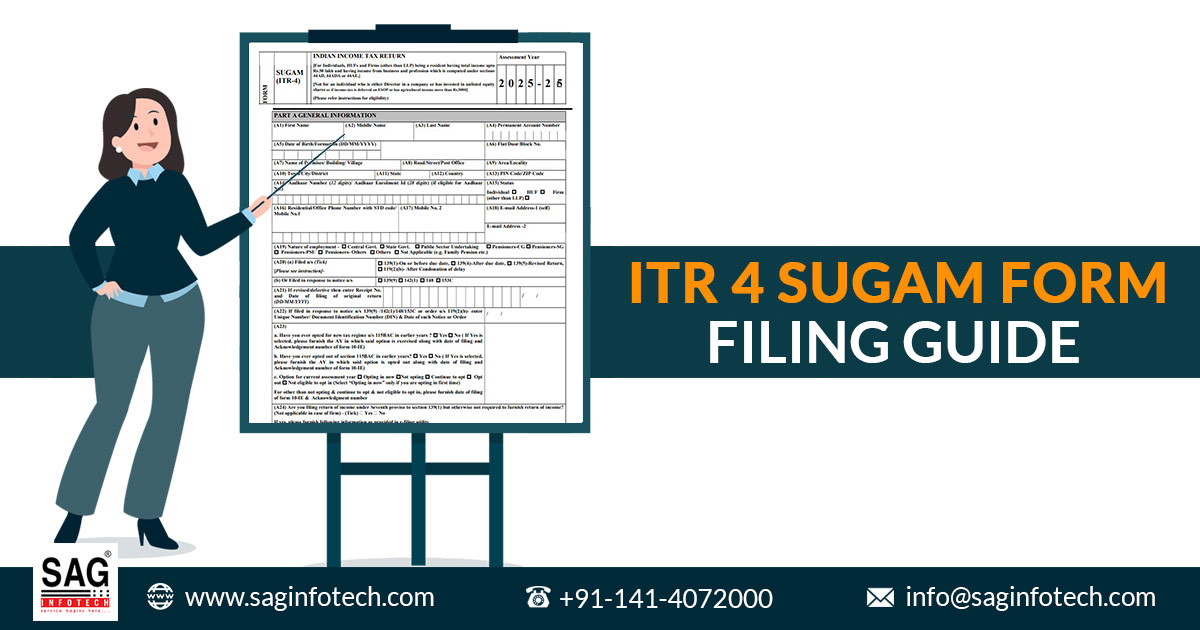

Which Itr Form To Fill For Small Business

Businesses need to use Sugam ITR-4 for Income Tax return if they have opted for the presumptive income scheme as per section 44AD and Section 44AE of the Income Tax Act. This video shows how a businessman can file his.

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Tax department has introduced various forms for individuals like ITR-1 ITR-2 ITR-4 and ITR 4S.

Which itr form to fill for small business. If you are running a small business its likely you have heard of the ITR 4S sugam form. Form 1120-S US. This guide will help you determine which forms to use and how to get the information for these forms.

Form 4562 Depreciation and Amortization. This video explains how a small businessman can file his own income tax return by using very simple method. Form 2553 Election By a Small Business Corporation.

Its for small businesses filing their tax returns on Schedule C with their personal returns Form 1040. If you will be reporting your business earnings on Schedule C you can search the IRS website for a copy or use TurboTax to generate the form for you after you input all of your financial information. In simple words ITR 3 needs to be filed when income is earned under the head Profit or gain of business or profession.

The physical or offline filing is allowed only for certain taxpayers including individuals with income less than Rs 5 lakhs and super senior citizens those above 80 years of age. Form 8829 Expenses for Business Use of Your Home. Individuals with presumptive income from a business or a profession.

The most common forms of business are the sole proprietorship partnership corporation and S corporation. It includes the tax calculated upon that income for the income tax department to review. - Sahaj can be filed by an individual having income up to Rs 50 lakh and who receives income from salary one house property other sources interest etc.

