How To Get Form 1099-g Online California

You will only get a Form 1099-G if all or part of your SDI benefits are taxable. To enter this from the Federal Section Income.

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Select the link View IRS 1099-G Information and 3.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

How to get form 1099-g online california. File your return reporting the income you actually received. If required the taxpayer reports the refund in year it was received 2020. All dividends are taxed as ordinary income.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. California does not have a lower rate for qualified dividends. The 1099-G may automatically populate.

Select the Year Issued. Your Form 1099-G information can be accessed on-line using the Departments Taxpayer Service Center TSC. Log on to Unemployment Benefits Services.

Select FTB-Issued Form 1099 List. Do you get 1099 g for disability. Select Unemployment Services and ViewPrint 1099-G.

Report the dividend amount as income when you file your federal return. This link will only appear if you received benefits from the EDD for that year. A 1099-G will be issued for the year the taxpayer receives the refund in this case 2020.

If you are eligible to the document access the IRS 1099-G website download 1099-F Form and complete it. 1099-G Form for state tax refunds credits or offsets. Tax preparation software with a 1099-G.

The Internet is available 24 hours a day 7 days a week in English and Spanish. If this is a state income tax refund you should be able to access and print this form through the state department of revenue website. Select Account in the top navigation bar.

You will receive a Form 1099G by mail or you can access your Form 1099G information in your UI Online SM account. Remember that coronavirus and tax deadlines do not affect this Form at the present time. How to Get Your 1099-G online.

You can access your Form 1099G information in your UI Online SM account. Contact the 1099-G issuer for a corrected form showing 0 benefits received. It depends on what type of income is reported on your 1099G Form.

Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. We will mail you a paper Form 1099G if you do.

Viewing your IRS 1099-G information over the Internet is fast easy and secure. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. If this is unemployment compensation you should be able to access and print this form through the website that you used to file your unemployment claim.

Typically your tax software will calculate the taxable portion of your state income tax refund as long as information from your prior years return is entered. Log in to your MyFTB Account. When tax preparation software is used.

To access this form please follow these instructions. Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments. If you receive a 1099-G you should use the information on the form to complete your tax return.

I did not receive a California Personal Income Tax Refund why did I receive a Form 1099-G. To view your. You will only get a Form 1099-G if all or part.

Pacific time except on state holidays. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at. Follow this link to go directly to the TSC to view and print your Form 1099-G information prior years available in most cases Visit the Form 1099-G Informational Page for tips on using the TSC to access your Form 1099-G information.

Pacific time except on state holidays. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file.

If the state issues you a refund credit or offset of state or local income that amount will be shown in Box 2 of your 1099-G form. Log in to your NYGov ID account. Log in to Benefit Programs Online and select UI Online.

By entering some basic information about your refund TaxSlayer will automatically fill out the worksheet for you. Check your state department of revenue website to see if the state issued additional directions. To view a copy of Form 1099-G go to MyFTB and use the easy to follow directions.

This income will be included in your federal adjusted gross income which you report to California. If your SDI benefits are taxable and you dont receive your Form 1099-G by mid-February you may call EDD at 800 795-0193 to get another copy. Select Print to print your Form 1099G information.

For more information see IRS Publication 525 Taxable and Nontaxable Income. Visit the Department of Labors website. Select View next to the desired year.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

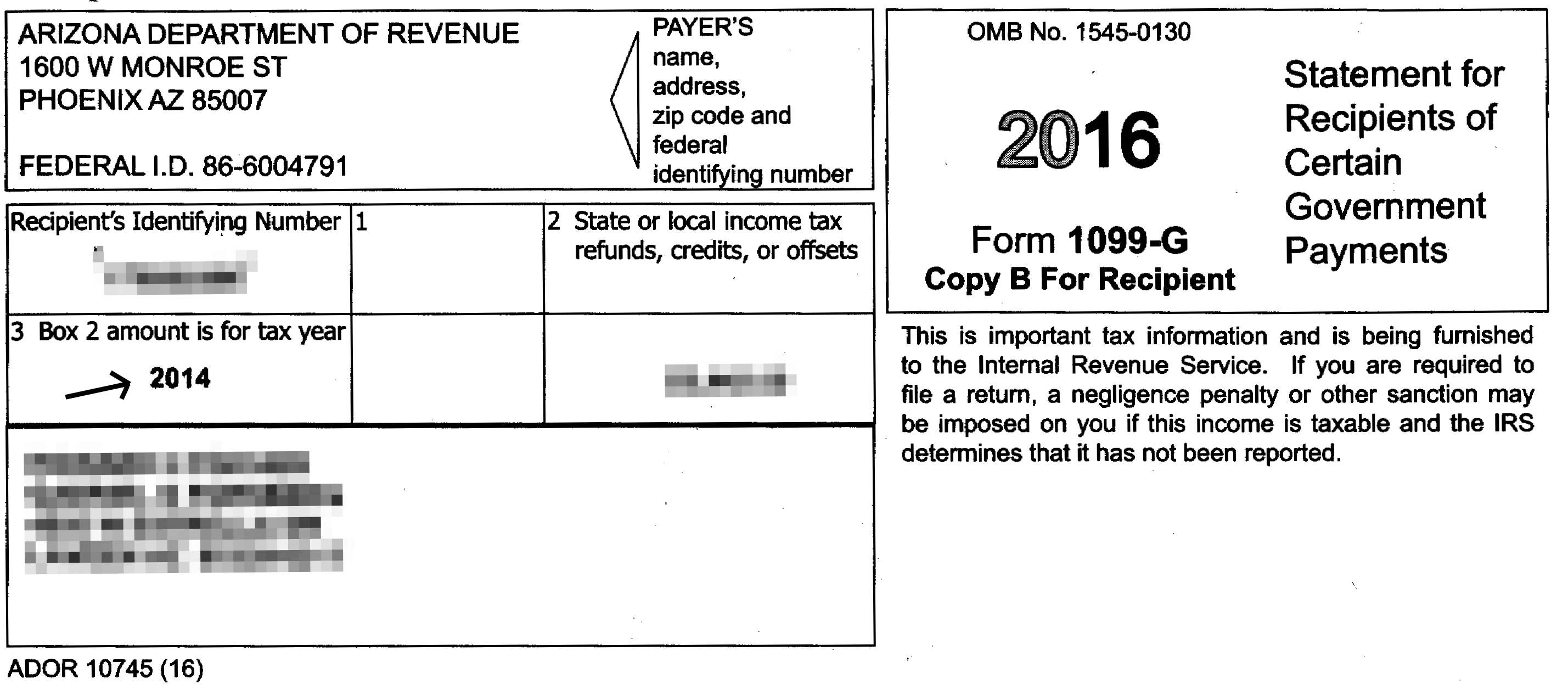

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 G 2020 Public Documents 1099 Pro Wiki

1099 G 2020 Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Form 1099 G Tax Information Is Available Online San Tan Valley News Info Santanvalley Com

Form 1099 G Tax Information Is Available Online San Tan Valley News Info Santanvalley Com

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

Hold Up On Doing Your Taxes Arizona Tax Form 1099 G Is Flawed The Verde Independent Cottonwood Az

Hold Up On Doing Your Taxes Arizona Tax Form 1099 G Is Flawed The Verde Independent Cottonwood Az

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition