Form X-201 For Sole Proprietors Only

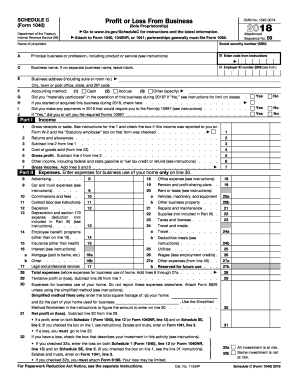

If you are starting a business as a sole proprietor or partnership you must file a document with the city county or state as required by the laws of the state in which your business will be conducted. Report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Form X201 Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Form X201 Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

LLCs in the form of a sole proprietorship file on the owners personal tax return.

Form x-201 for sole proprietors only. The same goes for liabilities. File it with Form 1040 or 1040-SR 1041 1065 or 1065-B. Individuals including sole proprietors partners and S corporation shareholders generally use Form 1040-ES to figure estimated tax.

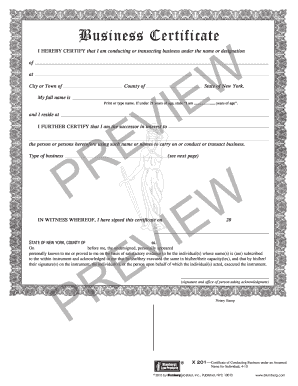

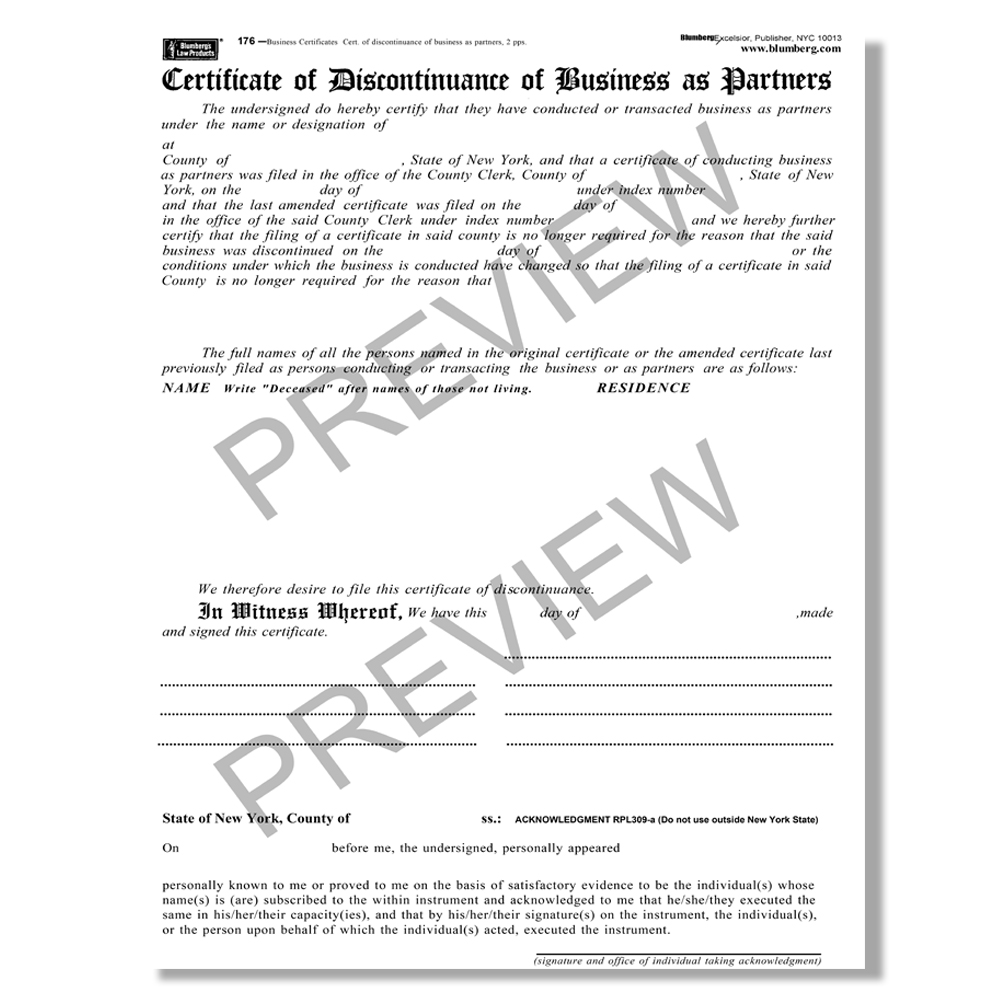

In fact the only place you can obtain a business certificate form in New York City is at one of 15 stationary stores that sell legal forms printed by a company called Blumberg. Blumberg Forms Online Web Only. For that reason its one of the easiest business entities to form because taxes are easier to report.

When you work for an employer you only pay the employees portion of these taxes and the employer pays the other half. The business certificate is X-74 for partnerships and X-201 for sole proprietorships. Form 339 Certificate of use of assumed name by a corporation.

A sole proprietorship does not distinguish between the two. As a sole proprietor you have to pay both the employers and the employees portions. That opens the program to unprofitable businesses.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. The closest one to the Queens County Clerks office is in Forest Hills about a mile and a half away. Also use Schedule C to report wages and expenses you had as a statutory employee.

Certificate to conduct business under assumed name. New York Business Certificate DBA Form 201. The sole proprietorship is a popular business form due to its simplicity ease of setup and nominal cost.

If you are filing as a sole proprietor one owner you need FORM X 201 BUSINESS CERTIFICATE. The New York County Clerk accepts for filing pursuant to Section 130 of the General Business Law certificates of sole proprietorships partnerships and assumed names for businesses including DBA for businesses the address of which is in New York County. 639 BFO Amendment of assumed name.

The new PPP application for self-employed workers and sole proprietors who file IRS Form 1040 Schedule C now asks for the total amount of gross income found on line 7 of the tax form. A sole proprietor need only register his. The rate is a combined 153 for the first 132900 of earnings and 29 for Medicare only after that.

A sole proprietorship also known as individual entrepreneurship sole trader or simply proprietorship is a type of an unincorporated entity that is owned by one individual only. Schedule F 1040 or 1040-SR Profit or Loss from Farming. The form is fairly easy to fill out but use caution because it will be rejected if there are too many white-outs cross-outs or other correction marks.

It is the simplest legal form of a business entity. The county does NOT provide Business Certificate forms. For starters running all of my business earnings through a separate bank account will help create a narrative for the IRS that my sole proprietorship is a bonafide endeavor thus giving more credibility to the expenses I.

The Business Certificate form is X-74 for a partnership and X-201 for a sole proprietorship and they can be purchased at any commercial or legal. Report farm income and expenses. Business owners are advised to purchase them in the lobby of the courthouse in Manhattan or at a legal stationery store.

Blumberg legal forms are respected by courts and attorneys for. New York Business Certificate DBA Form x201. An advertisement that shows the sole proprietorship is available to work for others.

Under the new formula sole proprietors can get loans based instead on their income before expenses. Proof that the sole proprietorship is paid by the job and an IRS 1099 form is given to the sole proprietorship by the general contractor at the end of the year. When you form a sole proprietorship your business assets and your personal assets are one and the same.

Self-employment taxes are the equivalent of the Social Security and Medicare taxes that all employers and workers have to pay. A sworn statement from the sole proprietor that he or she has no employees.

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

How To Start A Sole Proprietorship In New York Legalzoom Com

How To Start A Sole Proprietorship In New York Legalzoom Com

Bathroom Remodel Checklist Bathrooms Remodel Estimate Template Checklist Template

Bathroom Remodel Checklist Bathrooms Remodel Estimate Template Checklist Template

Http Www Cityofbell Org Home Showdocument Id 12116

Webb County Assumed Name Search Fill Online Printable Fillable Blank Pdffiller

Webb County Assumed Name Search Fill Online Printable Fillable Blank Pdffiller

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Https Www Sec Gov Rules Other 2019 Memx Memx Form 1 Execution Pdf

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Https Www Citybarjusticecenter Org Wp Content Uploads 2016 09 Cbjc Nelp Sole Proprietorship Fact Sheet Pdf

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Https New Content Mortgageinsurance Genworth Com Documents Training Course Taxreturnschc Presentation 0219 Pdf

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products