New York State Llc Registration

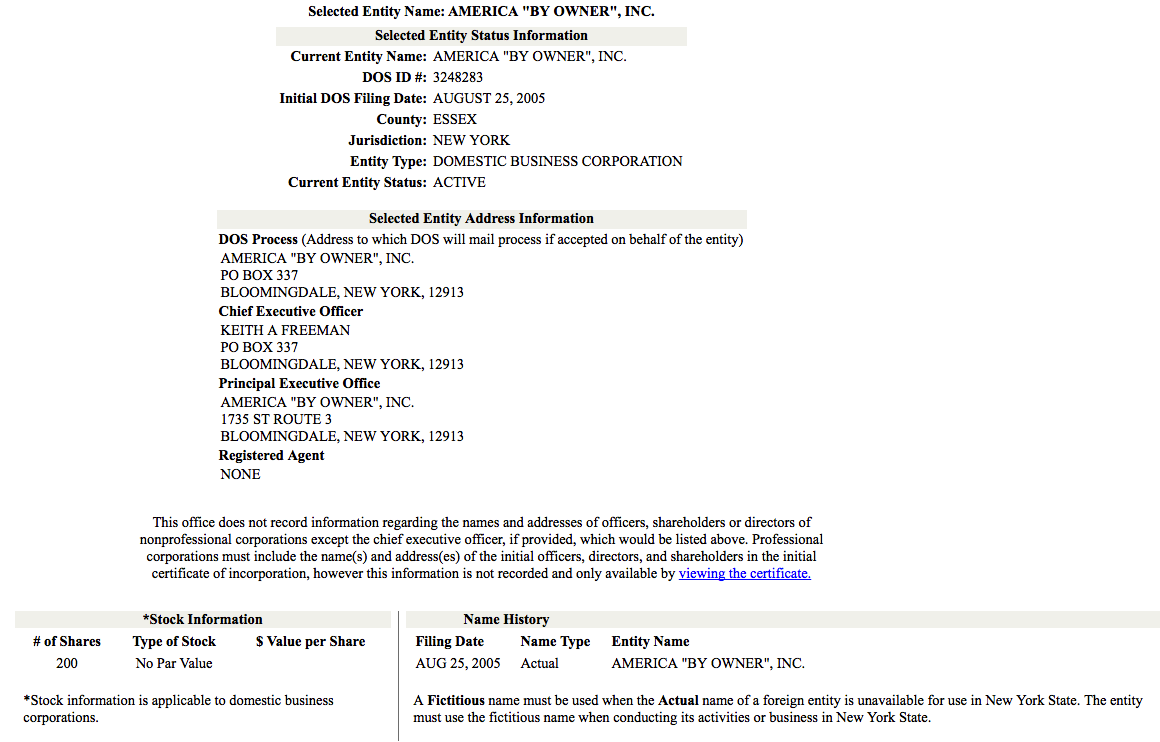

Companies register with the New York State Department of State NYSDOS. The Department of State has launched a new and streamlined online filing system to form Domestic Business Corporations and Domestic Limited Liability Companies LLCs.

What Is A Business Registration Certificate Kloss Stenger Gormley Llp

What Is A Business Registration Certificate Kloss Stenger Gormley Llp

File as a Foreign Corporation.

New york state llc registration. Register or renew. Form a Not-for-Profit Corporation. A limited liability partnership LLP is a partnership whose partners are authorized to provide professional services and that has registered as a limited liability partnership under Article 8-B of the Partnership Law of New York State or under the laws of another jurisdiction.

Starting an LLC in New York. You must register with the Tax Department before carrying on certain activities in New York State. The Registered Agent is required to record the service of process and corporation.

To register your business in New York you must file an Application for Authority with the New York Secretary of State SOS. Registrations do not need to be in the owners name or for only one person. The amount of the filing fee will be based on the New York source gross income for the tax year immediately preceding the tax year for which the fee is due preceding tax year.

Determine if a Name I Want To Use is Available. Domestic Limited Liability Company On-Line Filings for 3rd Party Non-Service Company Filers Domestic Business Corporation For Profit and Domestic Limited Liability Company. Form a Limited Liability Company.