There are three ways of filing Income Tax Return online. Form ITR-4 Sugam is a simplified return form to be used by an assessee at his option if he is eligible to declare profits and gains from business and profession on presumptive basis under section 44AD 44ADA or. ITR Form 1 Sahaj and ITR Form 4 Sugam - ITR Form 1 Sahaj and ITR Form 4 Sugam are simpler Forms that cater to a large number of small and medium taxpayers.

Form 2848 Power of. 2 days agoAssessees with income from business or profession were required to exercise such option on or before the due date for furnishing the returns by filing Form 10-IE. State Tax Forms and Information.

Owners of small businesses also need to file for income tax return under ITR 4 ie. It is also filed when Tax Audit is applicable. When beginning a business you must decide what form of business entity to establish.

ITR 4S also called Sugam is for those businesses who have calculate the business income on the basis of presumption irrespective of actual income. Form SS-5 Application for a Social Security Card PDF PDF Form 1045 Application for Tentative Refund. Therefore small businesses can file their returns through Forms ITR-3 or ITR-4 online.

In the ITR form you must furnish information regarding the income earned during the previous year. ITR 3 form means having income from business or Profession and from partnership firmLLP for individual or HUFs. Fill out your Schedule C or Form 1120.

Income Tax Return for an S Corporation. Small businesses calculate their business profit or loss for income taxes then include this information on their personal tax returns. Your form of business determines which income tax return form you have to file.

Any business that has a. A Limited Liability Company LLC is a business structure allowed by state statute.

40 Years Ago And Now From 70 To 30 Peak I T Rate Income Tax Tax Rules Inheritance Tax

40 Years Ago And Now From 70 To 30 Peak I T Rate Income Tax Tax Rules Inheritance Tax

Filling An Itr Form Is Not Really Difficult One Can Actually Take Care Of It All Alone The Procedure Is Q Filing Taxes Bookkeeping Services Income Tax Return

Filling An Itr Form Is Not Really Difficult One Can Actually Take Care Of It All Alone The Procedure Is Q Filing Taxes Bookkeeping Services Income Tax Return

Know Why Income Tax Last Date Is Important Income Tax Return Income Tax Tax Return

Know Why Income Tax Last Date Is Important Income Tax Return Income Tax Tax Return

The Changing Face Of Lending In India Small Business Loans Small Business Loans Business Loans Types Of Small Business

The Changing Face Of Lending In India Small Business Loans Small Business Loans Business Loans Types Of Small Business

Pin By Efiler Taxreturn On Income Tax Filing Service Income Tax Return Tax Return Filing Taxes

Pin By Efiler Taxreturn On Income Tax Filing Service Income Tax Return Tax Return Filing Taxes

File Your Indian Income Tax Return With Ease For 2019 20 Income Tax Return Tax Return Income Tax

File Your Indian Income Tax Return With Ease For 2019 20 Income Tax Return Tax Return Income Tax

Documents Required For Filing Income Tax Return Itr In India Tax2win Blog Income Tax Return File Income Tax Tax Return

Documents Required For Filing Income Tax Return Itr In India Tax2win Blog Income Tax Return File Income Tax Tax Return

Types Of Itr Forms Find Which Form Is For You And How To Fill It Business News Times Of India

Types Of Itr Forms Find Which Form Is For You And How To Fill It Business News Times Of India

Types Of Itr Forms Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Types Of Itr Forms Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

You Might Think Why Should I File Tax Return If My Income Doesn T Exceed The Prescribed Limit But In O Filing Taxes Income Tax Return Financial Management

You Might Think Why Should I File Tax Return If My Income Doesn T Exceed The Prescribed Limit But In O Filing Taxes Income Tax Return Financial Management

Ay 2020 21 Income Tax Return Filing Tips New Itr Forms

Ay 2020 21 Income Tax Return Filing Tips New Itr Forms

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

You Are Losing These Benefits If You Didn T File Itr Till Now Income Tax Return File Income Tax Tax Return

You Are Losing These Benefits If You Didn T File Itr Till Now Income Tax Return File Income Tax Tax Return

Confused About Which Income Tax Return Form You Have To Fill Check Out This Tool To Know Your Itrs Income Tax Return Income Tax Knowing You

Confused About Which Income Tax Return Form You Have To Fill Check Out This Tool To Know Your Itrs Income Tax Return Income Tax Knowing You

Verify Prefilled Data Chartered Accountant Business Intelligence Filing Taxes

Verify Prefilled Data Chartered Accountant Business Intelligence Filing Taxes

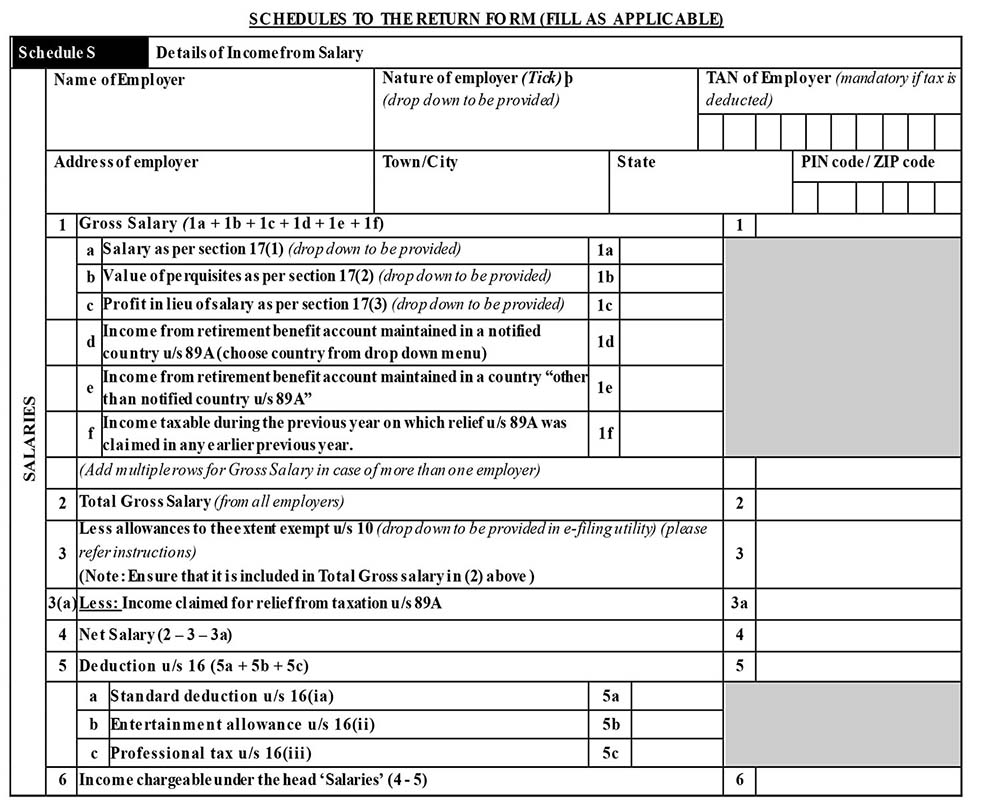

The Details Being Called For In Itr 1 Pertaining To Salary Income Profit In Lieu Of Salary Are Not Very Complex To Fill Tax Advisor Income Salary

The Details Being Called For In Itr 1 Pertaining To Salary Income Profit In Lieu Of Salary Are Not Very Complex To Fill Tax Advisor Income Salary

A Financial Calendar For 2020 21 Keep Your Date With Investments Taxes And Holidays Incometax Finance Calendar Investing Financial Finance

A Financial Calendar For 2020 21 Keep Your Date With Investments Taxes And Holidays Incometax Finance Calendar Investing Financial Finance