Does An Llc Have A K1

If you are an owner of a partnership LLC S-corp or other entity that passes through taxes to its owners in most cases you will receive a K-1 form each year. Schedule K-1 has two versions.

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

In this instance the LLC must issue K-1s to.

Does an llc have a k1. S corporation members should report their income share on Schedule-K1 of Form 1120S. But one-member LLCs must report as if they were a sole proprietorship using Schedule C. As a partnership profits are allotted among the members at the end of each year.

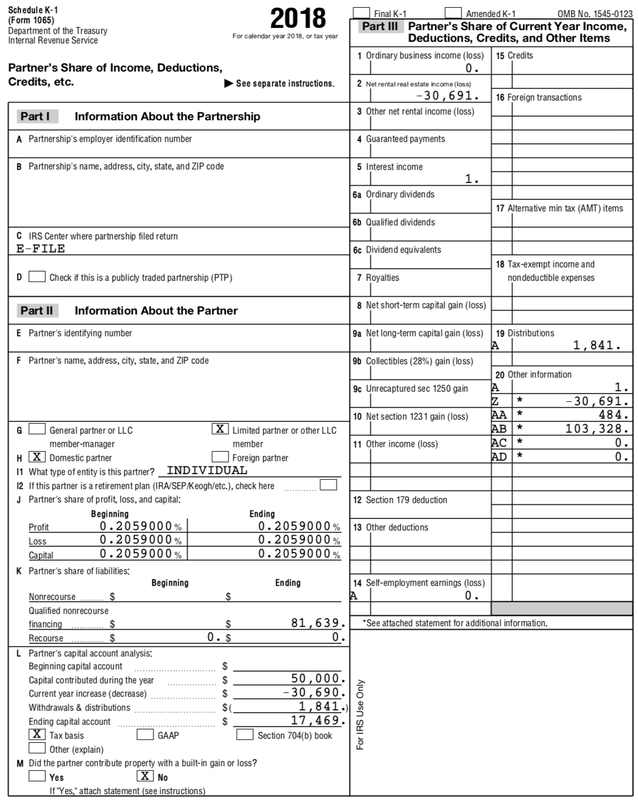

Box 14 Code C is gross non farm and really it should not be there nor code B for that matter IF that K-1s member is listed as Limited or Other LLC Members. Multiple-member LLCs use the K-1 form to report information about owners income. Income Tax Return for an S Corporation Instructions US.

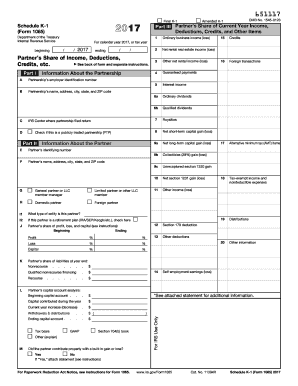

Income Tax Return and S corporation laws apply to the LLC. If your business is a pass-through entity like a partnership S corporation or LLC taxed as a partnership or S corp youll have to fill out a Schedule K-1 for each of your shareholders or partners including yourself. S corporations should report corporate income on Form 1120S.

Those profits are taxable income. When an LLC has more than one member the IRS considers it as a partnership. A Schedule K-1 is used by partners in a business LLC members and S corporation shareholders to report their income deductions and credits for the tax year.

The LLC should then report the corporate income on Form 1120. Accordingly it was long accepted that partners in CPA firms and law firms had their compensation reported on Schedule K-1 rather than on Form W-2 with no withholding thereon and paid income tax and self-employment tax via required quarterly estimated tax payments. However if a qualifying LLC elected to be an S Corporation it should file a Form 1120S Form 1120S US.

The LLC pays taxes as a corporation does. The partnership must furnish copies of Schedule K-1 Form 1065 to the partner. These payments are generally made in return for services or capital the members have provided to the company and are separate from shared distributions of income generated by the LLC.

Return of Partnership Income. K1 income from an LLC taxed as a partnership and self-employment tax. The tax form reports the participation of each member in the business income deductions and tax credit items.

The partnership Schedule K-1 is also used to show the income is distributed among the members in an LLC that has multiple members. Each owner reports their pro-rata share of corporate income credits and deductions on Schedule K-1 Form 1120S. Single-member LLCs are taxed the same way as sole proprietorships.

Therefore they do not need to use a Schedule K-1. Such LLCs are taxed as partnerships. Annual Return of Income.

To file your taxes you must submit Form 1065 and Schedule K-1. For deadlines see About Form 1065 US. Members of a limited liability company LLC that is treated as a partnership for tax purposes may take guaranteed payments from the company.

The K-1 is prepared by the entity to distribute to ownersshareholders to outline their portion of the income loss and deductions. However if the LLC HAS made the election to be taxed as an S-corporation the corporation should issue you a W-2 and a K-1 no Schedule C. The owners of an LLC can choose to have the IRS treat the company as a corporation a partnership or a disregarded entity.

The partnership as an entity may need to file the forms below. Partners are not employees and shouldnt be issued a Form W-2. Shareholders use the Schedule K-1 to put these amounts on their personal tax returns.

A single-member LLC that is a disregarded entity that does not have employees and does not have an excise tax liability does not need an EIN. An LLC applies for an EIN by filing Form SS-4 Application for Employer Identification Number. Schedule K-1 of Form 1041 which must be filed by beneficiaries of trusts or estates.

This is a great thread with much good info but it kinda dwindled on specifics at end. Owners receive a K-1 showing their share. That is it hasnt filed Form 8832 There are actually two more forms that the IRS calls Schedule K-1.

The Schedule K-1 will help all of the business owners file their personal tax returns. Your company is an LLC and has not decided to be taxed as a corporation this year. The Schedule K-1 is also used to report the capital gains of shareholders for S corporations and certain trusts.

LLCone owner - Form K1 or Schedule C Carls response is correct if the LLC has NOT made the election to be taxed as a corporation. See Form SS-4 for information on applying for an EIN. When an LLC has more than one member the IRS automatically treats it as a partnership for tax purposes.

If youre required to file a Schedule K-1 with the IRS its important to understand what it is when its due how it works and how to include it with your personal tax return.

What Is A K 1 And Does My Llc Need To Issue One

What Is A K 1 And Does My Llc Need To Issue One

K1 Form Fill Out And Sign Printable Pdf Template Signnow

K1 Form Fill Out And Sign Printable Pdf Template Signnow

I Received A K 1 What Is It The Turbotax Blog

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

1065 1120s 1041 K 1 Sorting And Viewing K1

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Is A Schedule K 1 By Itself Enough To Prove Llc Membership New York Business Divorce

Is A Schedule K 1 By Itself Enough To Prove Llc Membership New York Business Divorce

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Dissecting And Understanding A Schedule K 1

Dissecting And Understanding A Schedule K 1

What Is A Schedule K 1 Form Zipbooks

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet