Calculate Business Value Based On Revenue

They value a business by trying to come up with a value for that stream of cash. Revenue is the crudest approximation of a businesss worth.

Contribution Margin Explained In 200 Words How To Calculate It Contribution Margin Words Cost Accounting

Contribution Margin Explained In 200 Words How To Calculate It Contribution Margin Words Cost Accounting

The times-revenue method uses a multiple of current revenues to determine the ceiling or maximum.

Calculate business value based on revenue. Add up the value of everything the business owns including all equipment and inventory. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for. For example a full-service restaurant with a liquor license will be worth about 30 annual gross revenue if big if its.

While there are potentially many ways to value a business one popular method is using the discounted or present value of your estimated cash flow. A less accurate method of estimating the value of a business is to apply a percentage to the companys annual gross revenue. An ROI based on a selling price value you have in mind or a selling price based on an ROI that you set ROI net annual profitselling price x 100 For example you have a selling price of 200000 in mind but want to test your ROI based on that price.

For a product-based business the formula is Revenue Number of Units Sold x Average Price. Buyers guided by appraisers and business valuation experts use rules of thumb to value businesses based on multiples of business earnings. Bizbuysell says nationally the average business sells for around 06 times its annual revenue.

The enterprise value-to-revenue EVR is easily calculated by taking the enterprise value of the company and dividing it by the companys revenue. 355598 161598 Estimated Business Value 234000 Estimated Real Estate Value 40000 Liabilities Our business valuation expert helped us put together these values. For service-based companies the formula is Revenue.

Market Approach - Sales Based Compare the companys revenue to the sale prices of other similar companies that have sold recently. Subtract any debts or liabilities. There are some national standards depending on industry type and business size.

Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. For example a competitor has sales of 3000000 and is acquired for 1500000. The times-revenue method is a valuation method used to determine the maximum value of a company.

There are a number of ways to determine the market value of your business. Total Sales Cost of Goods Sold Expenses Owners Wage TSDE your profit So when we say that a business was sold for a multiple of 244X for example it means that the amount paid for the business is a value of 244 times the profit. This method takes your current income before income taxes depreciation and amortization and projected income for a defined number of years and determines the present value of that income based on the cost of capital.

Tally the value of assets. Total Estimated Value. This is a 05x sales multiple.

Calculate Gross Margin On A Product Cost And Selling Price Including Profit Margin And Mark Up Percent Price Calculator Financial Calculators Online Calculator

Calculate Gross Margin On A Product Cost And Selling Price Including Profit Margin And Mark Up Percent Price Calculator Financial Calculators Online Calculator

Customer Lifetime Value Calculator Plan Projections Customer Lifetime Value The Unit How To Plan

Customer Lifetime Value Calculator Plan Projections Customer Lifetime Value The Unit How To Plan

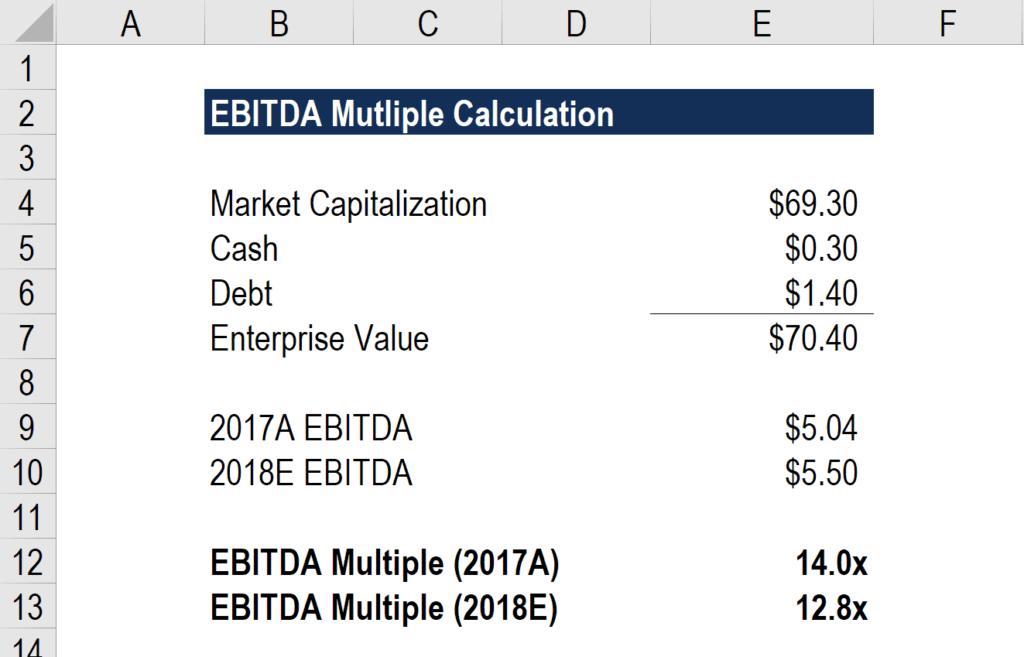

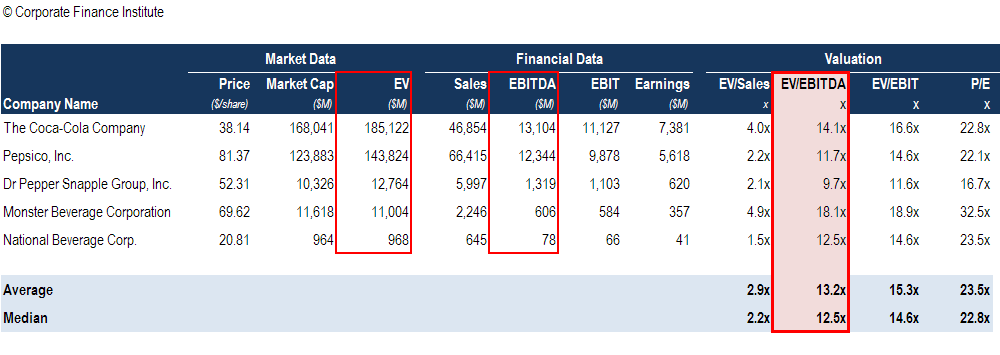

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

Calculate Website Traffic Worth Revenue And Page Views Website Traffic Website Value Website

Calculate Website Traffic Worth Revenue And Page Views Website Traffic Website Value Website

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

Website Value Calculator Website Value I Site Website

Website Value Calculator Website Value I Site Website

Check Website Value Website Traffic Site S Builtwith Technology And Get The Idea Of Website Worth And Domain Value Be Website Value Traffic Adsense Earnings

Check Website Value Website Traffic Site S Builtwith Technology And Get The Idea Of Website Worth And Domain Value Be Website Value Traffic Adsense Earnings

Pre And Post Money Valuation Calculator Plan Projections Budget Forecasting Financial Analysis Financial Modeling

Pre And Post Money Valuation Calculator Plan Projections Budget Forecasting Financial Analysis Financial Modeling

Revenue Definition Formula Example Role In Financial Statements

Revenue Definition Formula Example Role In Financial Statements

Monte Carlo Simulation Calculator For Startups Plan Projections Start Up Monte Carlo Business Planning

Monte Carlo Simulation Calculator For Startups Plan Projections Start Up Monte Carlo Business Planning

Economic Profit Formula Calculator Examples With Excel Template

Economic Profit Formula Calculator Examples With Excel Template

Working Capital Needs Calculator Plan Projections Business Planner Business Planning Finance Planner

Working Capital Needs Calculator Plan Projections Business Planner Business Planning Finance Planner

Startup Exponential Growth Calculator Plan Projections Exponential Growth Exponential Growth

Startup Exponential Growth Calculator Plan Projections Exponential Growth Exponential Growth

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

How To Determine The Valuation Of A Startup Company Infographic Startup Funding Business Valuation Start Up Business

How To Determine The Valuation Of A Startup Company Infographic Startup Funding Business Valuation Start Up Business

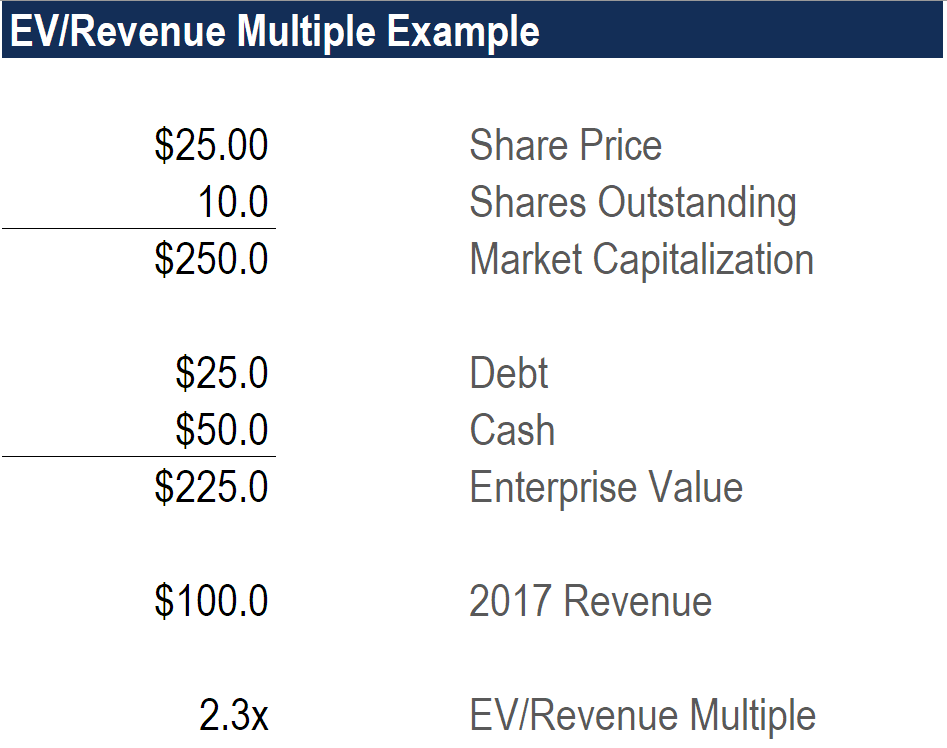

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Business Valuation In A Nutshell Fourweekmba Business Valuation Cash Flow Statement Valuing A Business

Business Valuation In A Nutshell Fourweekmba Business Valuation Cash Flow Statement Valuing A Business

Weighted Average Price Calculator Plan Projections Price Calculator Weighted Average How To Plan

Weighted Average Price Calculator Plan Projections Price Calculator Weighted Average How To Plan

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio