How To Change Ownership Of A Sole Proprietorship

You cant sell a sole proprietorship. The deed for declaring transfer is different from a regular partnership deed.

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Unlike a corporation theres no legal difference between a sole proprietorship and its owner.

How to change ownership of a sole proprietorship. There are two considerations you need to discuss. Second establish how the acquiring sole proprietor will compensate you. The company doesnt own assets or sign contracts you do.

Use the Business Licensing Wizard to get information and links that will help you do the following. Negotiate with the sole proprietor who will receive the assets upon transfer. You can only sell the business assets.

Late notification of the change. All the legal obligations and debts that youve undertaken throughout the operation of the business will remain with. Create your business structure with the Washington Secretary of State.

Transferring ownership of a sole proprietorship involves an asset sale and closing out the original owners personal responsibility for the business. Sole-proprietorships Partnerships Updating information of sole proprietorship Renewing sole proprietortorship Common offences under the Business Names Registration Act Closing the sole proprietorship Variable Capital Companies Setting up a VCC Managing a VCC Updating info of VCC and VCC officers Register a charge for VCC. To transfer ownership of your business you transfer ownership of the relevant assets.

If you plan to transfer business ownership or if there are any changes to the particulars of the Sole-Proprietorship or Partnership you sole-proprietorpartner or authorised representative if any must lodge the changes with the Registrar online via BizFile using SingPass or CorpPass within 14 days from the date of the change. First address which assets and rights the acquiring sole proprietor wants. It will make several references to the proprietorship business and will declare the transfer to a partnership firm.

As a sole proprietor he can do business under his own name or create another doing business as name and register with the state government. The process to change a business structure for example change from a sole proprietorship to a corporation is the same as starting a new business. If you plan to transfer business ownership of the Sole-Proprietorship you must lodge the change with the Registrar online via BizFile using SingPass or CorpPass within 14 days from the date of the change.

An attorney can tell you the best process for your jurisdiction and help you define what assets should be included with the sale. The GST authorities have clarified that transfer or change in the ownership of business would happen in the case of death of the sole proprietor and would include the transfer or change in the ownership of a business. GST Authorities Clarifies ChangeTransfer In Ownership Of Sole Proprietorship.

The first step in selling your sole proprietorship is consulting an attorney. If you have operated your sole proprietorship under a Doing Business As DBA name contact the state office where you registered the name. The attorney can help you define the documents and contracts that will need to be drawn up and signed by both the buyer and the seller.

In the case of proprietorship change the ownership from all deeds Bank rent agreements by executing by a settlement deed. Skip this step if you are. If the new owner wants to continue the business using the same DBA the sole proprietor has to request for change of ownership form if available.

Register your sole proprietorship Declaration of Transfer. Since a sole proprietorship represents the owner of the business you cannot actually transfer a sole proprietorship to someone else. It is not applicable to all the state.

Best Ownership Transfer Letter Templates For Free Besty Templates Printable Letter Templates Contract Template Lettering

Best Ownership Transfer Letter Templates For Free Besty Templates Printable Letter Templates Contract Template Lettering

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Advantages Of Business Incorporation Business Business Structure Sole Proprietorship

Advantages Of Business Incorporation Business Business Structure Sole Proprietorship

Income Contribution Letter Example Of Sole Proprietorship Letter Sole Proprietorship Letter Example Lettering

Income Contribution Letter Example Of Sole Proprietorship Letter Sole Proprietorship Letter Example Lettering

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

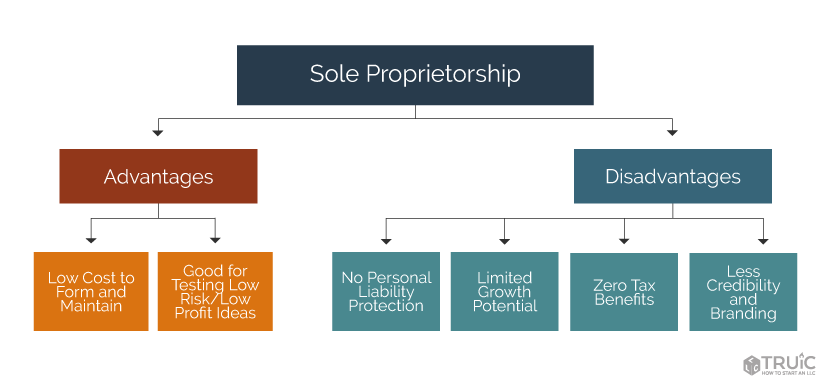

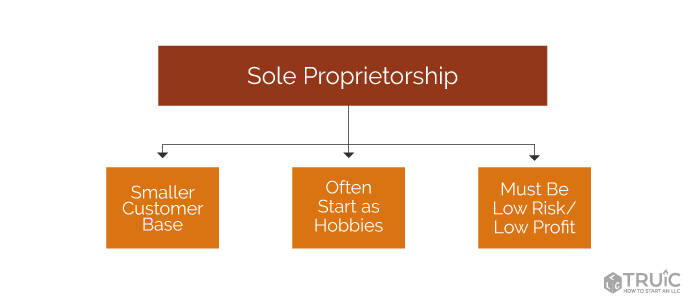

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Chapter 2 Forms Of Business Ownership Forms Of Business Ownership Sole Proprietorship Owned By One Person Franchise One Business Licenses Another Ppt Download

Chapter 2 Forms Of Business Ownership Forms Of Business Ownership Sole Proprietorship Owned By One Person Franchise One Business Licenses Another Ppt Download

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Investment Business Structure

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Investment Business Structure

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Types Of Business Ownership Powerpoint Note Taking Guide Quiz And Quiz Key Business Ownership Business Note Taking

Types Of Business Ownership Powerpoint Note Taking Guide Quiz And Quiz Key Business Ownership Business Note Taking

Forms Of Business Ownership Business Ownership Organization Development Business

Forms Of Business Ownership Business Ownership Organization Development Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management