1099 Reporting Requirements For S Corporation

If no 1099-S is required on the transaction because the sale is an exempt transaction. S Corps are not required to get a form 1099-MISC or 1099-NEC from their clients.

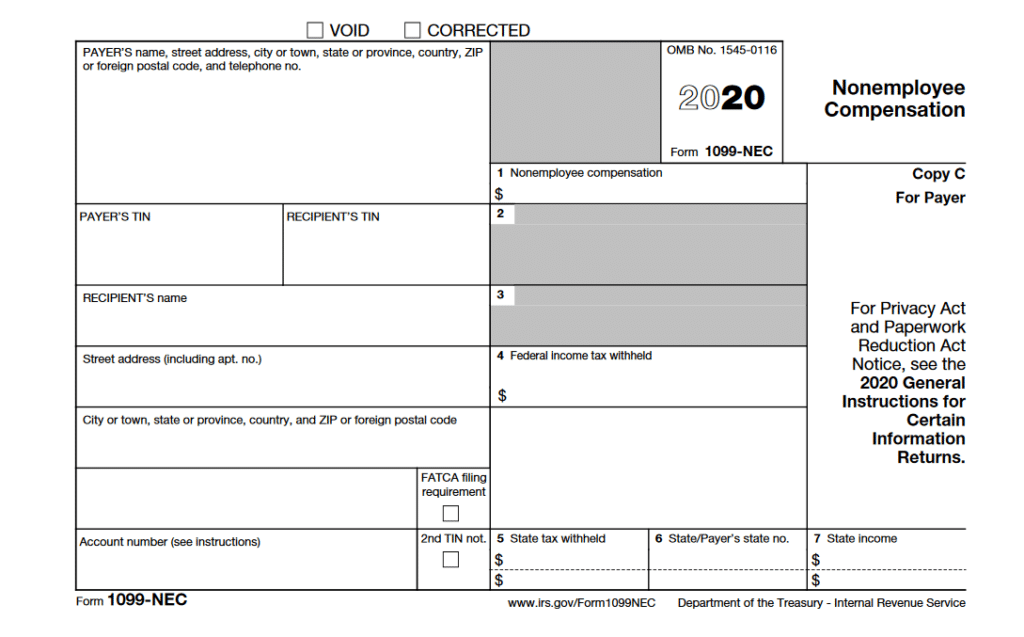

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

You may wonder Are S Corps 1099 reportable As an S Corporation if you have utilized independent contractors it is very likely you will have form 1099 reporting requirements.

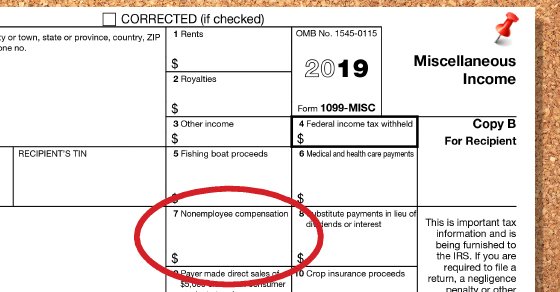

1099 reporting requirements for s corporation. Payments for which a Form 1099-MISC is not required include all of the following. The 1099-MISC was adjusted to eliminate the input of a dollar amount into Box 7. Certain payments to corporations are reportable on Forms 1099-MISC and 1099-NEC.

Reporting 1099-S information to the IRS using REsource 1. Medical and healthcare payments 1099-MISC Box 6 Attorneys fees 1099-NEC Box 1 Gross proceeds to an attorney 1099-MISC Box 10. Form 1099-MISC although they may be taxable to the recipient.

While the IRS requires you to issue 1099 forms to self-employed contractors there are exceptions for S corporations. - Medical and health care payments reported in box 6. This may be achieved by completing IRS Form W-9 using the corporate EIN and identifying the S corporation as the formal payee.

The following payments made to corporations generally must be reported on Form 1099-MISC. As for deadlines 1099-NECs are due to recipients and IRS by Feb. You should report payments of 600 or more for services of nonemployees and attorneys in Box 1 of the 1099-NEC not Box 7 of the 1099-MISC.

Exception to the general rule. If the S corporation sells or abandons secured property to you you must issue a 1099-A. If you engaged in a barter exchange with an S corporation you will need to provide a 1099-B.

Form MISC 1099s serve several purposes. 1 2021 both paper filing and e-filing. However see Reportable payments to corporations later.

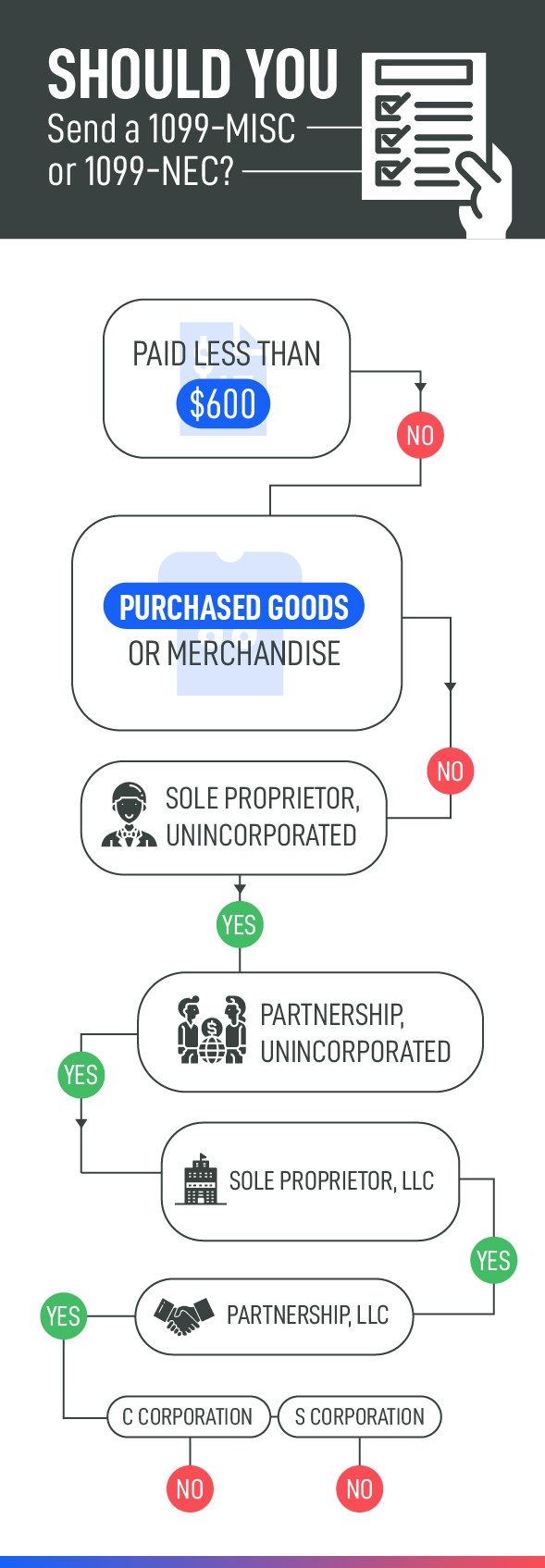

1099-MISC Thresholds and Reporting Requirements In general companies must send 1099-MISC forms if theyve paid a nonemployee 600 or more during the year. Although most payments to corporations are not 1099-MISC and 1099-NEC reportable there are some exceptions. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc.

Most payments to corporations are NOT required to be reported on Form 1099-MISC. To corporations generally must be reported on Form 1099-MISC. From IRSs 1099-Misc instructions.

There is no dollar threshold for filing Form 1099-B. But there are other requirements depending on the type of payments and the relationship between the payor and payee. Most of the time however businesses issue the 1099-MISC forms for payments made directly to the contractors they used for business services during the tax year in question.

Information returns report transaction made during the calendar year to the IRS sometimes us and the recipient. If you made a payment as part of your trade or business including a corporation partnership individual estate and trust who makes reportable transactions during the calendar year you may be required to file an information return. Tax Reporting For practical purposes to direct 1099 income to an S corporation the hired individual must instruct the customer or client to pay the corporation instead of the individual at the outset of the work.

Do i need to issue a 1099 to an S-Corp. The 1099 allows the independent contractors to properly account for and report their income as well as the businesses they contract with to measure their contractor expenses. Form 1099-B is required to be furnished to recipients by February 15 of the year after the year in which the transaction occurred.

Most common questions by corporations and other business entities on 1099 reporting requirements. IRS provides further guidance on Form 1099 reporting. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation.

- Fish purchases for cash reported in box 7. Businesses taxed as S Corps report their employee earnings directly to. Corporations include both S and C corporations as well as limited liability companies LLCs that have elected to be taxed as a C or S corporation with the IRS.

To generate the 1099-S form and 1099 reports it will be necessary to enter the Social Security number of the first seller listed in the Seller tab. Similarly businesses that contract with S Corps do not need to issue them a Form 1099-MISC. 1099 Requirements Generally any time you pay someone 600 or more in a year for services in the course of your trade or business you must issue a.

Below is a direct IRS response to frequently asked question on 1099 issues. In fact separate transactions andor different types of securities are required to be reported on separate 1099-B forms or substitute statements must be used. The business owner or company making payments to independent contractors is responsible for filing.

1099 S Form 4 Part Carbonless Discount Tax Forms

1099 S Form 4 Part Carbonless Discount Tax Forms

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

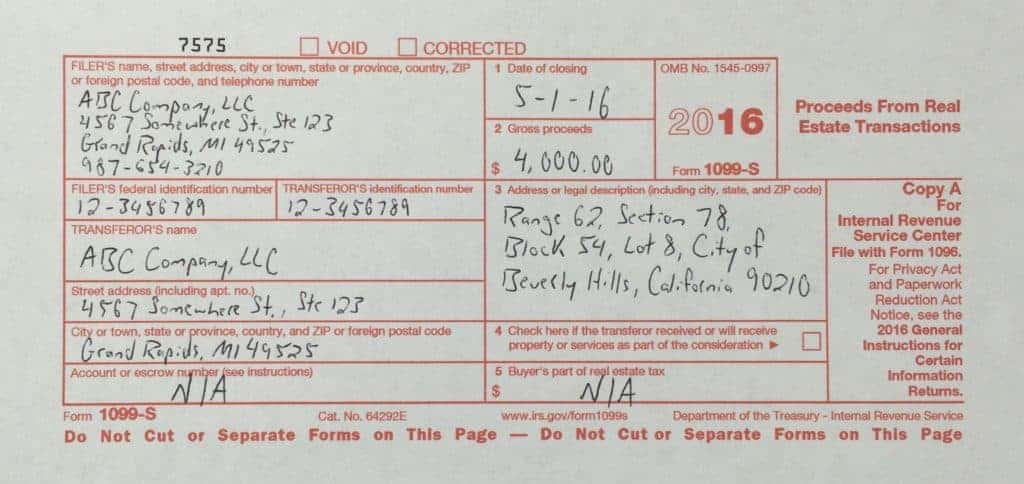

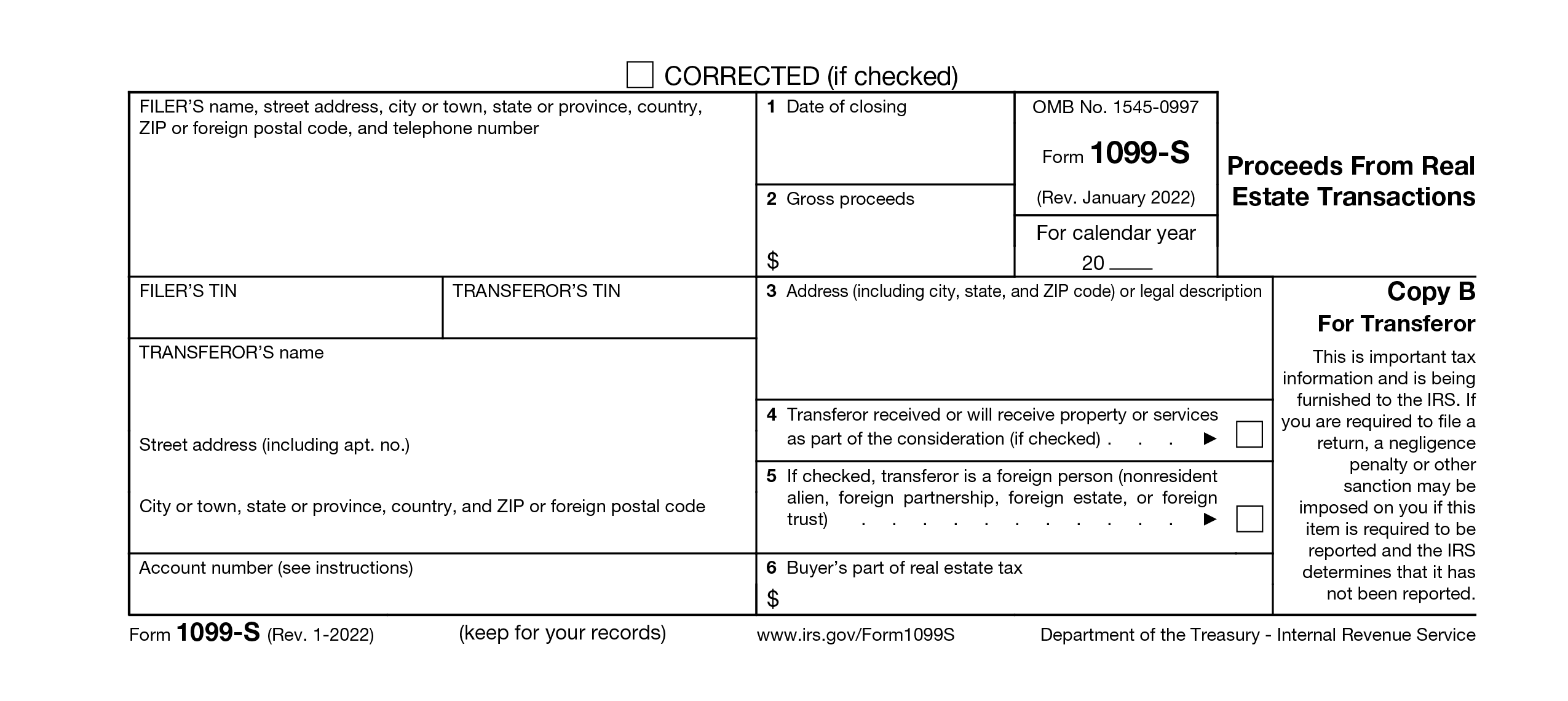

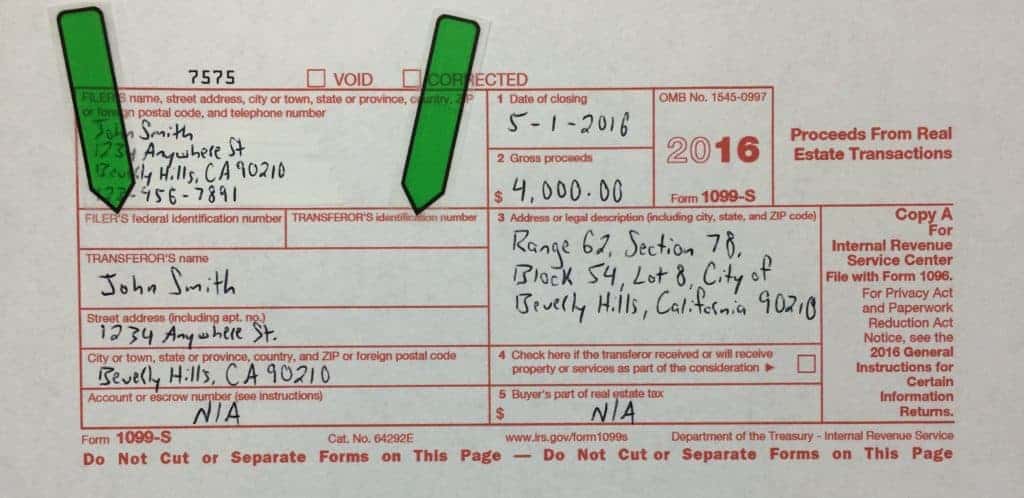

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is Form 1099 S 1099 S Filing Reporting

What Is Form 1099 S 1099 S Filing Reporting

Do Brokers Need To Issue A 1099 For Commission Paid To A Llc Berkshirerealtors

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It