Irs Business Name Change Form 1120

For instructions and the latest information. Corporations engaged in farming.

Irs Instructions For A Business Name Change Legalzoom Com

Irs Instructions For A Business Name Change Legalzoom Com

If you are a tax-exempt organization see instructions check here Check.

Irs business name change form 1120. 3 rows If you are filing a current year return mark the appropriate name change box of the Form. Income Tax Return for an S Corporation. Boxes this change affects.

For Businesses Corporations Partnerships and Trusts who need information andor help regarding their Business Returns or Business BMF Accounts. S-Corporation Form 1120S Page 1 Line H Box 2. Corporation Income Tax Return Form 1120.

A corporation other than a corporation that is a subchapter T cooperative that. The 1120 Instructions and 1120-S Instructions both specify that. If you own a corporation including an S corporation you can change your name when you file your tax return on Form 1120 or you can write to the IRS at the address where you mailed your tax return.

Number street and room or suite no. 3402 Taxation of Limited Liability Companies. Corporation Income Tax Return which requires companies to annually file their debts and income.

Your change can occur from a state or federal change that affects items used to compute your Illinois net income net loss or credits such as an amendment of your federal income tax return an adjustment made by the Internal Revenue Service IRS or. Corporations that have assets of 10 million or more and file at least 250 returns annually are required to electronically file their Forms 1120 and 1120S for tax years ending on or after December 31 2007. Corporations Form 1120 Page 1 Line E Box 3.

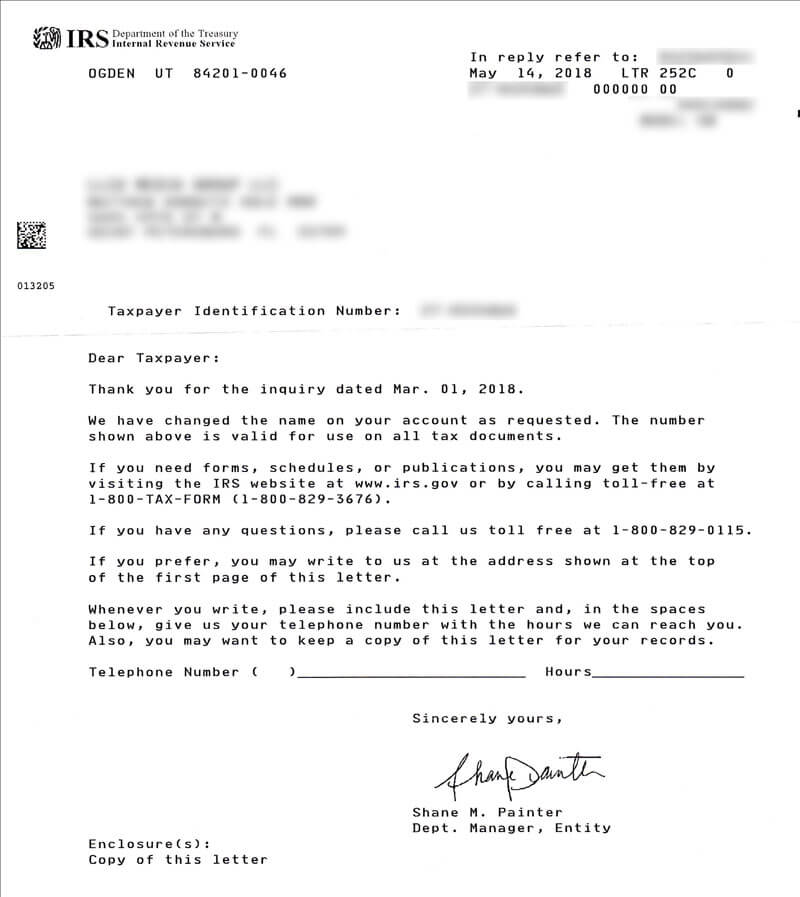

Send a letter signed by the business owner or an authorized representative to the same address where you file your tax returns notifying them of your name change. Employee plan returns Forms 5500 5500-EZ. When supplying the organizations new name under section A of the form including the old name of the company wont be necessary because an officer of the company must sign the form.

Employee plan returns Forms 5500 5500-EZ. Form 1120 Department of the Treasury Internal Revenue Service US. LLC sole member cannot update name by filing return.

Employment excise income and other business returns Forms 720 940 941 990 1041 1065 1120 etc 2. If you are a tax-exempt organization see instructions check here Check. A corporation or s-corporation changing its name does not need to file a form with the IRS prior to filing its tax return for the year in which the name change occurs.

Name Change with Tax Filing Select the Name Change option at the top of the Form 1120 Form 1120S or Form 1120-F. For more e-file information see e-file for Business and Self-Employed Taxpayers. As a corporation you can file an annual Form 1120 by checking Name Change on page 1 line E.

Must use Option 2. A corporate officer must sign the notice. When filing a current year tax return you can change your business name with the IRS by checking the name change box on the entitys respective form.

If you are also changing your home address use Form 8822 to report that change. If using Form 1120 the box is on Page 1 Line E Box 3. The LLC can file a Form 1120 only if it has filed Form 8832 to elect to be treated as an association taxable as a corporation.

You can change your name with the IRS when you file taxes by including the change on your tax forms or through other written correspondence. The one youll use will depend on your principal business location the year-end value of your assets and what additional schedules you must file. If using the US.

Attach a copy of the amended certificate of incorporation or other state-provided documentation that confirms the legal name change of. For more information about LLCs see Pub. Prepare the corporate return as usual.

If you choose to mail your Form 1120 and if the IRS permits you to do so you can find a list of addresses on the IRS website. Tax Return or Form IL-1120-X for a tax year ending on or after December 31 1986. Employment excise income and other business returns Forms 720 940 941 990 1041 1065 1120 etc 2.

Services cover Employer Identification Numbers EINs 94x returns 1041 1065 1120S Excise Returns Estate and Gift Returns as well as issues related to Federal tax deposits. If you have already filed the return for the current year you. When filing a current year return mark the Name Change box on the appropriate version of the US.

You can check the box in Forms Mode Form 1120-S p1-2 or click the Business Info tab click A bout Your Busines s and then click the Edit button to the right. If you are also changing your home address use Form 8822 to report that change. If the corporation changed its name since it last filed a return check the Name change box.

Boxes this change affects. Form 1120 is for the US. How you give notice depends on your business type.

Corporation Income Tax Return For calendar year 2020 or tax year beginning 2020 ending 20 Go to.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

How To Change Your Llc Name With The Irs Llc University

How To Change Your Llc Name With The Irs Llc University

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

4 Form Irs Ten Solid Evidences Attending 4 Form Irs Is Good For Your Career Development Power Of Attorney Form Career Development Reference Letter

4 Form Irs Ten Solid Evidences Attending 4 Form Irs Is Good For Your Career Development Power Of Attorney Form Career Development Reference Letter

My Business Name Changed How Do I Notify The Irs Bhandlaw

My Business Name Changed How Do I Notify The Irs Bhandlaw

Amazon Dolman Bateman Accountants Sydney Employer Identification Number Business Valuation Business Structure

Amazon Dolman Bateman Accountants Sydney Employer Identification Number Business Valuation Business Structure

3 12 217 Error Resolution Instructions For Form 1120 S Internal Revenue Service

3 12 217 Error Resolution Instructions For Form 1120 S Internal Revenue Service

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

C Corporation Updated 628x1024 Jpg 628 1024 S Corporation Tax Guide Quickbooks

C Corporation Updated 628x1024 Jpg 628 1024 S Corporation Tax Guide Quickbooks

Guide Your International Clients Who Work And Live Both Inside And Outside Of The Us The Bene Continuing Education Credits Business Format Continuing Education

Guide Your International Clients Who Work And Live Both Inside And Outside Of The Us The Bene Continuing Education Credits Business Format Continuing Education

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

Dean T Carson Ii C P A Taxes And Taxation Tax Services Income Tax Return Business Campaign

Dean T Carson Ii C P A Taxes And Taxation Tax Services Income Tax Return Business Campaign

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

S Corp Vs C Corp Business Structure Accounting Services Tax Accountant

S Corp Vs C Corp Business Structure Accounting Services Tax Accountant

Entity Names 1065 1120 1120 S K1 Scheduleq