Hmrc Corporation Tax Registration Form

Your companys online Corporation Tax account. See this list for where your company tax number may be located.

Fill Free Fillable Hm Revenue Customs Pdf Forms

Fill Free Fillable Hm Revenue Customs Pdf Forms

Monday through Friday 900 am.

Hmrc corporation tax registration form. Filter by year All 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004. Register for Corporation Tax Most companies register for Corporation Tax and PAYE as an employer at the same time as registering with Companies House. Once youve registered you can sign in for things like your personal or business tax account Self Assessment Corporation Tax PAYE for employers and VAT.

You can browse for other HMRC taxes and services. If you want to register an agent for example an accountant or professional tax adviser to deal with HMRC on your behalf you will need to provide HMRC with authorisation to deal with that agent instead of directly with you. Your company tax number will also be printed on your payslip.

Return form CT600 Company Tax Return form Your Company Tax Return Company Information 3 Tax Reference Company Information 1 Company name Enter the registered name of the company. Front Street 2nd Floor. You can register to file your returns online instead of sending paper forms.

If the company is. Register file and pay business tax obligations. The company must register for corporation tax the tax paid by companies online within three months of any business activities starting.

If the company is active has been trading a year and not received notice to file a return register now for corporation tax. View List OBG Login. Taxpayers may use the secure drop box located in the lobby of the 77.

Signed up to use the HM Revenue Customs HMRC Corporation Tax online service and would like some help to do this. If you currently send paper tax returns. Should you need to file prior to receiving an employer account number please complete the Quarterly Tax Return JFS-20125 when due.

To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. When completing the Quarterly Tax Return JFS-20125 please use a tentative contribution rate of 27. HM Revenue and Customs HMRC forms and associated guides notes helpsheets and supplementary pages.

Register for HMRC Online Services enrol or sign up for the Corporation Tax online service activate or switch on the Corporation Tax online service. HMRC will send a letter to all newly formed companies. Cross-border royalties CT600H 2015 Version 3 16 May 2018.

Before you can file your Company Tax Return online you must. If youre a tax. Common HMRC Forms for Registering an Agent for VAT PAYE and Corporation Tax.

Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit. If you have not yet started trading just complete the dormant company insert in the same form. Make sure you check your tax returns letters or documents such as a P60 or P45.

If the company is only a year old youve plenty of time before tax or a return is due. Download and print tax forms instructions and publications. 614 645-7193 Customer Service Hours.

Sign in to HMRC online services. You should complete the enclosed form CT41G which contains details on your new company and return this to HMRC. If youve already registered sign in to HMRC.

City of Columbus Income Tax Division 77 N. Search Forms Ohio Business Taxes. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader.

HMRC say they MAY charge penalties for late registration. View a complete list of every business tax administered by ODT. Either by using the paper form or.

Due to the COVID-19 pandemic the Division is currently closed to the public. Most of your HMRC correspondence will show your company tax number. Supplementary charge in respect of ring fence trades CT600I 2019 version 3.

Division of Income Tax home page. Login Online Services for Business. To file your Quarterly Tax Return online please visit the Employer Resource Information Center ERIC.

The letter will include the companys 10-digit Unique Taxpayer Reference UTR. You can provide this authorisation in two ways. Even if you dont receive the registration form you must still inform HMRC within three months of starting business operations.

Company Registration Private Limited Company Limited Company Public Limited Company

Company Registration Private Limited Company Limited Company Public Limited Company

Fill Free Fillable Hm Revenue Customs Pdf Forms

Fill Free Fillable Hm Revenue Customs Pdf Forms

Cryptocurrency Taxes In The Uk The 2020 Guide Koinly

Cryptocurrency Taxes In The Uk The 2020 Guide Koinly

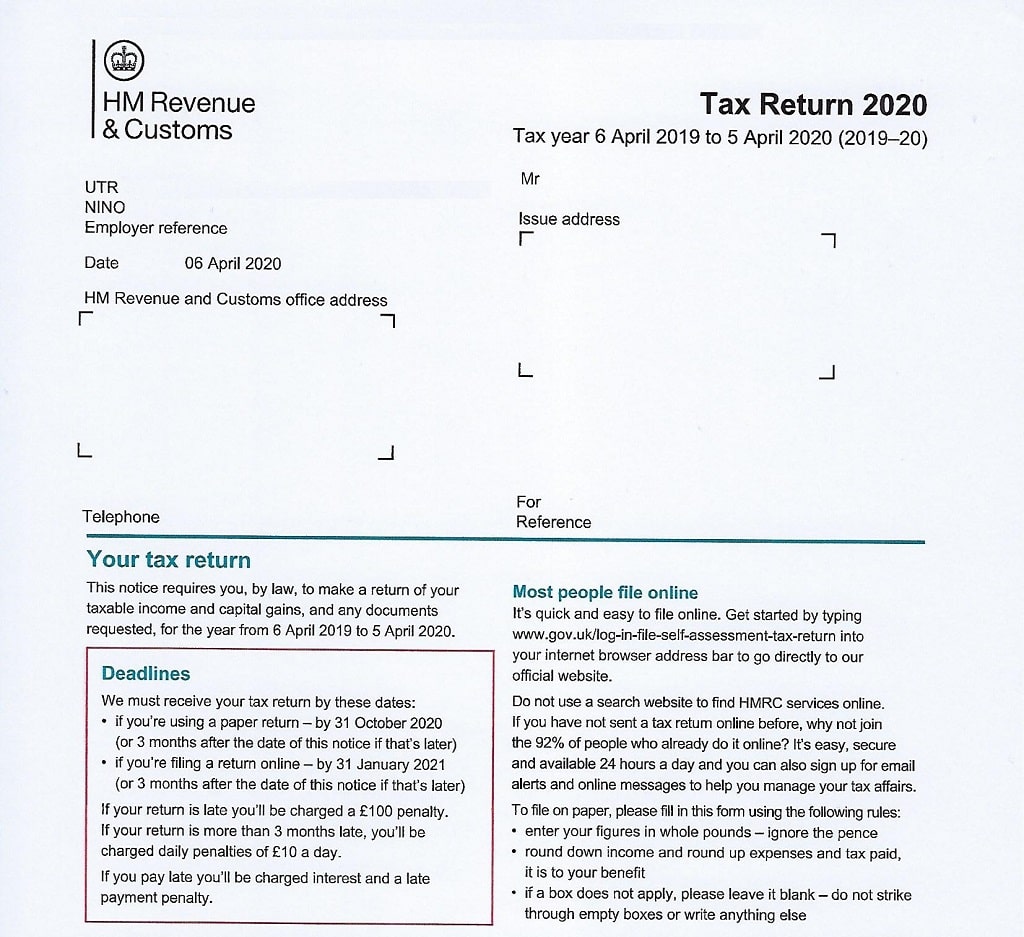

Hmrc 2020 Tax Return Form Sa100

Hmrc 2020 Tax Return Form Sa100

Fill Free Fillable Hm Revenue Customs Pdf Forms

Fill Free Fillable Hm Revenue Customs Pdf Forms

Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

Fill Free Fillable Hm Revenue Customs Pdf Forms

Fill Free Fillable Hm Revenue Customs Pdf Forms

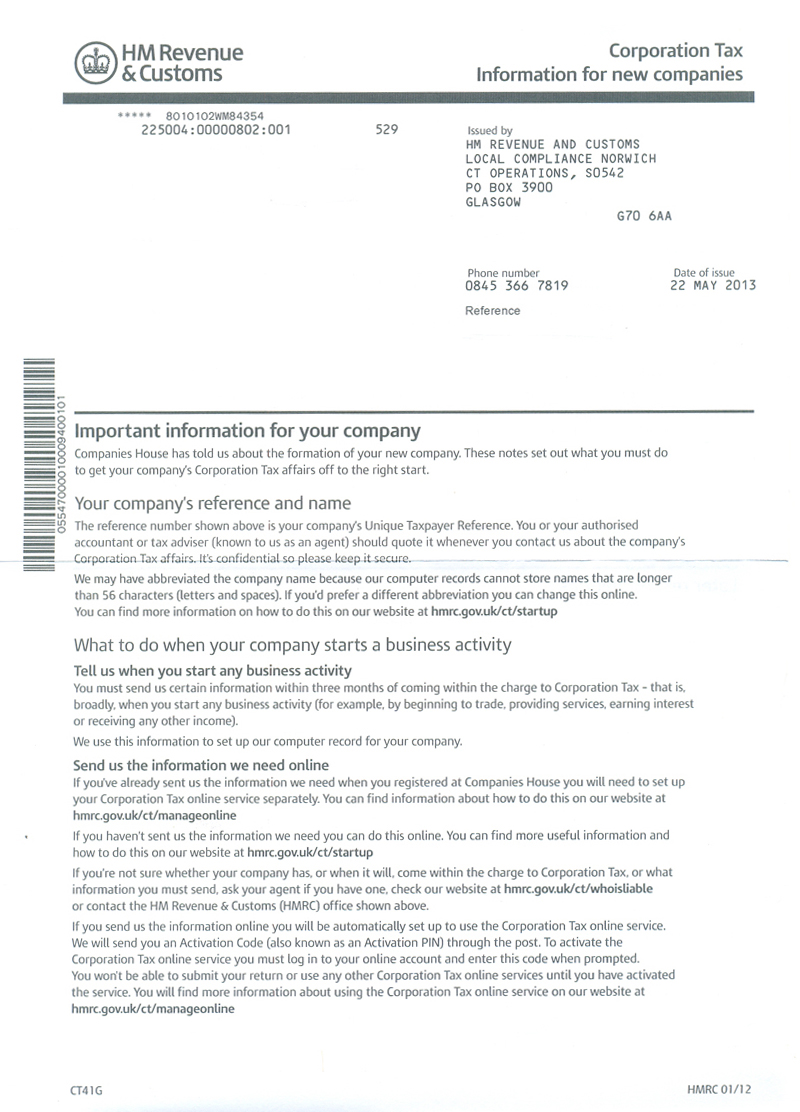

Ct41g Corporation Tax Information For New Companies

Ct41g Corporation Tax Information For New Companies

2015 Form Uk Ct600 Fill Online Printable Fillable Blank Pdffiller

2015 Form Uk Ct600 Fill Online Printable Fillable Blank Pdffiller

2014 2021 Form Uk Hmrc P87 Fill Online Printable Fillable Blank Pdffiller

2014 2021 Form Uk Hmrc P87 Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Hm Revenue Customs Pdf Forms

Fill Free Fillable Hm Revenue Customs Pdf Forms

Responsive Forms Registration Form Templates Form

Responsive Forms Registration Form Templates Form

Millions Of People Missing Out On Refund From Hmrc Skint Dad Money Saving Expert Money Saving Tips Tax Refund

Millions Of People Missing Out On Refund From Hmrc Skint Dad Money Saving Expert Money Saving Tips Tax Refund

A Limited Company Is A Business Structure That Offers Its Members Shareholders And Directors Limited Company Public Limited Company Limited Liability Company

A Limited Company Is A Business Structure That Offers Its Members Shareholders And Directors Limited Company Public Limited Company Limited Liability Company

Waleedkhan895 I Will Prepare And Submit Your Uk Personal Tax Return To Hmrc For 75 On Fiverr Com Tax Return Person Tax

Waleedkhan895 I Will Prepare And Submit Your Uk Personal Tax Return To Hmrc For 75 On Fiverr Com Tax Return Person Tax

Fill Free Fillable Hm Revenue Customs Pdf Forms

Fill Free Fillable Hm Revenue Customs Pdf Forms

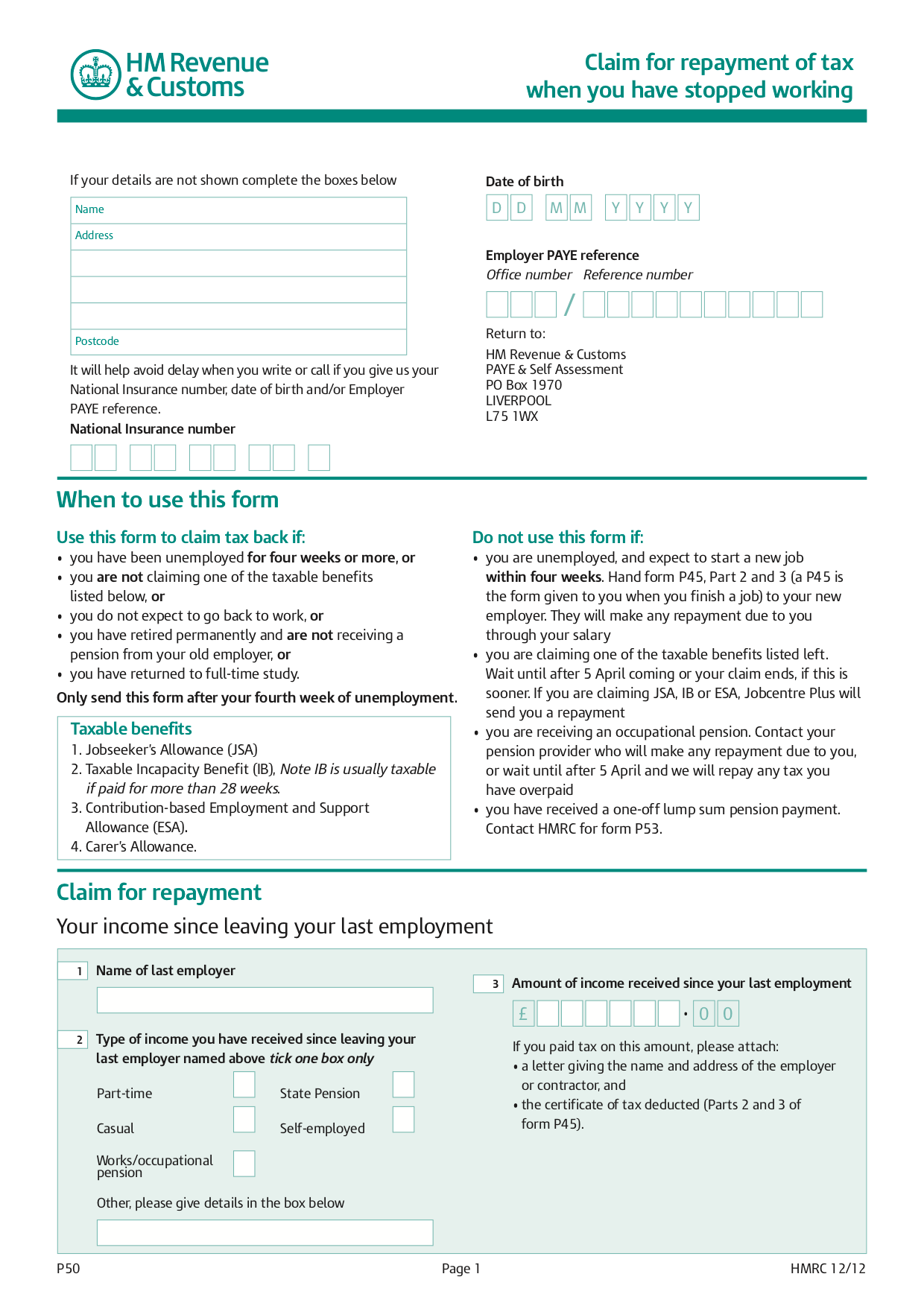

How To Claim Personal Tax Back With P50 If You Overpaid Hmrc

How To Claim Personal Tax Back With P50 If You Overpaid Hmrc