How To Get Form 1099g Online Virginia

Get Your 1099 Form Now Electronically To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. All individual income taxpayers now have access to Form 1099G1099INT electronically.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

If you cannot access your 1099-G form you may need to reset your password within IDESs secure website.

How to get form 1099g online virginia. Select Unemployment Services and ViewPrint 1099-G. If you change addresses you must give the VEC the new address to receive your 1099G. To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return.

Go to the IRS website. Virginia Relay call 711 or 800-828-1120. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax.

The ability to access 1099-G information will transition to the Department of Revenues new online e-services system myPATH starting on November 30 2020. Pacific time except on state holidays. This is the fastest option to get your form.

Open or continue your tax return in TurboTax online. This 1099-G does not include any information on unemployment benefits received last year. To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return.

Request Your 1099 By Phone. Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more. Visit the Department of Labors website.

You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN. Form 1099G1099INT Now Available Online. The 1099-G tax form is commonly used to report unemployment compensation.

Log in to your NYGov ID account. If there is a problem with your PIN you can also access your form by selecting IRS Form 1099-G for UI Payments then enter other credentials. Look up your 1099G1099INT.

Get Your 1099 Form Now Electronically To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. If you have any questions please submit them through the departments Online Customer. The Form 1099G is a report of the income you received from the Virginia Department of Taxation.

Request Your 1099 By Phone. Your Social Security number If you filed jointly youll also need your spouses SSN. Search for unemployment compensation and select the Jump to link.

The tax year of your return. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G. The Virginia Employment Commission will send you and the IRS Form 1099G at the years end detailing the benefits you received plus any federal tax withholdings elected.

View solution in original post 0. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. You can view or print your forms for the past seven years.

We will mail you a paper Form 1099G if you do. 1099-G Information and Access. By providing your information below you consent to receive your 1099G information electronically.

Heres how you enter the unemployment. Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1. You can access your Form 1099G information in your UI Online SM account.

However most state governments offer to access the form online on the unemployment benefits website. Select the appropriate year and click View 1099G. This new service is available through the VATAX 1099G Lookup application at httpswwwindividualtaxvirginiagov1099Gloginjsf.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. Effective October 30 2020 the online system for 1099-G information DOR e-Services will no longer be available.

This is the fastest option to get your form. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund. If you are not sure exactly where just type 1099G then your state in google for example - you may find an option to retrieve 1099-g online.

How to Get Your 1099-G online. To access this form please follow these instructions. Instructions for the form can be found on the IRS website.

The Internal Revenue Service IRS requires government agencies to report certain payments made during the year because these payments or refunds may be considered taxable income for the recipients. You may choose one of the two methods below to get your 1099-G tax form. If your responses are verified you will be able to view your 1099-G form.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

4 Signs You Re About To Be Hit With A Big Tax Surprise Wgn Tv

4 Signs You Re About To Be Hit With A Big Tax Surprise Wgn Tv

Https Www Vatax Gov Sites Default Files Inline Files Virginia Free Fillable Forms How To Avoid Rejects Pdf

1099 G Virginia Page 1 Line 17qq Com

1099 G Virginia Page 1 Line 17qq Com

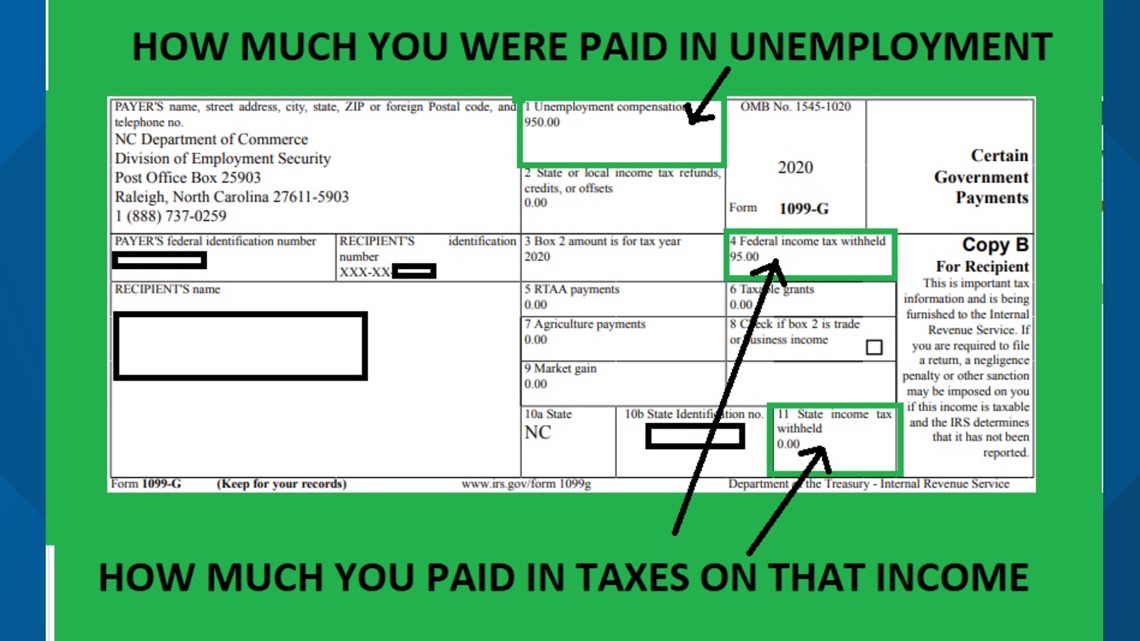

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

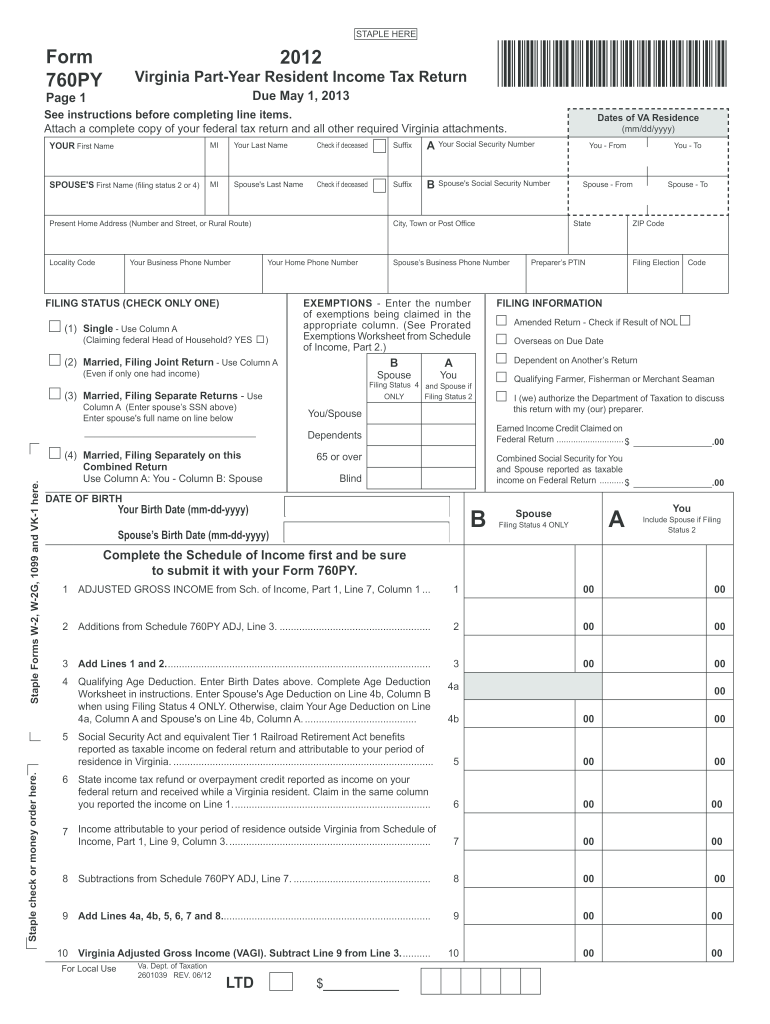

Va Dot 760py 2012 Fill Out Tax Template Online Us Legal Forms

Va Dot 760py 2012 Fill Out Tax Template Online Us Legal Forms

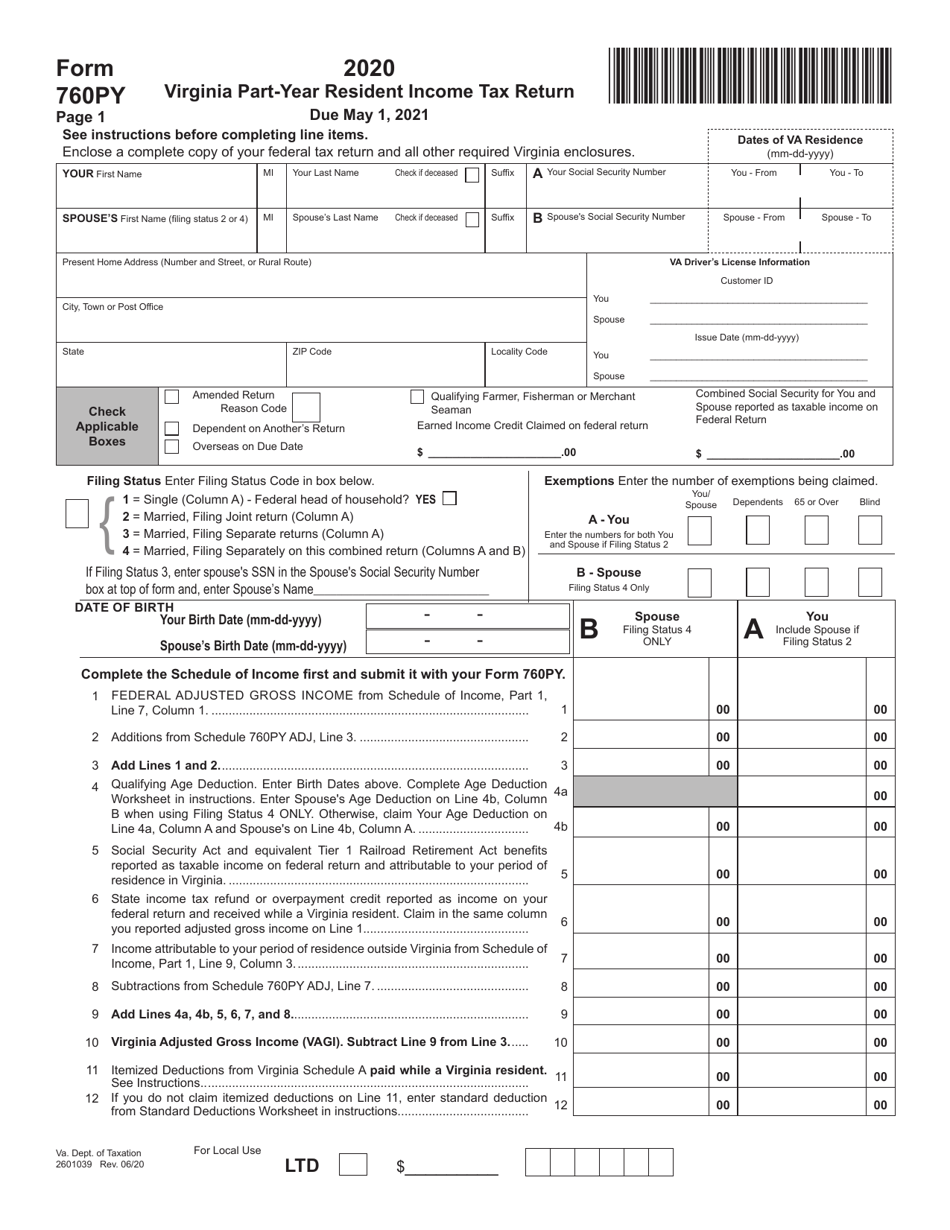

Form 760py Download Fillable Pdf Or Fill Online Part Year Resident Individual Income Tax Return 2020 Virginia Templateroller

Form 760py Download Fillable Pdf Or Fill Online Part Year Resident Individual Income Tax Return 2020 Virginia Templateroller

Https Www Tax Virginia Gov Sites Default Files Taxforms Early Release 2020 Individual Income Tax Draft 2020 763 Instructions Pdf

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Https Www Vec Virginia Gov Printpdf 1099

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Virginia Unemployment W2 Forms Vincegray2014

Virginia Unemployment W2 Forms Vincegray2014

1099 G Tax Form Causing Confusion For Some In Kentucky 13newsnow Com

1099 G Tax Form Causing Confusion For Some In Kentucky 13newsnow Com

State Tax Department No Longer Sending 1099s Wvpb

State Tax Department No Longer Sending 1099s Wvpb

Acceptance Waiver Of Service Of Process Virginia Acceptance Circuit Court

Acceptance Waiver Of Service Of Process Virginia Acceptance Circuit Court

Https Www Tax Virginia Gov Sites Default Files Inline Files 2020 Software Provider Letter Of Intent Pdf

1099 G Virginia Employment Commission Fill Online Printable Fillable Blank Pdffiller

1099 G Virginia Employment Commission Fill Online Printable Fillable Blank Pdffiller

1099 G Virginia Page 1 Line 17qq Com

1099 G Virginia Page 1 Line 17qq Com

The Taxman Cometh Virginia Unemployment

The Taxman Cometh Virginia Unemployment