Small Business Disaster Loan Criteria

The SBA sets the guidelines that govern the 7a loan program. One of the IBank Small Business Finance Centers loan guarantee programs is designed for Disaster Relief and is currently available to small businesses needing assistance to overcome economic injury caused by COVID-19.

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

SBA disaster loan requirements.

Small business disaster loan criteria. Location credit score repayment ability and available collateral. Economic Injury Disaster Loans. You may not use the loan to replace very expensive or rare and unique items.

SBA Office of Disaster Assistance 1-800-659-2955 409 3rd St SW. Loan eligibility Small business owners and qualified agricultural businesses in all US. Borrowers need to have excellent credit and strong financials that demonstrate their ability to repay the loan.

What are the collateral requirements. Agricultural business with 500 or fewer employees that has suffered substantial economic injury as a result of the COVID-19 pandemic you can apply for. Terms conditions and eligibility.

Verified uninsured disaster loss. If you are a small business nonprofit organization of any size or a US. You may also be able to borrow up to 40000 to replace damaged or destroyed personal property.

There are four main considerations for an SBA disaster loan. Learn whether you qualify for this loan and how receiving one may affect your taxes. The leading Business Financial Management platform Nav has been used by 1 million business owners in the US to monitor and build their business and personal credit and explore more than 100 different financing products including a variety of loans and credit cards.

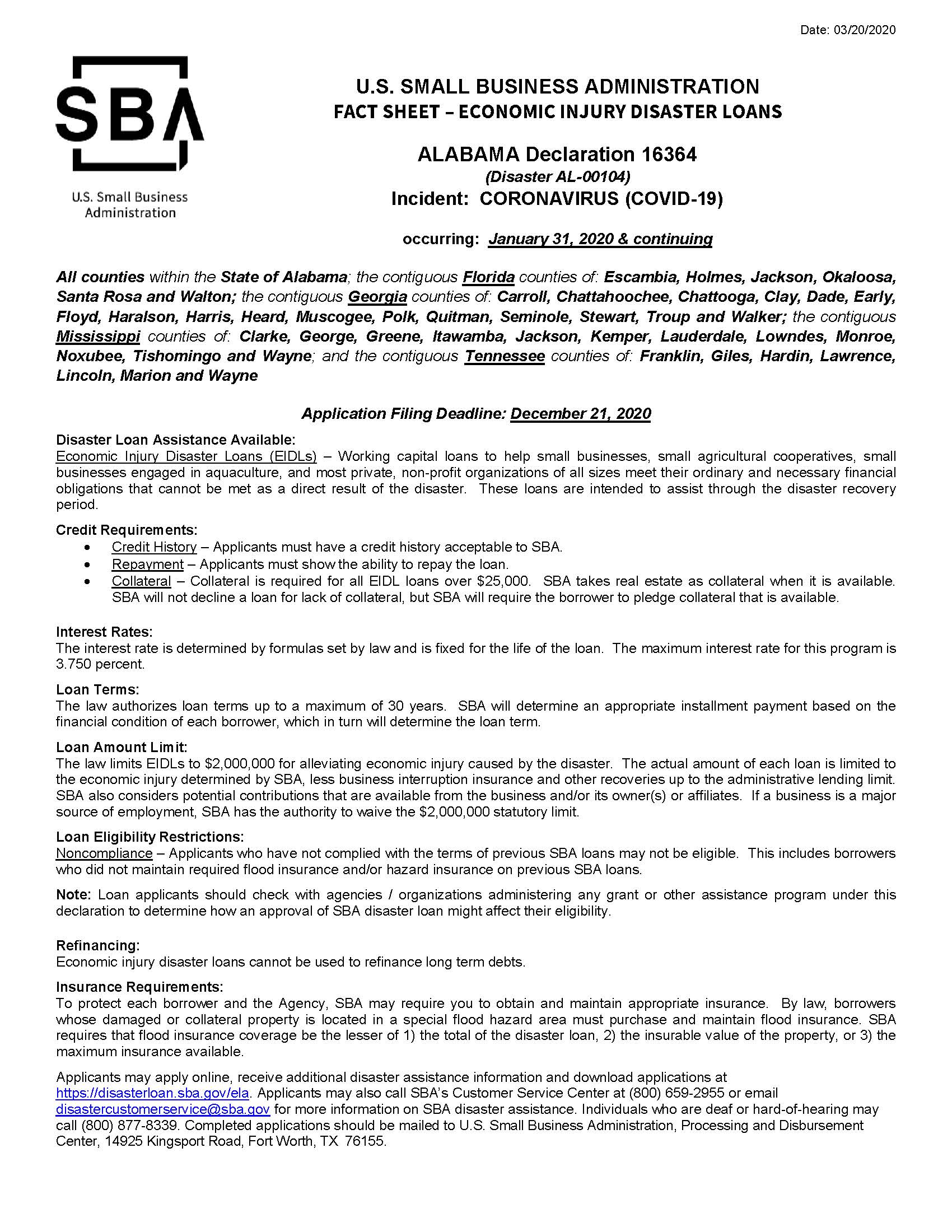

SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a. SBA disaster assistance loans are typically only available to small businesses within counties identified as disaster areas by a Governor. Disaster Financial Assistance for Workers and Small Business Owners.

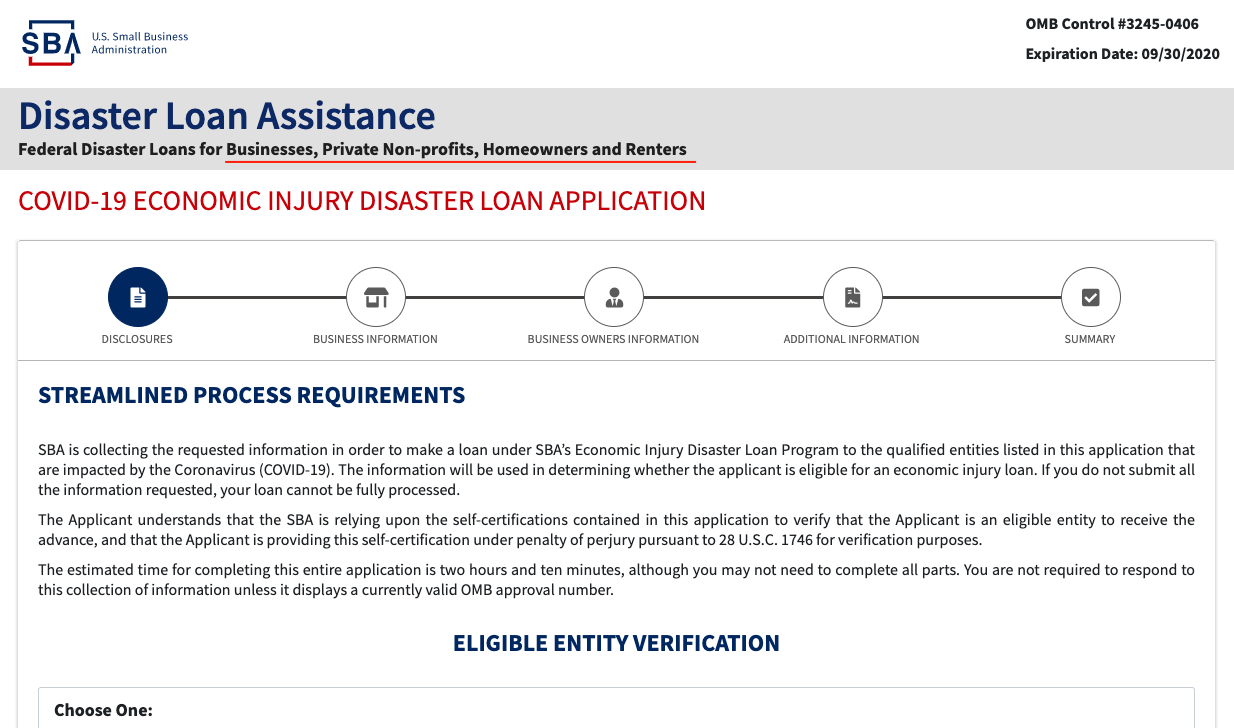

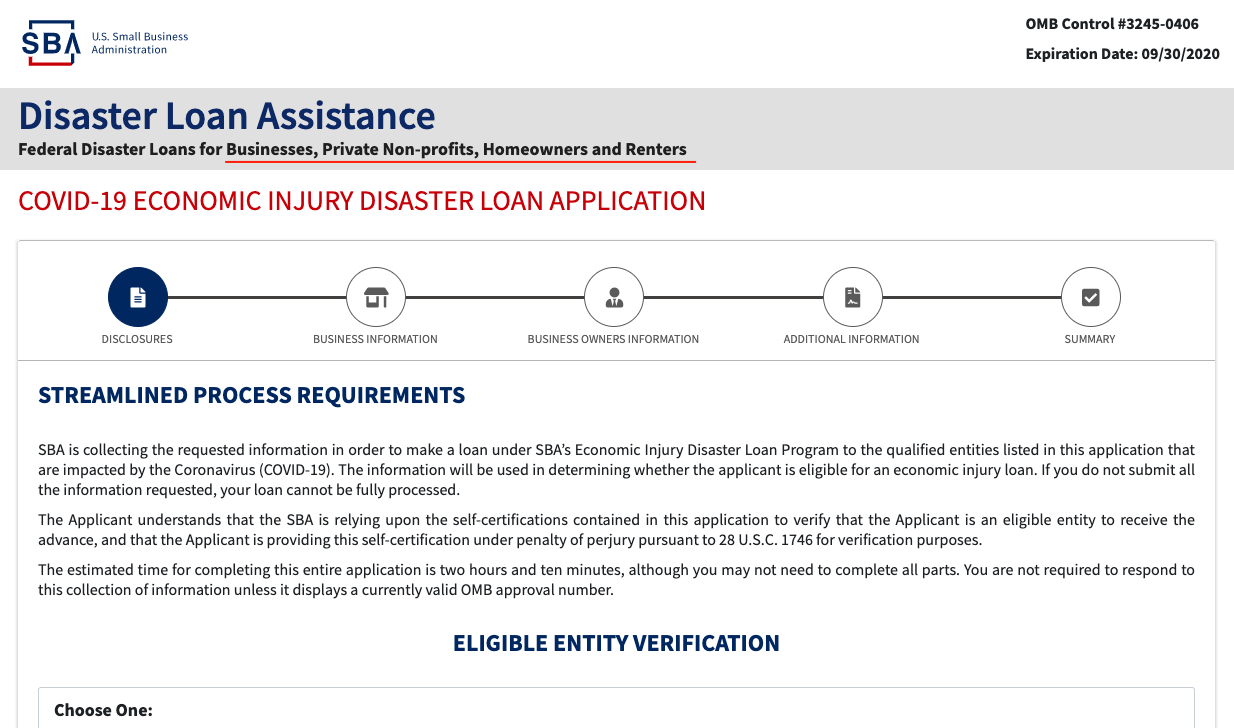

Freelancers and self-employed business owners experiencing financial hardship due to Coronavirus COVID-19 have the option to apply for an Economic Injury Disaster Loan EIDL a low-interest federal disaster loan thats directly administered by the Small Business Administration SBA. Agricultural businesses with 500 or fewer employees are now eligible as a result of new authority granted by Congress in response to the pandemic. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters.

Under the revised criteria issued today disaster assistance loans will be available statewide following an economic injury declaration. The 2000000 statutory limit for business loans applies to the combination of physical economic injury mitigation and refinancing and applies to all disaster loans to a business and its affiliates for each disaster. Get financial help from the government if you own a small business.

As a lender these conditions determine which businesses you can lend to and the type of loans you can give. Small Business Administration SBA loan requirements determine your eligibility to qualify for funding and are focused on the characteristics of you and your business. Disaster Relief Loan Guarantees.

If youve been affected by the COVID-19 pandemic learn how you could qualify for unemployment benefits paid leave and more. The Paycheck Protection Program created by the CARES Act on March 27 2020 provides forgivable SBA emergency 7 a loans of up to 10 million to. States and territories are currently eligible to apply for a low-interest loan due to COVID-19.

For economic injury disaster loans at least five businesses within a county have suffered substantial economic injury 40 percent or more uninsured losses in revenue each as compared with the same time the previous year and there is no reasonable financial assistance available in the area. Businesses should apply directly with one of the participating lenders below. To qualify for an SBA disaster loan you must operate a business located within a declared disaster zone.

Certain rental properties may qualify for a business disaster loan. Economic Injury Disaster Loans over 25000 require collateral SBA takes real estate as collateral when it is available SBA will not decline a loan for lack of collateral but requires borrowers to pledge what is available 7 Economic Injury Disaster Loan Terms West Virginia District Office 7. If a business is a major source of employmentSBA has the authority to waive the 2000000.

Through this program borrowers can access low-interest loans of up to 2 million directly from the SBA to repair or replace real estate or other assets damaged or destroyed in. This may include items from the list below. Nav offers business owners transparent start-to-finish services to help get them the best financing possible.

Who can use an SBA disaster loan. This will apply to current and future disaster assistance declarations.

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 15 2020 10am Pdf

Covid 19 Disaster Resources Ascension Economic Development Corporation

Covid 19 Disaster Resources Ascension Economic Development Corporation

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

What Is The Economic Injury Disaster Loan H R Block

What Is The Economic Injury Disaster Loan H R Block

Small Business Financial Assistance The Chamber Of Commerce Of West Alabama

Small Business Financial Assistance The Chamber Of Commerce Of West Alabama

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Small Business Entrepreneurship Council

Small Business Entrepreneurship Council

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Emergency Funding For Small Business How To Qualify Funding Circle

Emergency Funding For Small Business How To Qualify Funding Circle

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Https Www Sba Gov Sites Default Files Resource Files Eidl Bdo Presentation March 26 Pdf