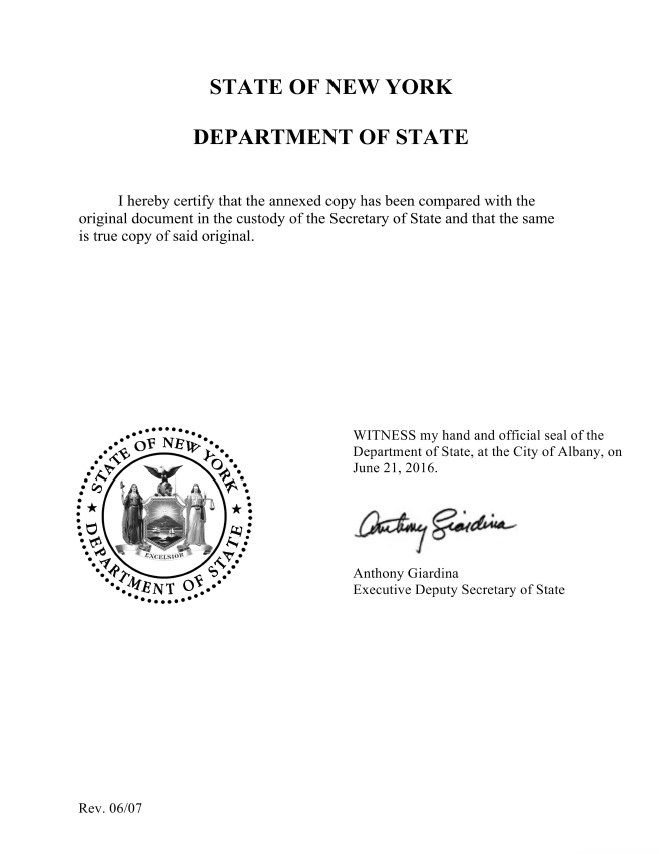

New York State will then send you a Certificate of Authority which must be displayed at your place of business at all times. To form an LLC in New York. Amount of annual filing fee.

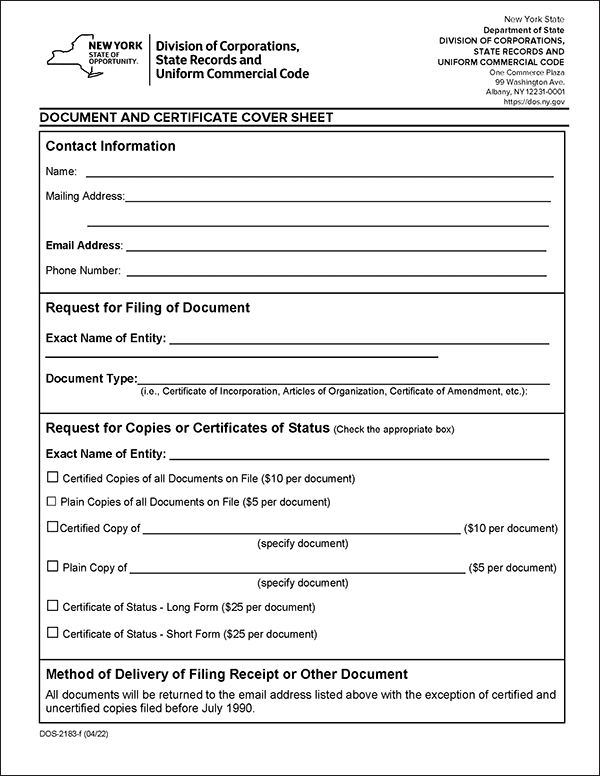

By mail send the completed Articles of Organization with the filing fee of 200 to the New York State Department of State Division of Corporations State Records and Uniform Commercial Code One Commerce Plaza 99 Washington Avenue Albany New York 12231. Obtain Copies of Documents. If you expect to make taxable sales in New York State you must register with the Tax Department at least 20 days before you begin business.

Businesses will need to provide proof of registration in their home state or country. The New York State Registered Agent accepts service of process for Corporations LLCs. Business Corporation LLC Formation.

You can download a copy of the application form from the SOS website. You can submit this document by mail by fax or in person. To register a foreign LLC in New York you must file a New York Application for Authority with the New York Department of State Division of Corporations.

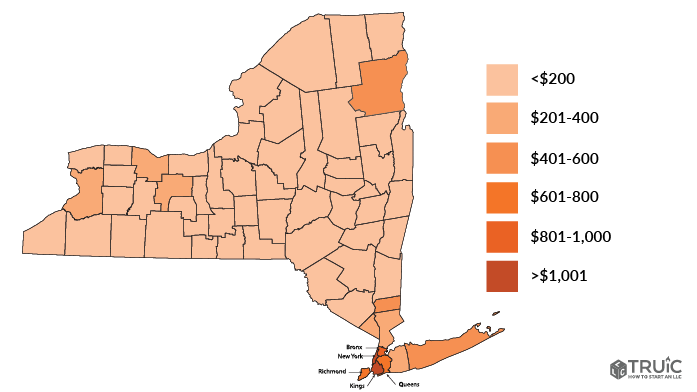

For example if you choose to register your business as a limited liability company the filing fee is 200. All corporations are required to maintain a good standing status with the NYSRA for continued service. Tax treatment of LLCs and LLPs.

File Form DOS -1336 Articles of Organization with the Department of State. If you have any questions about performing a search or the results you receive please contact the NYS Department of State Division of Corporations at 518 473-2492 Monday - Friday 900 am. You or your business must register and title any vehicle you own or lease.

An out-of-state Limited Liability Company can register for a Certificate of Authority in New York State. Your registration is the sticker placed on your windshield and the paper registration certificate that you must keep in your vehicle. If you have any questions about performing a search or the results you receive please contact the NYS Department of State Division of Corporations at 518 473-2492 Monday - Friday 900 am.

The Application for Authority costs 250 to file. Heres a quick list. Businesses can file their Certificates of Incorporation and Articles of Organization electronically saving both time and money.

Businesses should consult with an attorney to learn more about legal structures. This document requires you to list the name of your LLC the name and address of your registered agent and your tax ID number. To complete the form you must provide more or less the same information that you need to create an LLC in your home state.

Obtain a Certificate of Status. In person deliver the Articles of Organization to the above address. When budgeting for your new business remember to consider any applicable New York state.

If an LLC or LLP did not have any New York Source gross income for the preceding tax year the filing fee is 25. Do business under an assumed name dba Fax a Request to the Division of Corporations. A certified copy of the filing is 10.

The cost to register a business in the State of New York depends upon your startups entity structure. Beverage container deposit initiator.

Llc In New York How To Form An Llc In New York Nolo

Llc In New York How To Form An Llc In New York Nolo

New York Registered Agent Service For 49 00 Per Year

New York Registered Agent Service For 49 00 Per Year

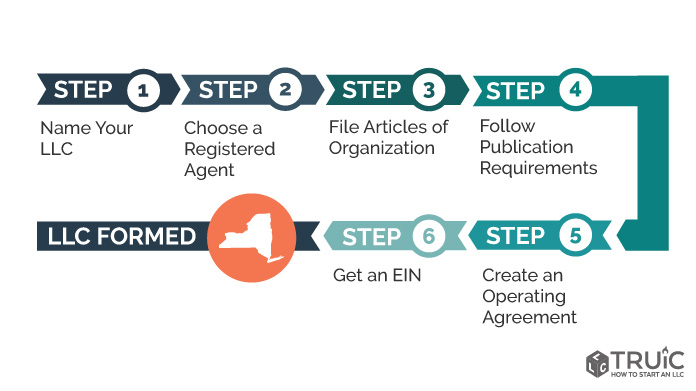

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

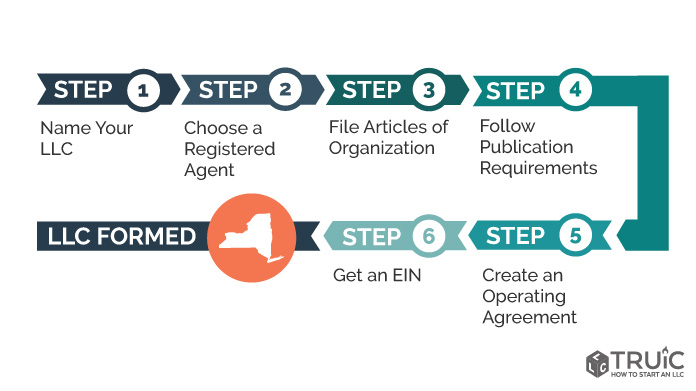

New York Llc Registered Agent Truic Guide

New York Llc Registered Agent Truic Guide

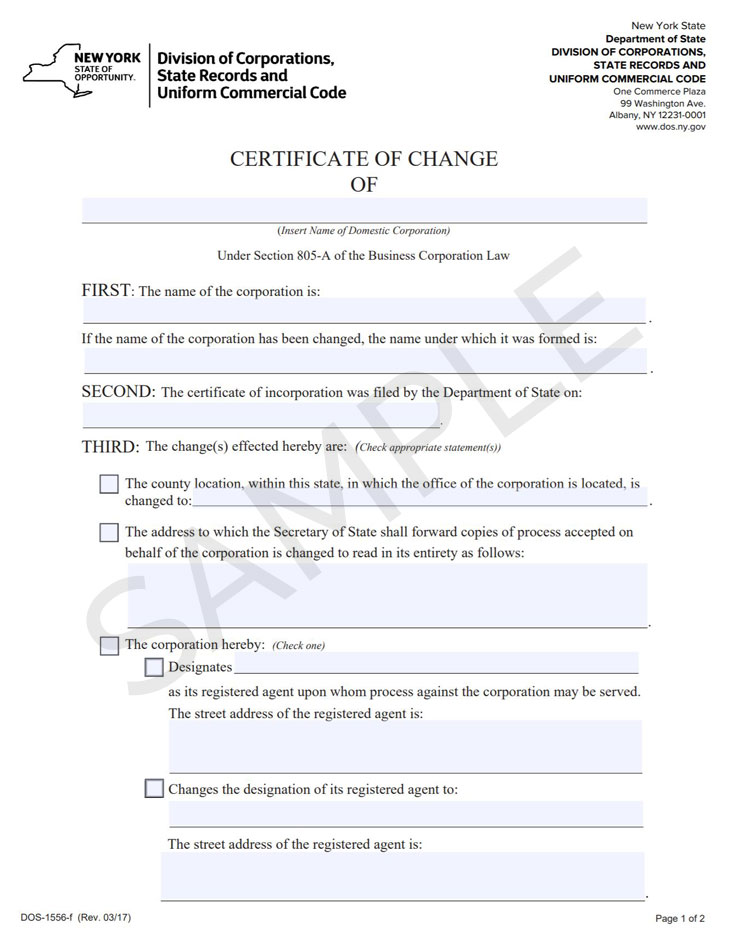

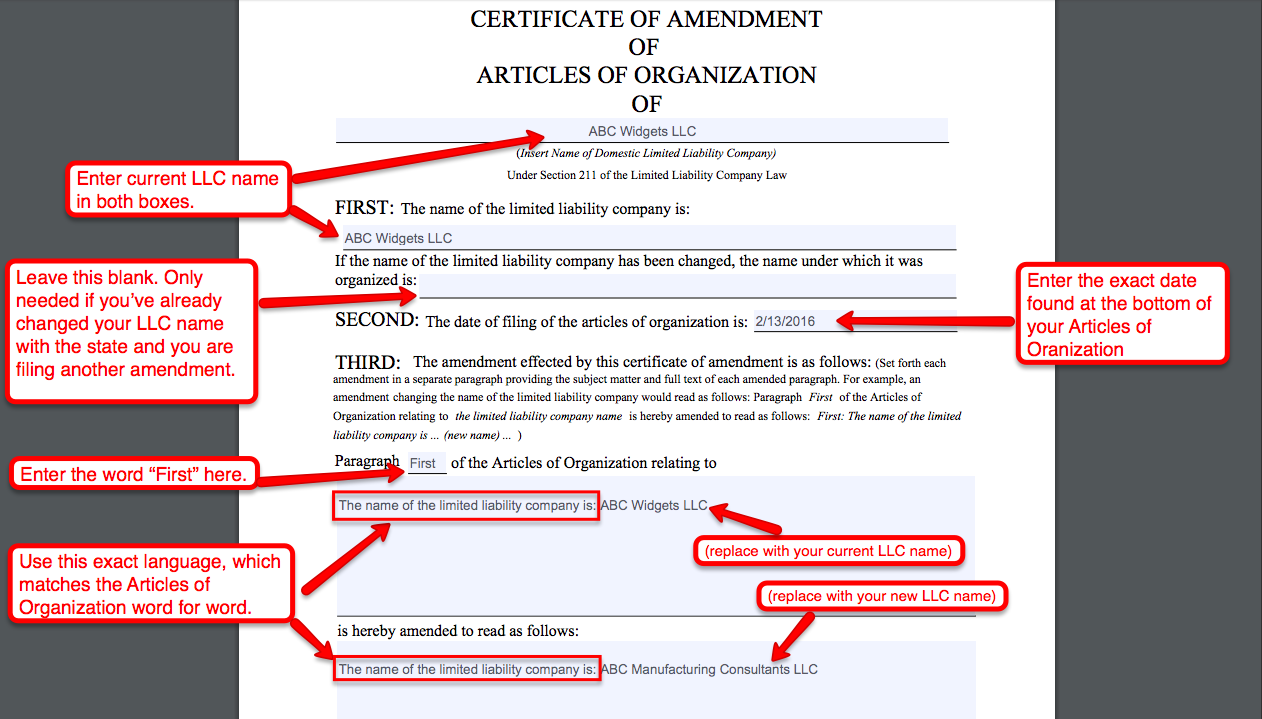

How To Change Your Ny Llc Name Certificate Of Amendment Llc University

How To Change Your Ny Llc Name Certificate Of Amendment Llc University

Https Dmv Ny Gov Forms Mv821 Pdf

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

New York Business Entity Search Corporation Llc

New York Business Entity Search Corporation Llc

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

New York Business Entity Search Corporation Llc

New York Business Entity Search Corporation Llc

How To Get A Resale Certificate In New York Startingyourbusiness Com

How To Get A Resale Certificate In New York Startingyourbusiness Com

![]() Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

New York Llc Publication Requirements

New York Llc Publication Requirements

New York Department Of State Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

New York Department Of State Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

Obtain New York Certified Copies Harbor Compliance

Obtain New York Certified Copies Harbor Compliance

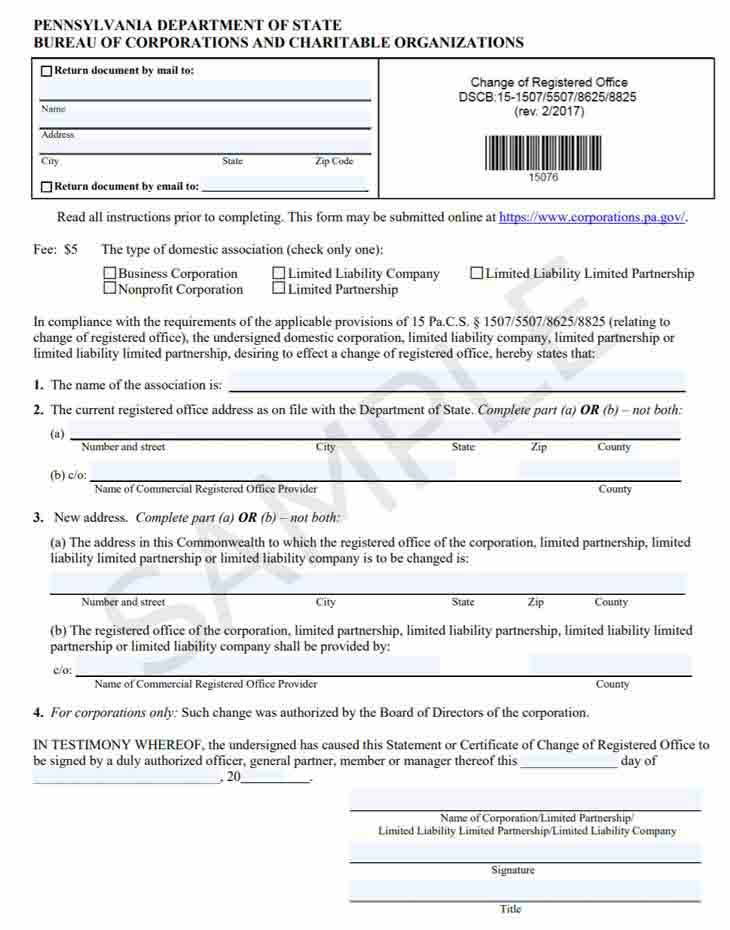

Pennsylvania Llc Registered Agent Truic Guide

Pennsylvania Llc Registered Agent Truic Guide

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Limited Liability Companies Frequently Asked Questions Nys Dos