Form 1065 Qualified Business Income Deduction

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

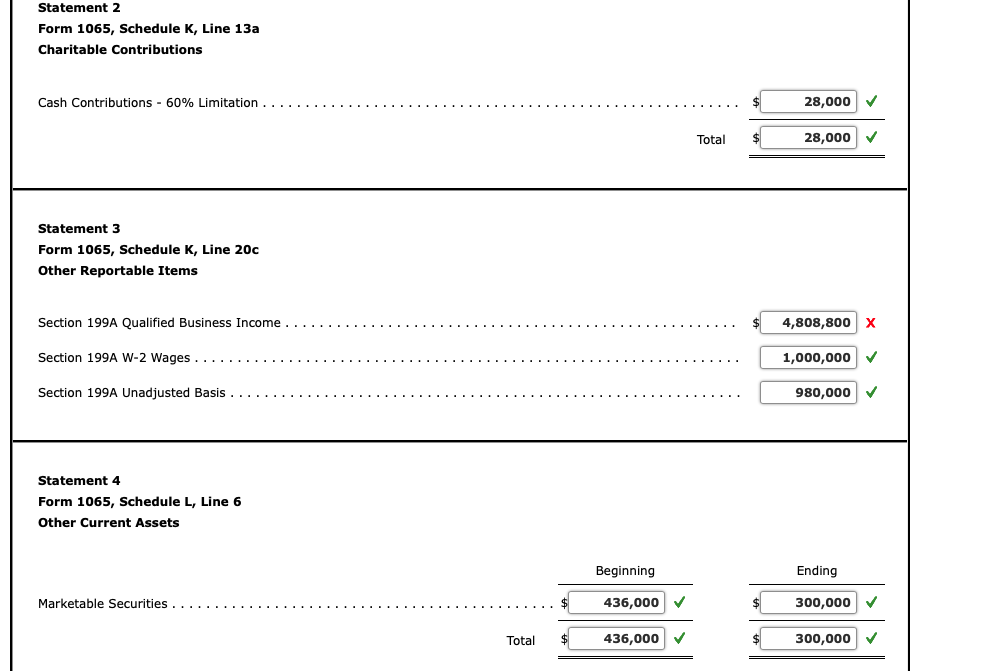

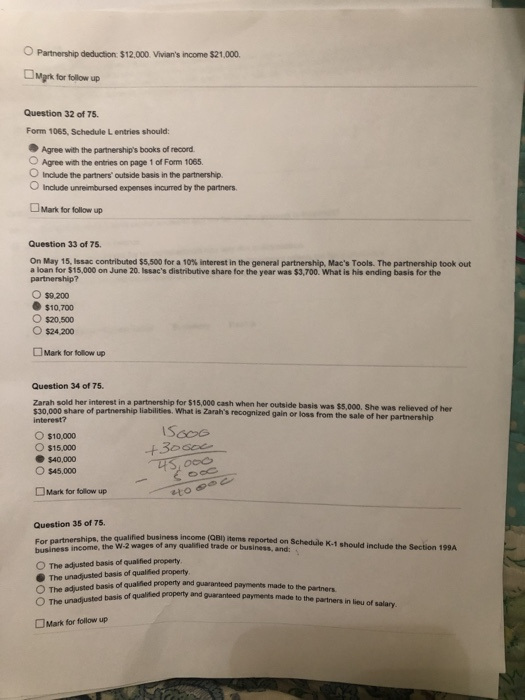

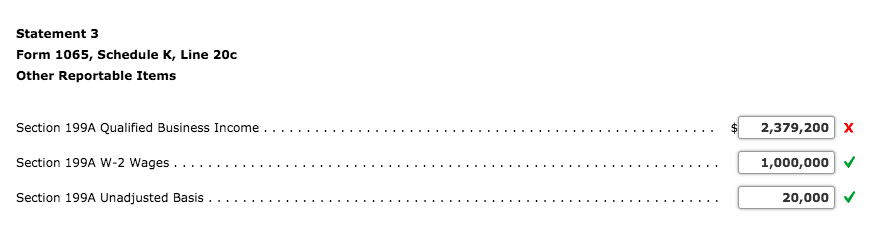

Solved Partnership Deduction 12 000 Vivian S Income 21 Chegg Com

Solved Partnership Deduction 12 000 Vivian S Income 21 Chegg Com

Here Is The Problem I Ve Answered It All Except I Chegg Com

Here Is The Problem I Ve Answered It All Except I Chegg Com

Basics Beyond Tax Flash April 2019 Basics Beyond

Basics Beyond Tax Flash April 2019 Basics Beyond

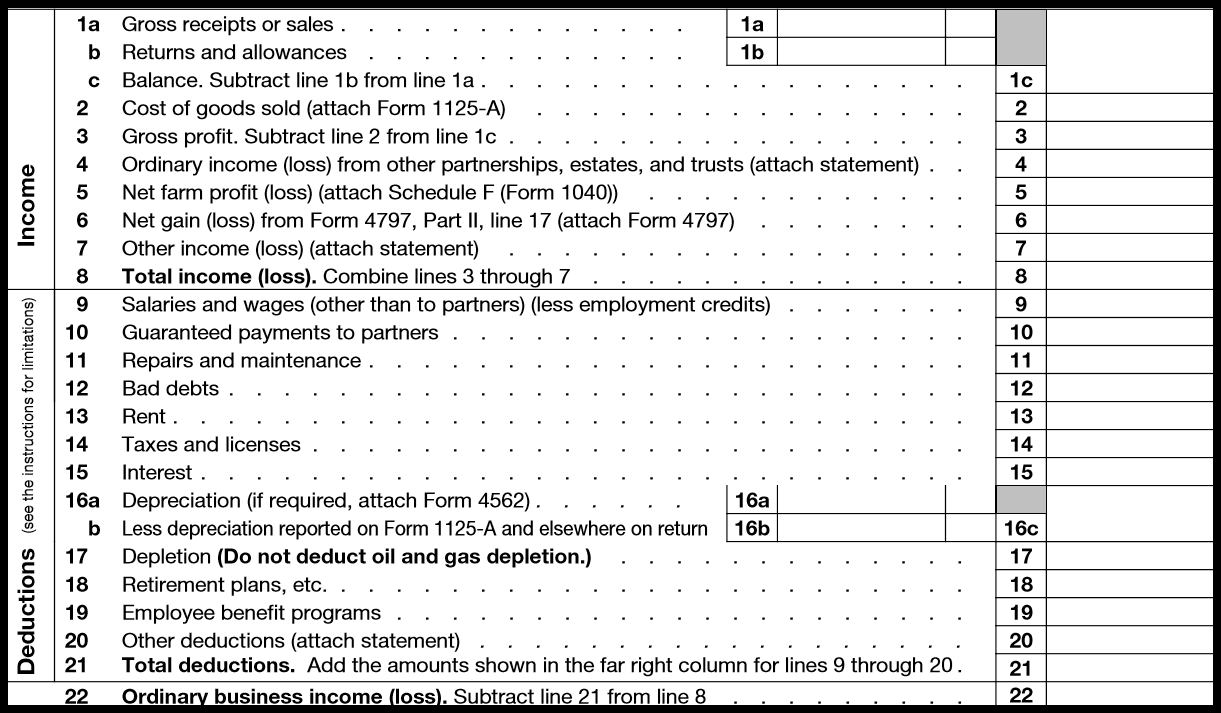

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

What Types Of Business Partnerships Must File Form 1065 Silver Tax Group

What Types Of Business Partnerships Must File Form 1065 Silver Tax Group

Can You Take The New Pass Through Income Deduction

Can You Take The New Pass Through Income Deduction

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

Irs Issues Guidance On Sec 199a Deduction For Rics Cpa Practice Advisor

Irs Issues Guidance On Sec 199a Deduction For Rics Cpa Practice Advisor

Irs Issues Revised Instructions On 1065 Parter Tax Basis Capital Reporting Cpa Practice Advisor

Irs Issues Revised Instructions On 1065 Parter Tax Basis Capital Reporting Cpa Practice Advisor

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

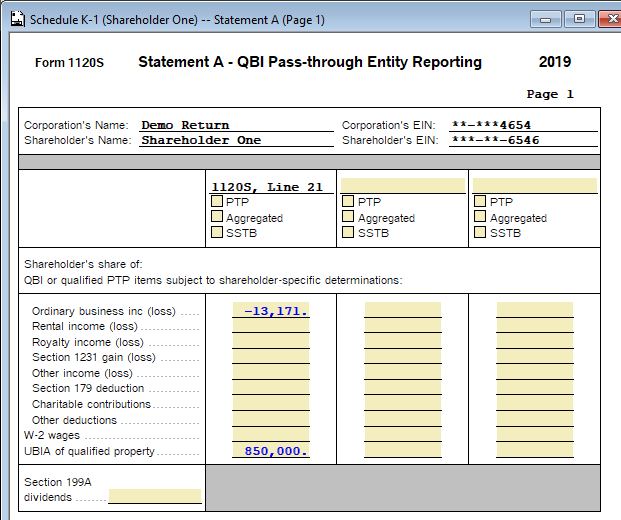

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community