How To Fill Out Ppp Loan Forgiveness Application For Sole Proprietor

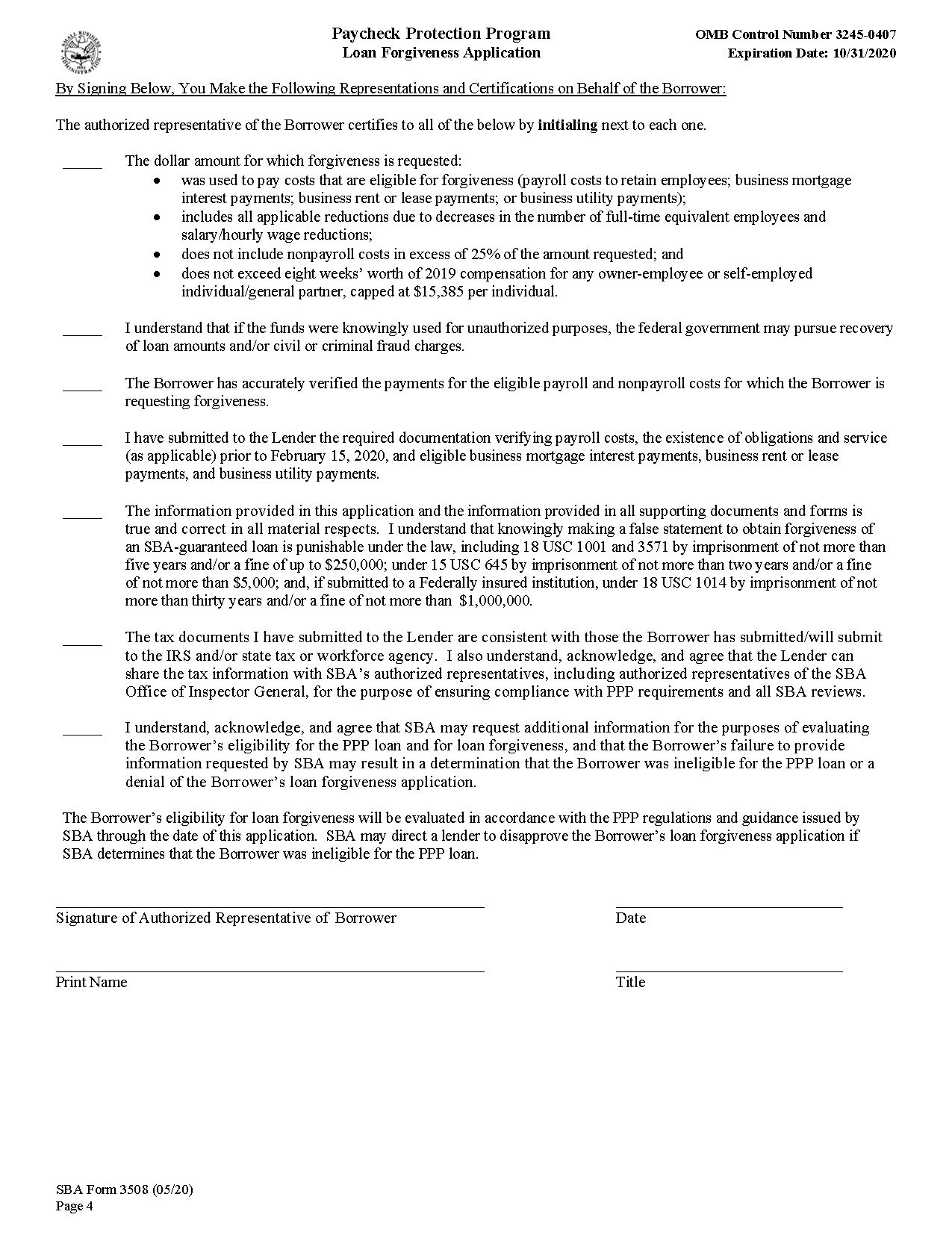

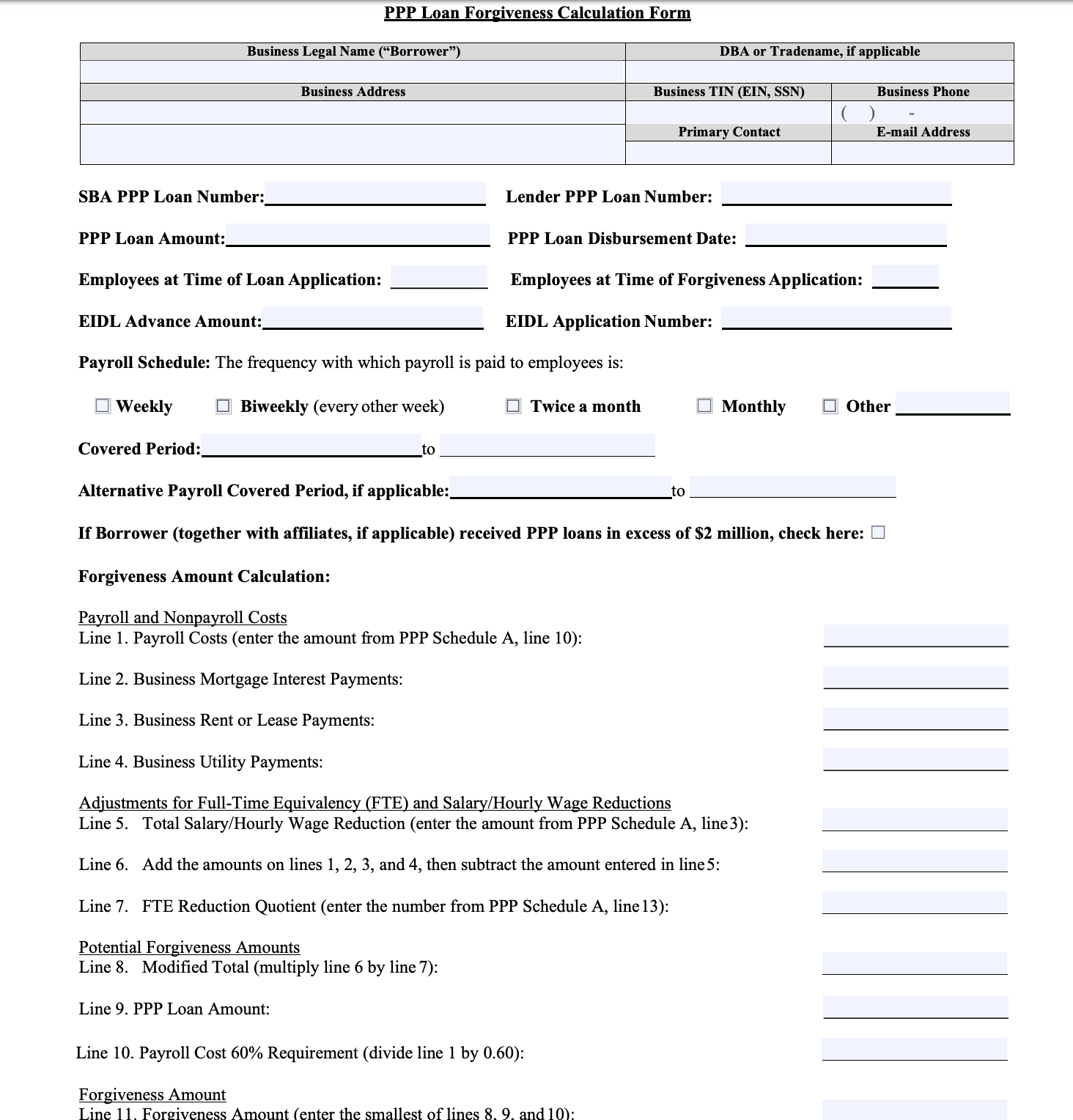

The amount of owner compensation replacement eligible for you to claim for forgiveness is calculated as follows. Check Yes or No for all questions on the form.

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

When it comes time to apply for forgiveness sole proprietors can claim Owner Compensation Replacement which allows them to automatically claim a portion of their PPP loan as lost profit.

How to fill out ppp loan forgiveness application for sole proprietor. This form may be used for both first and second draw PPP loans regardless of when you got your PPP loan as long as it has not yet been forgiven. Indicate your Business Type Independent Contractors and Sole Proprietors have slightly different document requirements. PPP Loan Forgiveness Applications.

There is one application form for first-time PPP loans and a different form for second draw PPP loans. The initial PPP loan program was intended to allow only one loan per EIN. However you will have to fill it out because you will need information from it to apply for your loan.

You can apply for forgiveness with the EZ application if. Weve put together step-by-step instructions that you can follow to avoid common mistakes. Take your reported net income in 2019 on your Schedule C and multiply that by 852 or 0154.

Sole proprietors will still need to prove expenses to receive forgiveness. If you are using 2020 to calculate payroll costs and have not yet filed a 2020 return fill it out and compute the value If this amount is over 100000 reduce it to 100000. Your lender can provide you with either the SBA Form 3508 SBA Form 3508EZ SBA Form 3508S or a lender equivalent.

But changes were made on March 3 2021 that affected the PPP loan calculation process. From your 2019 or 2020 IRS Form 1040 Schedule C you may elect to use either your line 31 net profit amount or your line 7 gross income amount. Previously sole proprietors were able to apply for a PPP loan using their 2019 or 2020 net income as reported on a Schedule C.

At least sixty percent of your forgiveness amount must be covered payroll costs but in fact you can submit a forgiveness amount that includes only payroll costs. This monthly average net profit is then multiplied 25 times to equal the PPP loan amount. Include your contact name and email address.

Make sure everything is as accurate as possible. With independent contractors and self-employed individuals becoming eligible to apply for US. If you havent filed your taxes and you plan to apply for a PPP loan you should fill out your tax return right away and file it as you complete your PPP loan application.

This applies to you if you did not have payroll costs at the time of your initial loan application and during the loans covered period. The forgivable portion is equal to 25 months worth of their 2019 net profit. The 3508EZ and the 3508S are shortened versions of the application.

Earlier this week a new EZ application for PPP loan forgiveness Form 3508EZ was introduced. Now its time to get into the heart of PPP loan forgiveness. It will be one of the following.

You are a self-employed individual independent contractor or sole proprietor. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. How sole proprietor PPP loans are calculated.

Applying for PPP Loan Once you have your number you grab a copy of the PPP Loan applicationfrom either the Treasurygov or the SBA website. Thankfully its not as hard as you think. In essence the PPP loan should be roughly ten weeks worth of 2019 net profit.

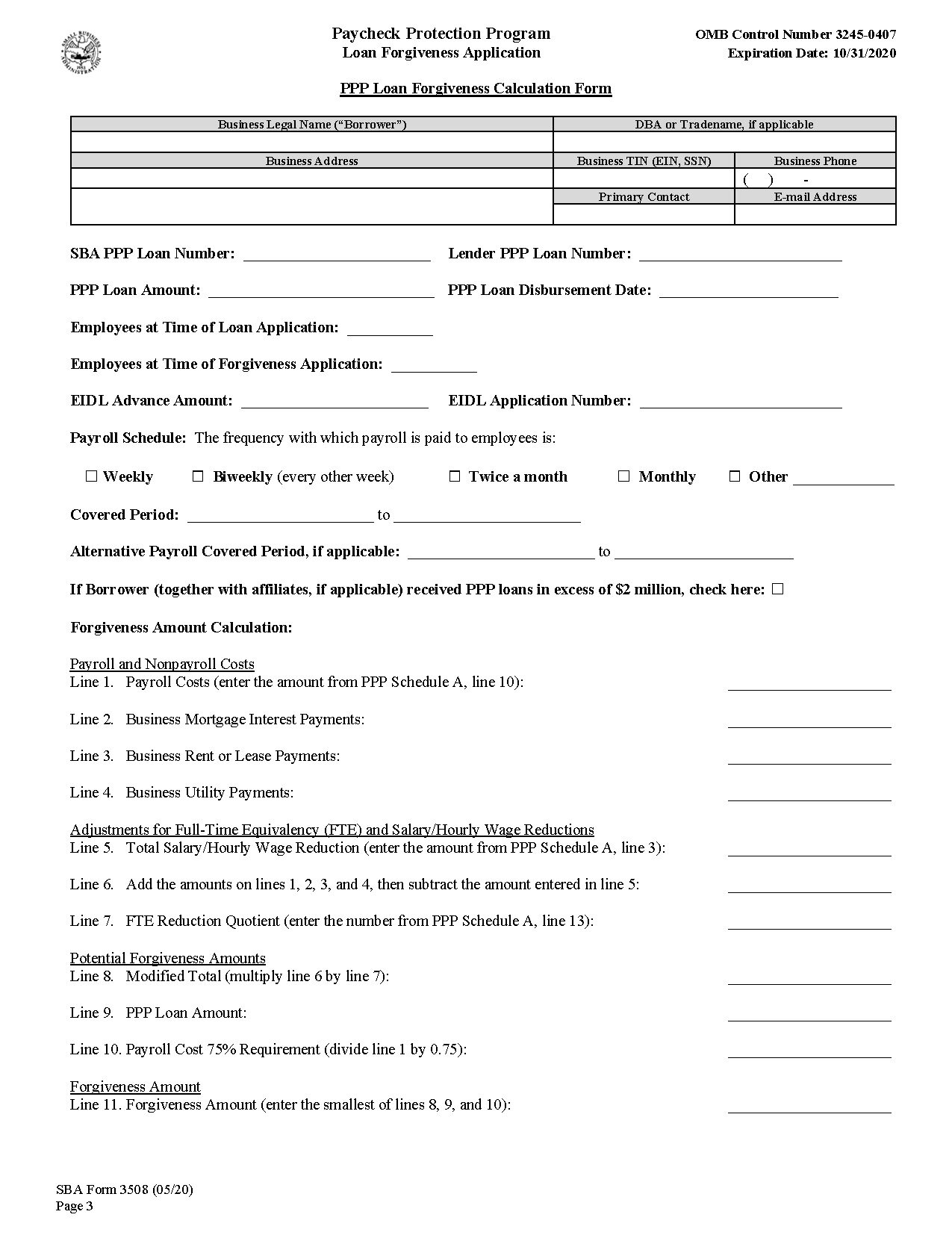

This is now two and a half months of your net or gross income as reported on your 2019 or 2020 Schedule C. Its only one page and much simpler than the previous application. The form requires you to 1 certify seven declarations 2 calculate your forgiveness amount and 3 provide documentation supporting your forgiveness amount.

SBA Form 3508S this is the form youd fill out if you borrowed less than 150000 Read more about forgiveness forms and revisions for self-employed individuals. For a sole proprietor or independent contractor. Notice that you provide your name and address and your taxpayer identification number.

Small Business Administration Paycheck Protection Program PPP loans Friday April 10 2020 the SBA issued an interim final rule on how Schedule C sole proprietors and individual partners in a partnership should treat their self-employment income regarding the PPP loan process. There are now two calculations depending on if you have payroll. The latest and simplest form is 3508S and it may be used for loans of 150000 or less.

The top part of the form shown below provides the fields you fill in. To apply for loan forgiveness you should contact your PPP lender and complete the correct application form. If you are self-employed an independent contractor or a sole proprietorship heres how to fill out the forgiveness amount request without payroll.

This will be your owner compensation replacement value. Filling out the application forms. Contact your PPP lender and complete the correct form.

Using the OCR sole proprietors can claim forgiveness based upon 2019 net profit. However as of the revisions in late 2020 if you already received PPP funding but qualify and can demonstrate sufficient economic harm you may be eligible for a second draw PPP loan see above.

A Complete Guide To Ppp Loan Forgiveness For The Self Employed Alignable

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube

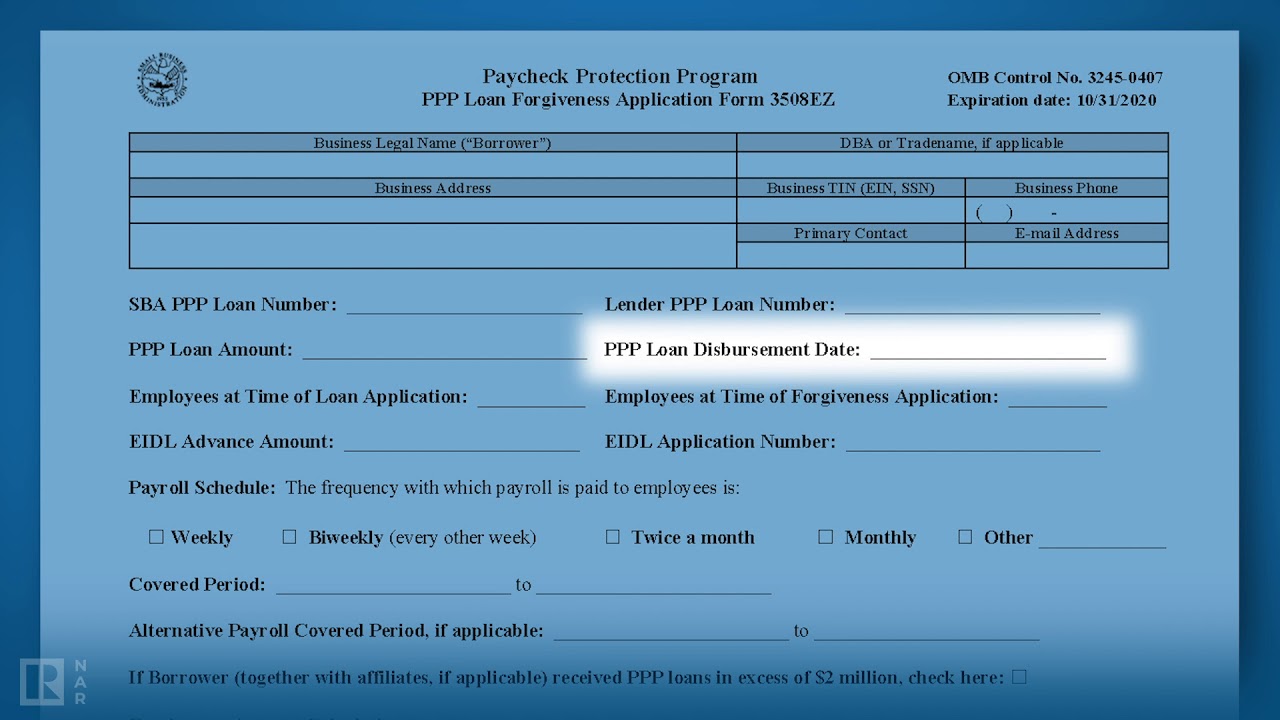

How To Complete The Ppp Loan Forgiveness Application Form 3508ez Youtube

How To Complete The Ppp Loan Forgiveness Application Form 3508ez Youtube

Tips And Strategies For Getting Ppp Loan Forgiveness

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application 24 Weeks How To Fill Out Ppp Loan Forgiveness Application 3508ez Youtube

Ppp Loan Forgiveness Application 24 Weeks How To Fill Out Ppp Loan Forgiveness Application 3508ez Youtube

Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

![]() How To Complete The Ppp Loan Forgiveness Application Form 3508ez On Vimeo

How To Complete The Ppp Loan Forgiveness Application Form 3508ez On Vimeo

A Complete Guide To Ppp Loan Forgiveness For The Self Employed Alignable

Ppp Loan Forgiveness Process Part 3 How To Complete The Sba 3508 Loan Forgiveness Application The Final Piece Anchor Business Brokers

Ppp Loan Forgiveness Process Part 3 How To Complete The Sba 3508 Loan Forgiveness Application The Final Piece Anchor Business Brokers

Ppp Loan Forgiveness For Sole Proprietor And Self Employed Youtube

Ppp Loan Forgiveness For Sole Proprietor And Self Employed Youtube

Ppp Loan Forgiveness Application How To Track Ppp Loan Expenses Updated Template Included Youtube

Ppp Loan Forgiveness Application How To Track Ppp Loan Expenses Updated Template Included Youtube

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

How To Fill Out Ppp Loan Forgiveness Application For Self Employed 1099 Freelancers Contractors Youtube

How To Fill Out Ppp Loan Forgiveness Application For Self Employed 1099 Freelancers Contractors Youtube

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

How To Fill Out Your Ppp Forgiveness Application Form Cannabis News Culture Heady Vermont

How To Fill Out Your Ppp Forgiveness Application Form Cannabis News Culture Heady Vermont