plc

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Seber Tans Plc

33 Free Download Postcard Templates Postcard Template Postcard Template Free Business Postcards

33 Free Download Postcard Templates Postcard Template Postcard Template Free Business Postcards

Azeez Restaurant Poojappura Rejilal Indian Food Menu Restaurant Specials Indian Food Recipes

Azeez Restaurant Poojappura Rejilal Indian Food Menu Restaurant Specials Indian Food Recipes

1099 Form Fillable All Categories Bioseven Fillable Forms 1099 Tax Form Doctors Note Template

1099 Form Fillable All Categories Bioseven Fillable Forms 1099 Tax Form Doctors Note Template

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

Https Clearlawinstitute Com Webinars The 1099 W 9 Annual Update Course 8 Cli The 1099 W 9 Annual Update Course 9

Azeez Restaurant Social Media Poster Hot Weekend Combo Offer With Unlimited Ginger Tea Enjoy Your Weeken Indian Food Menu Food Poster Design Food Design

Azeez Restaurant Social Media Poster Hot Weekend Combo Offer With Unlimited Ginger Tea Enjoy Your Weeken Indian Food Menu Food Poster Design Food Design

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

-blog-01-test.png) Law Firm Cfo 1099 Reporting Decision Flowchart

Law Firm Cfo 1099 Reporting Decision Flowchart

Customer Feedback Form Templates 13 Free Xlsx Docs Pdf Samples Feedback Customer Feedback Survey Template

Customer Feedback Form Templates 13 Free Xlsx Docs Pdf Samples Feedback Customer Feedback Survey Template

Our Design For High End Italian Restaurant Babbo Seasonal Lunch Menu Promotion Lunch Menu Restaurant Marketing Restaurant

Our Design For High End Italian Restaurant Babbo Seasonal Lunch Menu Promotion Lunch Menu Restaurant Marketing Restaurant