Do You Need To Send A 1099 To An Individual Or Sole Proprietor

From a practical standpoint when it comes to filling out the Payable form for your 1099 as a Doordash or Instacart contractor it really doesnt matter if you choose Individual or Sole Proprietor. Another important point to note.

It S That Time Of Year Again W9 Best Practices Part I Apm Help Bookkeeping

It S That Time Of Year Again W9 Best Practices Part I Apm Help Bookkeeping

A sole proprietorship does not have to issue a 1099 to the business owner.

Do you need to send a 1099 to an individual or sole proprietor. A 1099 form is typically intended for individuals to file when they provide services or goods to a company. However the 1099-MISC still has uses as it is used for reporting payments to an individual or LLC in excess of 600 legal settlements or prize or award winnings. The 1099-K is not entered as an actual form in the return like the W-2 or 1099-DIV or -INT.

If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. And its not a disaster if you checked Single member LLC. The exception to this rule is with paying attorneys.

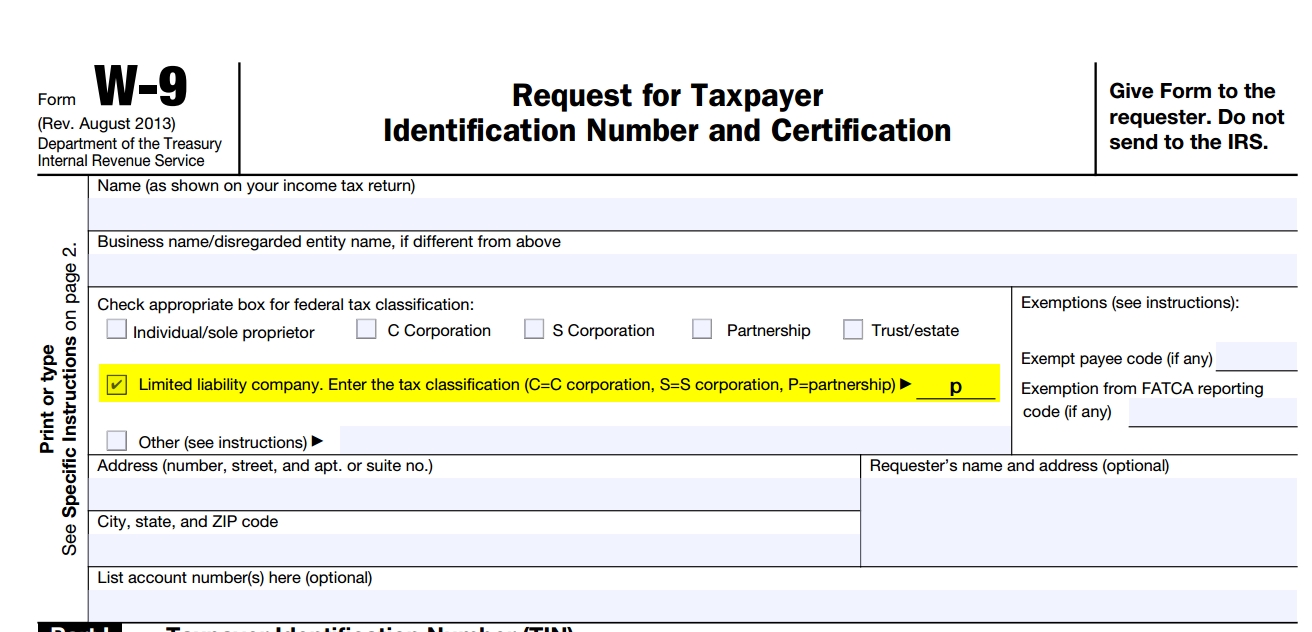

To complete Form W-9 as a sole proprietor enter your individual name as shown on your 10401040A1040EZ on line 1. But not an LLC thats treated as an S-Corporation or C-Corporation. You dont have to register your small business as a sole proprietor with your state as you would have to do if you have an LLC or corporation business type.

So the IRS wont be matching it like they do with the other forms. The IRS recognizes the sole proprietorship business and owner as the same person. Your business must file a Form 1099 with the IRS and to each unincorporated business or individual to whom you paid 600 or more during a given tax year.

In the event its a SMLLC that is not a corporation you would issue the 1099-MISC with their SSN on it. Beginning in 2020 the 1099-NEC is used to report payments of 600 or more to service providers typically work done by an independent contractor who is a sole proprietor or member of a partnership. If the single-member LLC is owned by a corporation or partnership the LLC should be reflected on its owners federal tax return as a division of the corporation or.

Sole proprietors may not operate as a business entity but the company might still file the 1099 for them. And you theres no way to register as an independent contractor. Line 2 is optional but it is helpful to the person requesting Form W-9.

If the company provided you a Social Security number instead of an EIN Employer Identification Number then they would appear to be operating as a sole proprietor LLC which is not a corporation. Youll need to file a 1099-MISC for each person to whom you have. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

There is no need to send 1099-MISCs to corporations. Every corporation must file Forms 1099-MISC if in the course of its trade or business it makes payments of rents commissions or other fixed or determinable income see section 6041 totaling 600 or more to any one person during the calendar year. For example the IRS receives a copy of the W-2 and they look at your return to see if you have the W-2 in your return.

In this way all profit earned by the business becomes taxable income. You just receive income from a 1099-MISC and report it on your business tax return. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not.

Next on line 2 you can enter your business trade or doing business as DBA name. If they write P for partnership you issue a 1099-MISC with their EIN on it. If they are a single-member LLC that is not taxed as a corporation they would check the Individualsole proprietor or single-member LLC box.

For most payments youll. In this case the contractor is filing as an individual without a business structure. This includes rent payments and payment for.

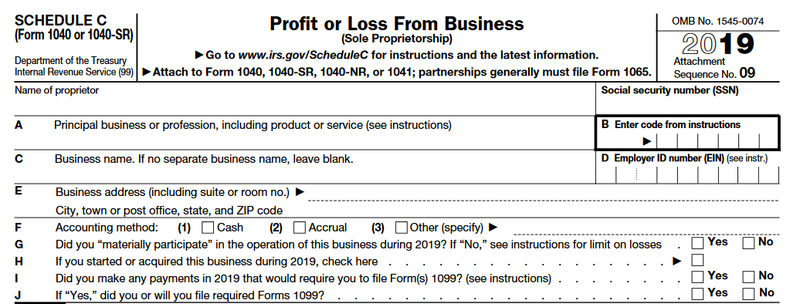

An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a sole proprietorship. Do I Have to Pay Self-Employment Taxes. Income earned by a sole proprietorship is reported on a Schedule C which is part of the business owners Form 1040.

They must send the forms to independent. States will send both you and the federal government a 1099-G form at the beginning of the year which shows income you received from that state during the previous tax year. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

The Internal Revenue Service requires business owners including sole proprietors and self-employed taxpayers to send IRS Form 1099-MISC to certain payees. Examples include graphic designers Web developers cleaning professionals freelance writers landscapers and other self-employed individuals. When you contract a sole proprietor for services the Internal Revenue Service requires you to issue a 1099 to the worker when you pay him more than 600 during the year.

You can use this useful form to determine whether or not you need to send a 1099-NEC MISC form for any independent contractor youve worked with.

Https Www Edfiles Com Casbolibrary Aspx Filename 1099 20reporting 20concepts 20 17 18 Pdf

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Free Fillable W9 Form W9 Invoice Template Attending W11 Invoice Template Can Be Fillable Forms Invoice Template Irs Forms

Free Fillable W9 Form W9 Invoice Template Attending W11 Invoice Template Can Be Fillable Forms Invoice Template Irs Forms

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

What Is The Difference Between An Individual And A Sole Proprietor

What Is The Difference Between An Individual And A Sole Proprietor

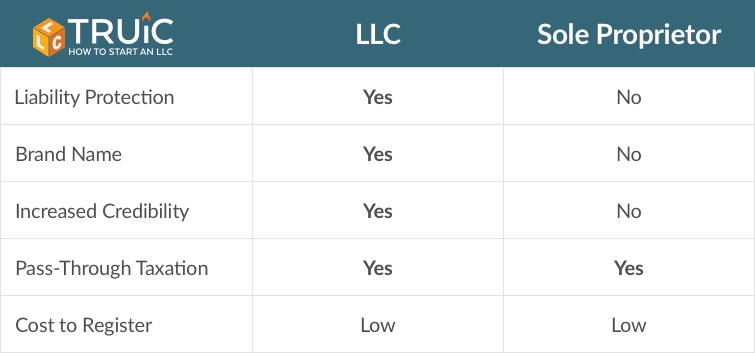

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

What Is The Difference Between An Individual And A Sole Proprietor

What Is The Difference Between An Individual And A Sole Proprietor

What Is The Difference Between An Individual And A Sole Proprietor

What Is The Difference Between An Individual And A Sole Proprietor

How To Fill Out A W9 For A Sole Proprietor Legalzoom Com

How To Fill Out A W9 For A Sole Proprietor Legalzoom Com

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Understanding A 1099 When To File Avizo Group

Understanding A 1099 When To File Avizo Group

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile