What Is A Short Form Merger

A short form merger also known as a parent - subsidiary merger is the combination of a parent company and a subsidiary previously the target firm that is not necessarily wholly owned by the parent. What is a typical amount of the merger filing fee for a Phase I clearance in Serbia.

Types Of Mergers Learn About The Different Types Of M A

Types Of Mergers Learn About The Different Types Of M A

Permitted when a subsidiary merges into a parent that already owns most of the subsidiarys shares.

What is a short form merger. The Division works closely with the registered agents that provide incorporating services and we encourage the users of this web page to contact one of the registered. A short-form merger sometimes referred to as a parent-subsidiary merger is generally used when the acquiring company plans on merging with a subsidiary company although the subsidiary doesnt necessarily have to be wholly owned by the acquiring company. The parent company is typically required to have an extremely large stake in the subsidiary a typical requirement is that the parent own 80 or 90 of each class of stock issued by the subsidiary.

The Short-Form Merger Process Effecting a short-form merger is a relatively straightforward process. What are the deadlines for merger notification in Serbia. A short-form merger is a procedure allowed in some jurisdictions where a parent can merge with a subsidiary without shareholder approval.

See Code of Ala. A merger is a financial activity that is undertaken in a large variety of industries. The short-form merger is the preferred route as it does not require a shareholder vote or proxy statement filing and can thus be completed significantly faster.

The merger is accomplished by filing a Certificate of Ownership with the Secretary of State. Delaware law requires every business entity to maintain a registered agent in Delaware. As a continuation of the previous article.

Short-Form Merger is a merger that is less expensive and time-consuming than an ordinary statutory merger usu. Healthcare financial institutions private investments industrials and many more. The parties must notify the planned transaction within 15 days of the signing of a binding transaction agreement.

In order to simplify the procedure when there are no or almost no minority shareholders business corporation statutes authorize what is called a short-form merger. A short form merger is when a parent corporation merges with a subsidiary business without a shareholders approval. Short-form merger should be aware of this recent authority and its implications.

There are two main types of mergers. A short-form merger may take place in situations in which the stockholder approval process is not necessary. Contest short form mergers by employing.

Short Form Merger Certificate of Ownership California Corporations Code section 1110 allows the merger of a subsidiary corporation into the parent by a simplified procedure if the parent owns 100 percent of the outstanding shares of the subsidiary. What is the definition of merger. Either entity can be designated as the survivor of the merger.

Although not available in all states state statutes will typically mandate that the parent entity owns at least 90 of the subsidiary before a short form merger can be enacted. State statutes typically mandate that the parent entity must own at least 90 of the subsidiary before. A short-form merger is the merger of a parent and a subsidiary when the parent already owns substantially all of the subsidiary.

A short-form merger does not require approval of the stockholders of the subsidiary. Short-Form Merger Also known as a parent-subsidiary merger a short-form merger is a merger between a parent company and its substantially but not necessarily wholly owned subsidiary with either the parent company or the subsidiary surviving the merger. A parent-subsidiary up-stream merger is a merger of a subsidiary business entity into its parent business entity with the parent business entity surviving.

A short form merger combines a parent company and a subsidiary that is substantially owned by the parent. The Division of Corporations provides these forms as a general guide. Such a merger is generally accomplished when the parent adopts a merger resolution mails a copy of the plan to the subsidiarys record shareholders and files the executed.

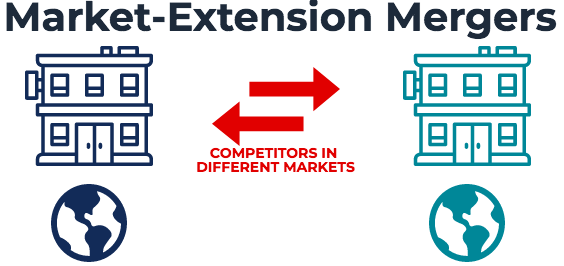

Is there a short-form merger notification in Serbia. Horizontal mergers occur when two businesses in the same industry combine into one. Yet short-form mergers historically required the bidder to own 90 percent of the outstanding shares compared with only 50 percent for a.

A short-form merger occurs in the case of a parent corporation who is merging with a subsidiary company of its own. The requirements for a short form merger are set forth in the statutes of the applicable state government. Put simply shareholders holding 90 percent or more of the shares called the control.

This type of combination can cause anti-trust issues depending on. Short-form mergers can either be upstream a merger of the subsidiary into the parent or downstream merger of the parent into the subsidiary.

Mergers Vs Acquisitions Accounting And Finance Financial Life Hacks Financial Literacy

Mergers Vs Acquisitions Accounting And Finance Financial Life Hacks Financial Literacy

Reasons For Merger And Acquisition Financial Management Marketing Skills Vertical Integration

Reasons For Merger And Acquisition Financial Management Marketing Skills Vertical Integration

Types Of Mergers And Acquisitions A Complete Summary

Types Of Mergers And Acquisitions A Complete Summary

Linkedin Announces Merger Of Elevate Functionality With Company Pages Social Media Today Https Replug Link 5b355 Social Media Stats Linkedin Page Elevation

Linkedin Announces Merger Of Elevate Functionality With Company Pages Social Media Today Https Replug Link 5b355 Social Media Stats Linkedin Page Elevation

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Types Of Mergers Learn About The Different Types Of M A

Types Of Mergers Learn About The Different Types Of M A

Mergers And Acquisitions Powerpoint Template Slidesalad Powerpoint Templates Powerpoint Design Templates Powerpoint

Mergers And Acquisitions Powerpoint Template Slidesalad Powerpoint Templates Powerpoint Design Templates Powerpoint

Mergers Are Like Marriages They Are The Bringing Together Of Two Individuals If You Wouldn T Marry Someone For The Operational Merger Two S Company Service

Mergers Are Like Marriages They Are The Bringing Together Of Two Individuals If You Wouldn T Marry Someone For The Operational Merger Two S Company Service

How To Write A Formal Letter To Clients Of A Merger We Provide A Perfectly Written Letter To Clients Of The Successor Firm Th A Formal Letter Lettering Merger

How To Write A Formal Letter To Clients Of A Merger We Provide A Perfectly Written Letter To Clients Of The Successor Firm Th A Formal Letter Lettering Merger

Mergers And Acquisitions Ma Process And Steps Merger Portfolio Strategy Life Cycles

Mergers And Acquisitions Ma Process And Steps Merger Portfolio Strategy Life Cycles

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Merge Different Video Clips Into A New Big Video Allpepole Software For All People Video All Video Merge

Merge Different Video Clips Into A New Big Video Allpepole Software For All People Video All Video Merge

Types Of Mergers Learn About The Different Types Of M A

Types Of Mergers Learn About The Different Types Of M A

Firstly Mergers And Acquisitions Are Two Terms In Business Where Two Brands Are Ready To Make Business Together Merger Make Business Online

Firstly Mergers And Acquisitions Are Two Terms In Business Where Two Brands Are Ready To Make Business Together Merger Make Business Online

Tips For Crafting Your New Culture In Mergers And Acquisitions M A Business Plan Presentation Merger Work Quotes

Tips For Crafting Your New Culture In Mergers And Acquisitions M A Business Plan Presentation Merger Work Quotes

Countries That Have Changed Their Names Vivid Maps Ancient Names Country Names Map

Countries That Have Changed Their Names Vivid Maps Ancient Names Country Names Map

Apply These 5 Secret Techniques To Improve Mergers And Acquisitions In India Infographic Merger Portfolio Strategy Financial Advisory

Apply These 5 Secret Techniques To Improve Mergers And Acquisitions In India Infographic Merger Portfolio Strategy Financial Advisory

Financial Management Toolkit Corporate Strategy Financial Management Financial Quotes

Financial Management Toolkit Corporate Strategy Financial Management Financial Quotes

What Actually Is Mergers And Acquisitions Equity Capital Merger Social Capital

What Actually Is Mergers And Acquisitions Equity Capital Merger Social Capital