Which Form Of Business Organization Is Most Commonly Associated With Joint And Several Liability

The business itself does not file a tax return. Risk of creating a partnership giving rise to unlimited joint and several liability where each of the JV parties is liable for all losses of the venture.

A Company Is A Form Of Business Organization The Lawyers Jurists

A Company Is A Form Of Business Organization The Lawyers Jurists

Joint and several liability is most relevant in tort claims whereby a plaintiff may recover all the damages from any of the defendants regardless of their individual share of the liability.

Which form of business organization is most commonly associated with joint and several liability. The extent of liability as well as the extent of the control the owner will have over the business is dependent on the form of business. Pursue a common plan or design to commit the tortious act they will be held jointly liable. O Easily formed o Cost is minimal o Not taxable entity o Each owner has equal voice in management o Can easily operate in more than one state o Subject to fewer.

Business relations and the manufacture or marketing of a fungible product in a generic form. Which of the following statements about the corporate form of business organization is true. A Sole proprietorships are the most common form of business organization because liability is limited to the amount invested in the business by the sole proprietor.

B The corporate form has the advantage of unlimited liability. The second section considers several types of business organizations that are. Which organization type is best for your business depends on a number of factors including the type of business it is the number of owners it.

In a general partnership partners share jointly and severally in the liability for business obligations. Business organization an entity formed for the purpose of carrying on commercial enterpriseSuch an organization is predicated on systems of law governing contract and exchange property rights and incorporation. In this chapter introducing the major types of business organizations describing how these forms are both created and ended.

Defendants held jointly. Taxation A sole proprietorship has pass-through taxation. Potentially difficult to raise external loan finance as not a legal entity and does not own assets it cannot grant a floating charge as security for financing.

This task can be a new project or any. The most common forms of business enterprises in use in the United States are the sole proprietorship general partnership limited liability company LLC and corporation. A limited partnership is a bit different in that it is typically defined as a partnership.

Individual proprietorships partnerships or limited-liability companies or corporations. Business enterprises customarily take one of three forms. Rather the income or loss passes through and is reported on the owners personal tax.

The sole proprietorship is the most common form of legal structure for small businesses. The rule is often applied in negligence cases though it is sometimes invoked in other areas of law. A joint venture JV is a business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task.

General Partnerships Partnership- a business organization consisting of two or more owners who agree to carry on a business and to share profits and losses Drafted in articles of partnership Advantages of Partnership. 1 most popular form for a large business 2 most business by volume is conducted by corporations 3 corporation is a separate legal entity created by state law - taxed as a separate legal entity - any income that is dispersed to the owners and shareholders is also taxed - result is a major disadvantage of the corporate form - double taxation. Joint and several liability will arise in certain actions Joint and several liability will not arise.

Joint and several liability is a legal term for a responsibility that is shared by two or more parties to a lawsuit. A wronged party may sue any or all of them and collect the total damages.

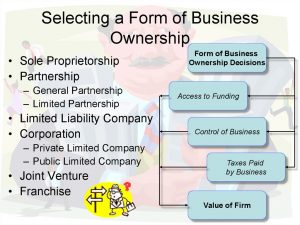

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Advisory Services Agreement Uses In Limitation On Liability Clause Liability Clause Agreement

Advisory Services Agreement Uses In Limitation On Liability Clause Liability Clause Agreement

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

The 5 Legal Structures Of A Business Salesforce Com

The 5 Legal Structures Of A Business Salesforce Com

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

8 Main Types Of Business Ownership Best Business Ownership Classification

8 Main Types Of Business Ownership Best Business Ownership Classification

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Ethiopian Laws Of Business Traders And Business Organizations Grin

Ethiopian Laws Of Business Traders And Business Organizations Grin

Fundamental Accounting Equation Accounting Accounting Jobs Finance

Fundamental Accounting Equation Accounting Accounting Jobs Finance