Why Did My Employer Give Me A 1099

She pays me under the table minimum wage. Why didnt I get my 1099 form.

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

I work at an optometry as a secretary I was never given a W-4 or any other form to fill out when I started working here I am not on a payroll nor do I get taxes taken out of my paychecks.

Why did my employer give me a 1099. If you have a traditional employer-worker relationship you must pay several taxes including. She just gave me a 1099-MISC form to fill out with only the 7 box nonemployee compensation filled with 191529. If you choose to do this you can enter your 1099-Misc in Turbo Tax and for the reason received select I got this 1099-Misc for another reason and then My employer reported this extra money on a 1099-Misc but it should have been reported on a W-2.

On the other hand if the individual is told not to work with other businesses or individuals and is also provided with a requirement for working conditions such as hours when he works that person might be considered an employee by the IRS. As such when an employer enters into a contract with a 1099 employee this individual remains responsible for their own hours tools taxes and benefits. The purpose of IRS Form 1099-S is to ensure that sellers are reporting their full amount of capital gains on each years tax return and thus paying the appropriate amount of taxes to the IRS.

Why is the 1099 Employee designation important. Instead of retroactively calling you a W2 employee the entire time your employer is cheating and attempting to classify you as a 1099 contractor the entire time. You may simply perform services as a non-employee.

Instead of being an employee of the company you are employed by your own business or self-employed Youve probably received a 1099 tax form instead of a W-2. Unlike a standard full- or part-time employee W2 employee 1099. If the worker is an integral part of the employers operations and if the employer exercises day-to-day control over the employee the employee is likely a W-2 employee.

Sometimes companies are. In short there is no such thing as a 1099Contract employee. Because they consider you a contract employee they send you a 1099 instead of a W-2.

Everything Employers Need to Know about 1099 Employees. Its a question many taxpayers find themselves asking. If you hire an independent contractor you avoid a large tax burden.

You may begin to receive these documents as. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. The 1099 employee designation is important due to taxes.

There are a number of reasons you might be missing a form. With that said they dont truly consider you an employee or they dont have the money to pay payroll taxes and want to skirt around that and leave the tax burden on your plate. However there may be instances where a worker may be serving as an independent contractor and.

See this article on worker classification for more information. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. A company must issue you a Form 1099-MISC to document the expenditure.

This is frowned upon by the IRS as well as the employee since as you discovered it costs you more money in the form of employer FICA. Why didnt I get my 1099. For example if an individual who is an officer and employee of a corporation also serves on the board of directors this person may receive a W-2 for employee compensation as well as a 1099 for fees received as a corporate director a non-employee position.

If they fail to give you a 1099-MISC by the IRS deadline which is usually in mid to late February the company may face a 50. Typically youll receive a 1099 because you earned some form of income from a non-employer source. Often referred to as an independent contractor or consultant a 1099 employee is self-employed.

Answered January 6 2021 Author has 452 answers and 347K answer views. The 1099 employee typically handles their own taxes. The people for whom he provided work will send out a Form 1099-MISC to the individual as well provides a copy to the IRS.

Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. The IRS will contact your employer to gather facts from them to make this determination. If a company treats you as an independent contractor in theory you are operating as an independent business.

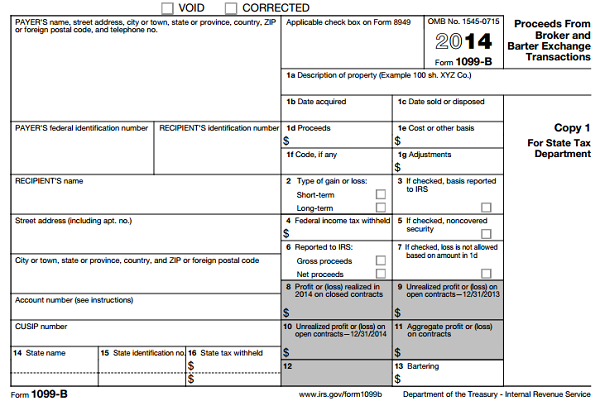

Deciphering Form 1099 B Novel Investor

Deciphering Form 1099 B Novel Investor

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

So Many Creative Entrepreneurs Are Often Confused When It Comes To The 1099 Or W 9 I Will Show You Wh Bookkeeping Software Business Blog Woman Business Owner

So Many Creative Entrepreneurs Are Often Confused When It Comes To The 1099 Or W 9 I Will Show You Wh Bookkeeping Software Business Blog Woman Business Owner

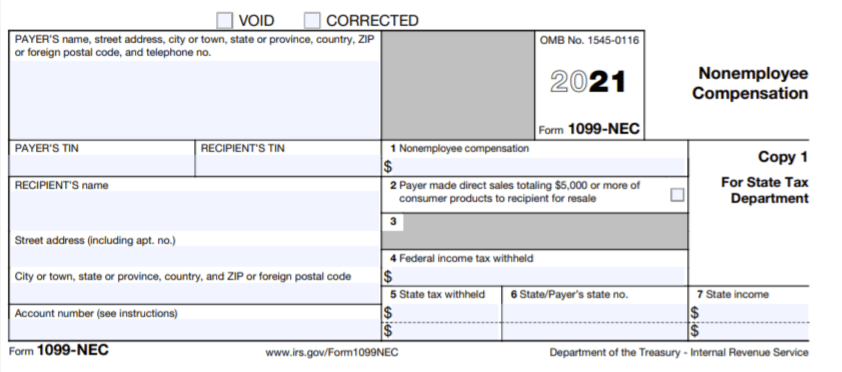

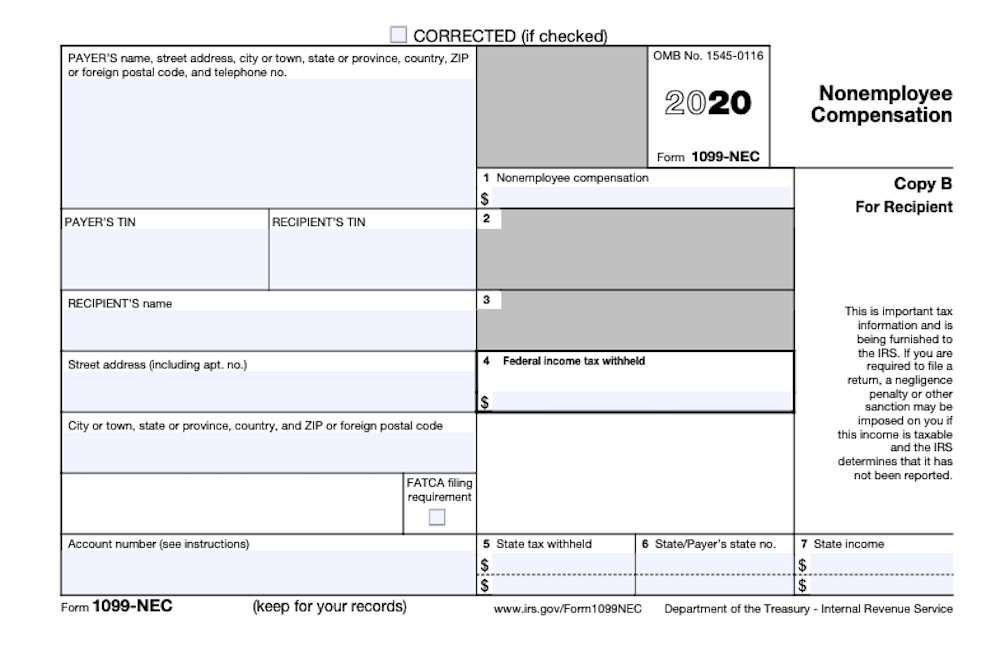

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

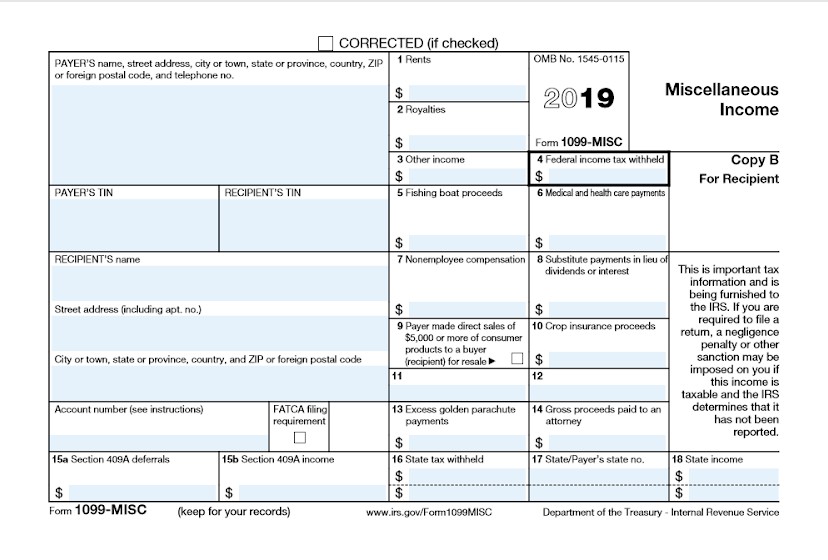

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition