How To Give 1099 Form To Employee

If youre a contractor youll use this form to fill out the IRS form 1099 Misc when filing your taxes. Topic 154 - Form W-2 and Form 1099-R What to Do if Incorrect or Not Received Employerspayers have until January 31 to issue certain informational documents.

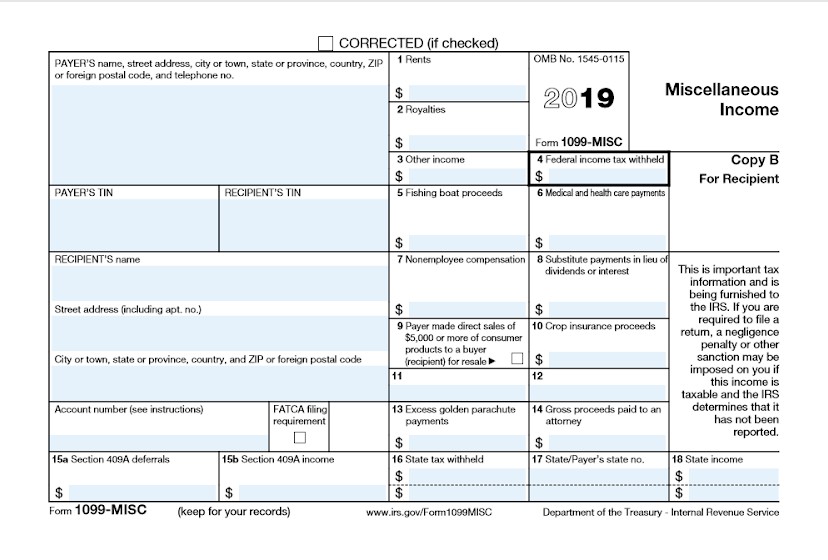

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Obtain a 1099-MISC form from the IRS or another reputable source.

How to give 1099 form to employee. For reporting non-employee payments theres no automatic 30-day extension to file the Form. Next you must submit your 1099-MISCs to the IRS. Submit final forms to submit.

These forms include a 1099-MISC form W-9 and a written contract signed by both parties. You can also buy 1099-MISC forms at your local office supply store although most only come in batches of 25 or 50. How to file a 1099 form Step 1.

What forms do you give a 1099 employee. Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was 600 or more. The first step is determining which of the people you work with are contractors.

As an employee youll enter your info on a W-2 in box 1 3 and 5. However the benefits to employers are often extensive and worth taking notice of. 1099 Employee Checklist FAQ Style Question.

Make sure that you have reviewed the 1099 forms before submitting as we do not handle corrected forms. Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US. Copy B Copy If you locate the View forms button youll only get Copy A that we sent to the IRS.

To file 1099s with the IRS electronically through the FIRE system youll need a Transmitter Control Code TCC which can be requested via Form 4419. If youre using a 1099 employee you will first want to create a written contract. Now the IRS provides a separate 1099-NEC Form for reporting non-employee payments.

You can ask the IRS to send you the necessary form by calling 1-800-TAX-FORM 1-800-829-3676 or navigating to their online ordering page. Other 1099 copies are available from the Home page. You can download and print the form you need Copy B of 1099-MISC from the IRS website.

While direct employees of a company receive a W2 that details their earnings and withholdings for the previous tax year contractors and self-employed individuals are eligible to receive a 1099 1099-Misc is the most common type form. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC.

Determine who is a contractor. For example employers will send out W-9 forms when they first begin working with an independent contractor to collect their tax information but they will also complete a 1099 at the end of the year to record the total payments they made to that contractor. Youll need to either file online or order the forms you need Copy A of 1099-MISC and Form 1096.

If you file as an employee you must file the form SS-8. Also the IRS provides only 30 days extension for filing 1099-NEC for certain reasons. You must send a 1099-NEC form to any non-employees to whom you paid 600 or more during the year.

It takes time to process paperwork so dont delay on that Form 4419. You have to submit it by November 1 of the year before you plan to electronically file your 1099s. Information Returns which is similar to a cover letter for your Forms 1099-NEC.

You will need to order the IRS form 1099s and then print out the information on them. 1099 employees can obtain a number of important benefits from this working relationship including the ability to work on a more flexible basis change work environments on a routine basis run their own business and have greater freedom. Download and Submit 1099 Forms Employer.

Our partner Vensure Employer Services has created a quick chartinfographic for the forms employers need for a 1099 employee. Copy 1 Copy C and Contractor. To do so in TurboTax.

If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor. Benefits of Using a 1099 Employee. If you need help with employee classification or filing the appropriate paperwork post your need in UpCounsels marketplace.

As self-employed youll add your self-employed business under Business Income Expenses and enter your income as other income. Extension for Sending 1099-Misc Forms to Recipients. The 1099-NEC is used for independent contractors who are self-employed individuals and do work for you but not for corporations or employees.

June 7 2015. This form is NOT used for employee wages and salaries. If you do not receive your Form W-2 or Form 1099-R by January 31 or your information is incorrect on these forms contact your employerpayer.

Both companies and individuals may need to fill out a 1099. Use Form W-2 to report these payments.

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099