How To Record Payroll Tax Expense

How to record accrued payroll and taxes 1. It is quite common to have some amount of unpaid wages at the end of an accounting period so you should accrue this expense if it is material.

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Look up the amount of taxes youve deferred by navigating to Payroll COVID-19 or Payroll Taxes Accumulating Taxes.

How to record payroll tax expense. This topic is easy to understand if you think about the way youve been paid by an employer in the past. Employers normally record payroll taxes at the same time as the payroll to which they relate. How to do payroll accounting.

However when reporting on a weekly monthly or quarterly basis to senior management bookkeepers may. In addition to state payroll tax State Unemployment Tax or SUTA employers are also responsible for remitting state income tax on behalf of their employees. If youve already paid a tax but the tax payment still appears due you might.

Enter the required payment information. From the left menu select Taxes. Its the nature of the beast that most companies will have accrued payroll and related payroll taxes.

Payroll Journal Entry Example 2. If you use the Expense account theres no need to write checks. Step 1 Create a journal entry to record the total payroll including tax withholding.

A company records an expense on the income statement for the employer matching portion of any Social Security and Medicare taxes as well as the entire amount of any federal and state unemployment taxes since they are paid by the. Is the PEO payment shown as a one line item and if so how is it categorized. After recording this entry reverse it at the beginning of the following accounting period and then record the actual payroll expense.

Select Enter Prior Tax History. Small business accounting payroll involves both expense and liability accounts. No employee has earned more than 7000 in this calendar year.

Assume the payroll taxes an employer pays for April are FICA taxes state unemployment taxes SUTA 1890. The entry to record the employer portion of the taxes is similar to the entry above except no cash is paid at the time the entry is recorded. Since you have not directly paid wages and filed your own tax returns how do you record the payments made to the PEO on your books.

Click on the More button in the upper right corner and choose. Heres how to record a tax payment for a prior tax period for a tax that no longer appears in the list of due taxes. Gross earnings are recorded using expense accounts such as salary or wage expense.

Have all your SUTA questions answered in just a 3 minute read. In other words a company owes these taxes but has not yet paid them. We must record the liabilities that will be paid and the company expense.

This can be a significant time saver especially when the month to month reporting is not needed. Set up payroll accounts. Navigate to Accounting Transactions.

According to this article Recording payroll transactions manually you may use either the Expense or Liability account when creating a Journal Entry for payroll transactions. It seems like you can not show wages and payroll tax expense since you are not considered the employer. And federal unemployment taxes FUTA.

The accrual entry as shown next is simpler than the comprehensive payroll entry already shown because you typically clump all payroll taxes into a single expense account and offsetting liability account. For example if the total payroll for the. Use the same payable accounts for.

Staff accountants and bookkeepers using payroll in QuickBooks can record all of their entries to wages and taxes payable while also grossing up payroll as infrequently as once a month quarter or year. Calculate taxes and other deductions. Net pay for your employees is recorded using payroll liability accounts such as net payroll payable wage payable or accrued wages payable.

For a payroll tax that is currently due. If you want to bookkeep the deferred tax amount you can follow these steps. Debit the salary expense account for the total amount of the payroll.

Record employer payroll taxes and contributions Record employer-paid payroll taxes such as the employers portion of. Most companies have. State and local payroll taxes are governed at the state and local level and every states payroll tax rules are different.

The total amount of company expense is 5880 because the is the total amount of tax that the company incurred. If you havent already set up your payroll accounts in your chart of accounts COA. Payroll accounts include a mixture.

When a company incurs an obligation to pay payroll taxes to the government a portion of it appears on the income statement and a portion on the balance sheet. Record employee wages and deductions Report your employees wages and deductions first.

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Expense Journal Entry How To Record Payroll Expense And Withholdings Youtube

Payroll Expense Journal Entry How To Record Payroll Expense And Withholdings Youtube

Net Pay Payroll Taxes Payroll Federal Income Tax

Net Pay Payroll Taxes Payroll Federal Income Tax

Payroll Form Templates Google Search Payroll Template Payroll Payroll Taxes

Payroll Form Templates Google Search Payroll Template Payroll Payroll Taxes

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Payroll Template

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Payroll Template

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Template Bookkeeping Templates Payroll

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Template Bookkeeping Templates Payroll

Estimated Income Tax Payments For Businesses Have To Be Paid Quarterly Here Is The Schedule Small Business Bookkeeping Small Business Accounting Business Tax

Estimated Income Tax Payments For Businesses Have To Be Paid Quarterly Here Is The Schedule Small Business Bookkeeping Small Business Accounting Business Tax

Define Yourself Saturday Weekend Cpa Lnk Accounting Bookkeeping Payroll Tax Smallbusiness Smallbiz Entrepreneur Br Cpa Business Account Small Biz

Define Yourself Saturday Weekend Cpa Lnk Accounting Bookkeeping Payroll Tax Smallbusiness Smallbiz Entrepreneur Br Cpa Business Account Small Biz

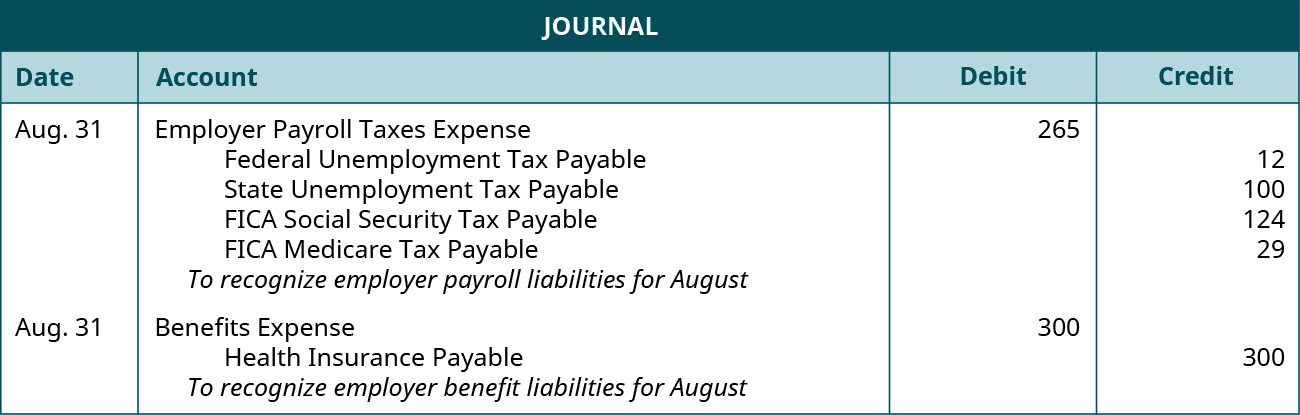

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Chart Of Accounts Cheat Sheet Accountingcoach Chart Of Accounts Accounting Basics Accounting Notes

Chart Of Accounts Cheat Sheet Accountingcoach Chart Of Accounts Accounting Basics Accounting Notes

What Should I Include In My Employee Payroll Records Payroll Small Business Entrepreneur Virtual Payroll Bookkeeping Business Business Checklist Payroll

What Should I Include In My Employee Payroll Records Payroll Small Business Entrepreneur Virtual Payroll Bookkeeping Business Business Checklist Payroll

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Tax

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Tax

What Is The Benefits Of Payroll Management Software Payroll Payroll Software Credit Score

What Is The Benefits Of Payroll Management Software Payroll Payroll Software Credit Score

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self Employed People Payroll Taxes Payroll Small Business Bookkeeping

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self Employed People Payroll Taxes Payroll Small Business Bookkeeping

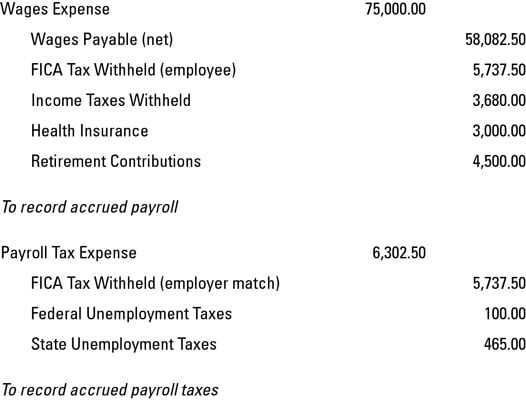

How To Record Accrued Payroll And Taxes Dummies

How To Record Accrued Payroll And Taxes Dummies

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach