Sole Proprietorship Business License Indiana

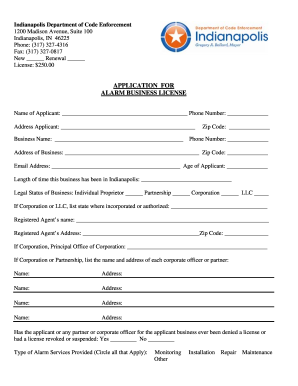

Indianapolis Certain types of activities require a business license in Indianapolis such as. There is no general state of Indiana business license however many cities require businesses to be licensed in order to operate.

Indianapolis Business License Fill Out And Sign Printable Pdf Template Signnow

Indianapolis Business License Fill Out And Sign Printable Pdf Template Signnow

To establish a sole proprietorship in Indiana heres everything you need to know.

Sole proprietorship business license indiana. Please note that closing your business in INBiz will only end your obligations to the Secretary of States office. A doing business as DBA name is a crucial part of many sole proprietorships as it enables you to use. DBA is an abbreviation for doing business as Well prepare and file all required documents to start your DBA.

Choose a business name for your sole proprietorship and check for availability. Apply for Business Licenses Permits. Where do I register a sole proprietorship.

If the business name is different than that of the sole proprietor or the partners the business name must be registered with the respective County Recorder If the county office does not have the appropriate form you can obtain one from the State Information Center 1-800-457-8283 STATE. Obtain an Employer Identification Number. Choose a business name.

You are entitled to all profits and are responsible for. Below are a few cities that have business license requirements. You are responsible for properly closing the business with all other agencies in which your business.

Get started Starting at 99 state filing fees. You dont have to file any forms with your state and can use your Social Security Number as your tax ID. If you are starting a new business in Indiana you may need to register with the Indiana Department of Revenue.

Register with the Department through INBiz Use Indianas one-stop resource for registering and managing your business. Your sole proprietorship must register with the Indiana Department of Revenue if you meet any requirements that are listed below. You have employees withholding tax.

Sole proprietors without employees usually dont need to acquire a federal tax ID. Starting a Business in Indiana Simple Step-by-Step Guide. If you run a business and file taxes under your own name you.

Rules for business registration vary depending on location and what the business does. Agriculture Environment. A sole proprietorship is a business owned by a single individual that isnt formally organized.

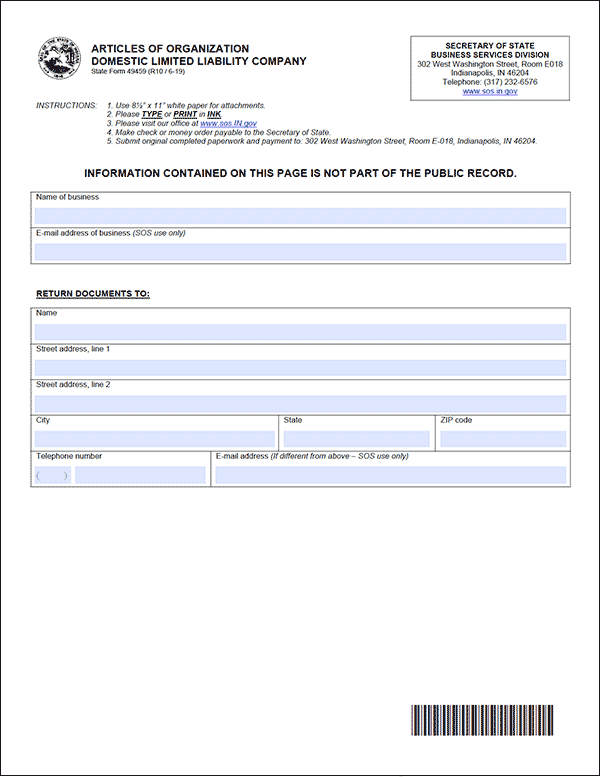

Indiana does not have any one single comprehensive business license. File an assumed business name with the county recorder. Write a Business Plan.

You should also read the general section for information applicable in any state. Each requirement has a link to the proper information needed for your business. To formally dissolve businesses must file with the Indiana Secretary of State first.

A sole proprietorship is the simplest and most common structure chosen to start a business. Animal Health Board of. However all businesses operating in Indiana are subject to regulatory requirements that may involve several state agencies.

Sole proprietors who wish to have employees need to obtain an Employer Identification Number or EIN. Small Business Development Center Indiana. INBiz is the state of Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations.

General partnerships and sole proprietorships are required to file their Indiana DBA with the County Recorder in the county that their business is located. Register a Business Name. March 17 2021 1438.

It is an unincorporated business owned and run by one individual with no distinction between the business and you the owner. All businesses with employees are required to report wages to the IRS using their EIN. If you conduct business as an individualsole proprietor association or general partnership under an assumed name many banks and lenders require you to file a Certificate of Assumed Business Name or Doing-Business-As DBA form.

The document must be notarized meet recording requirements and include the correct fee in order to be recorded. Obtain licenses permits and zoning clearance. Businesses that are starting expanding hiring employees for the first time changing ownership or organizational structure or moving into Indiana will need to consider the areas listed in this section.

How to Become an Indiana Sole Proprietor DBA Acquisition. Here is an outline of the steps you should follow to get started as a sole proprietor in Indiana. You will be selling products or tangible items.

Open a Business Bank Account. Workers Compensation Board of Indiana. However you might need to take additional steps depending on your business and whether you want to hire employees.

If youre a Sole Proprietor you need a DBA to register your business name. A sole proprietorship is the simplest business structure to form in Indiana and it has only one owneryou. Select a Business Entity.

We utilize state-of-the-art security features so you can feel safe about inputting your personal and business information into our system. Choose a Business Idea. Estates and real estate investment companies are also required to file with the county.

To register to do business in Indiana visit the. Please refer to the Online Business Tax Application BT-1 Checklist for more information. This is a nine-digit number issued by the IRS to keep track of businesses.

Agriculture Indiana State Department of.

Wow What An Amazing Lifeinsurance Product Suite We Have Wednesday Saw Our Marketing Leads Hit A Life Insurance Quotes Online Life Insurance Private Sector

Wow What An Amazing Lifeinsurance Product Suite We Have Wednesday Saw Our Marketing Leads Hit A Life Insurance Quotes Online Life Insurance Private Sector

How To Search Available Business Names In Alabama

How To Search Available Business Names In Alabama

How To Set Up A Sole Proprietorship In Indiana 13 Steps

How To Set Up A Sole Proprietorship In Indiana 13 Steps

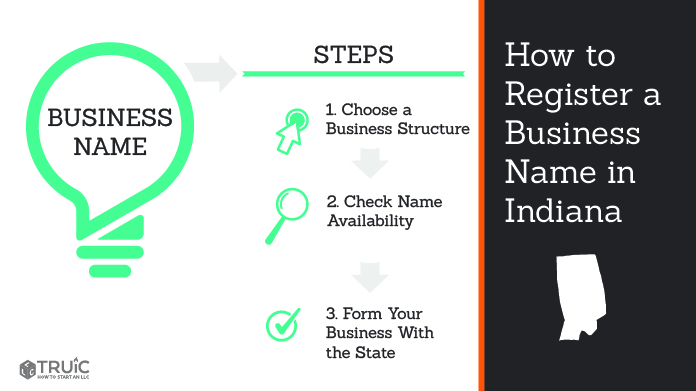

Llc Indiana How To Start An Llc In Indiana Truic Guides

Llc Indiana How To Start An Llc In Indiana Truic Guides

Sole Proprietorship What Is Sole Proprietorship Sole Proprietor Tax Sole Proprietorship Sole Proprietor This Or That Questions

Sole Proprietorship What Is Sole Proprietorship Sole Proprietor Tax Sole Proprietorship Sole Proprietor This Or That Questions

How To Set Up A Sole Proprietorship In Indiana 13 Steps

How To Set Up A Sole Proprietorship In Indiana 13 Steps

Llc Or Corporation Choose The Right Form For Your Business Paperback Business Ebook Starting Your Own Business Home Based Business

Llc Or Corporation Choose The Right Form For Your Business Paperback Business Ebook Starting Your Own Business Home Based Business

How To Register A Business Name In Indiana How To Start An Llc

How To Register A Business Name In Indiana How To Start An Llc

Home Improvement Contracting Hic Book Bundle General Contractor Business Book Bundles Exam

Home Improvement Contracting Hic Book Bundle General Contractor Business Book Bundles Exam

A Comprehensive 16 Step Checklist For Starting A Business In Indiana

A Comprehensive 16 Step Checklist For Starting A Business In Indiana

Sole Proprietorship Taxes Fees Inbiz

Sole Proprietorship Taxes Fees Inbiz

Https Ag Purdue Edu Agecon Fambiz Documents Licensing Regulatory Tax Requirements For Indiana Businesses Pdf

Pin On Www Getconnected360 Com

Pin On Www Getconnected360 Com

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Economics Business Organization Student Activity Economics Business Organization Student Organization

Economics Business Organization Student Activity Economics Business Organization Student Organization

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

Start Your Business In Downtown Seymour

Start Your Business In Downtown Seymour

Stumped How To Form A District Of Columbia Llc The Easy Way