Withdraw Money From Business Account For Personal Use

Any money you withdraw from the business checking is not going to affect your taxable income as all income and expenses are already flowing through to you on your K-1. At the top click the Create menu and select Cheque or Expense.

How To Record A Cash Withdrawal In Accounting

How To Record A Cash Withdrawal In Accounting

Can I Take Funds From My Business Account For Personal Use.

Withdraw money from business account for personal use. Choose the Payee and the Bank Account used to withdraw the money. When a business owner withdraws cash from a company account the value of company assets decreases because some capital reserves have been transferred from business to personal use. In the ACCOUNT column enter Owners Equity or Partner Equity.

Is it illegal for a business partner to withdraw money from a company account for personal use. In other words an owners withdrawal is when an owner takes money out of the company for personal use. Never make an ATM cash withdrawal from your business bank account.

How to Record Cash Withdrawal used for Business Expense. How to Journalize Cash Withdrawals for Personal Use Your Business Structure. The partner has been withdrawing money from the payrolltaxes bank account and has now cleaned out whatever was left.

In a partnership for. The legal structure you choose affects your ability to make withdrawals. For example say the business earned 100000 for the year after expenses there are 2 partners and each owns 50.

Simply prepare a check from the business account to yourself and deposit it into your personal bank account to pay your bills. Whether you find yourself in a situation where taking out some cash from your business is a question of necessity or whether this is an issue that has arisen as a matter of course taking the time to properly plan how youre going to withdraw money from your business will ensure that youll pay the minimum amount of tax necessary. You may withdraw cash from the corporation tax-free by borrowing money from it.

If your business needs to use cash set up a petty cash account and fund it by writing a check for petty cash. For a sole proprietorship accounting sample suppose you have 15000 in your. Corporations classify their shareholder payments differently.

The taking from Checking to Cash is a transfer function. However you can only make a cash withdrawal on behalf of a firm if you are an authorized signer of the business although you can cash a check drawn from the account even if you have no affiliation with the business. In the AMOUNT column.

A clean paper trail will keep the IRS off your back and that means money in your pocket. Go to the Account details section. Sole Proprietorship Accounting Sample.

As companies exist as a separate legal entity they must have a separate bank account for the business. The careful use of a combination of these methods can be an extremely tax efficient way to minimise personal tax liabilities and run a business. Neither state nor federal laws prevent you from withdrawing cash from a business account at a bank or credit union.

The laws regarding sole traders and the use of business income is different to that of companies. Withdrawing Funds Safely No matter the structure of your business the safest way for you to get funds to pay personal expenses is to withdraw the money from your business in the form of a paycheck or owner distribution. If you are the sole member of your LLC you can withdraw cash as owner distributions as your companys profit and cash flow allow.

Make sure the operating agreement explicitly empowers you to do that of course. You create a Bank account and name it Cash On Hand. Bottom line - technically the withdrawal is just writing yourself a check from the business account or moving money between your personal and business accounts.

Then you use Write Check from the CASH account to enter how those funds were spent. My husband is co-owner of a company and his business partner is a really bad drug addict. However to avoid having the loan characterized as a corporate distribution it should be properly documented in a loan agreement or a note and be made on terms that are comparable to those on which an unrelated third party would lend money to you.

Let me show you how to do it. An owners withdrawal sometimes called a distribution is a payment of cash or assets from a partnership or sole proprietorship to one of its owners. This is due to the fact that corporation tax is payable at just 20 percent while income tax on earnings over 50001 with the 12500 personal allowance sits at 40 percent.

I provided relevant information in this video in order to solve the problems of not being able to withdraw your cash to your personal bank accountYou can co. If your LLC is a multi-member LLC the members must agree on. If youre a sole member - you need not more than that.

If you want to pay yourself write yourself a check.

Journal Entry For Cash Withdrawn From Bank Class 11 Book Keeping And Accountancy Journal Entries Journal Withdrawn

Journal Entry For Cash Withdrawn From Bank Class 11 Book Keeping And Accountancy Journal Entries Journal Withdrawn

Paypalmoneyhacker Money Generator Money Tips Free Money Hack

Paypalmoneyhacker Money Generator Money Tips Free Money Hack

Creating A Business Account On Instagram Instagram Business Account Creating A Business Business Account

Creating A Business Account On Instagram Instagram Business Account Creating A Business Business Account

How To Deposit Withdraw Money Gbp Eur On Binance Coinzodiac Cryptocurrency Trading Bitcoin Currency Money

How To Deposit Withdraw Money Gbp Eur On Binance Coinzodiac Cryptocurrency Trading Bitcoin Currency Money

Us Dollar Google Da Ara Dollar Easy Online Business Dollar Banknote

Us Dollar Google Da Ara Dollar Easy Online Business Dollar Banknote

7 Penalty Free Ways To Withdraw Money From Your Retirement Account Inheritance Tax Retirement Accounts Inheritance

7 Penalty Free Ways To Withdraw Money From Your Retirement Account Inheritance Tax Retirement Accounts Inheritance

What You Need To Know Before You Withdraw From Your 401 K Plan Blissful In Business Personal Finance Printables Personal Finance Blogs Saving Money Budget

What You Need To Know Before You Withdraw From Your 401 K Plan Blissful In Business Personal Finance Printables Personal Finance Blogs Saving Money Budget

Deposit And Withdraw Personal Financial Literacy Make It Spend It Track It Personal Financial Literacy Financial Literacy Financial Literacy Activities

Deposit And Withdraw Personal Financial Literacy Make It Spend It Track It Personal Financial Literacy Financial Literacy Financial Literacy Activities

How To Withdraw Large Amounts Of Cash From A Bank

Withdrawal Finally Successful Waiting For Commission Confirmation Payday Forexprofit Forex Blockchain Wallet Bitcoin Investing

Withdrawal Finally Successful Waiting For Commission Confirmation Payday Forexprofit Forex Blockchain Wallet Bitcoin Investing

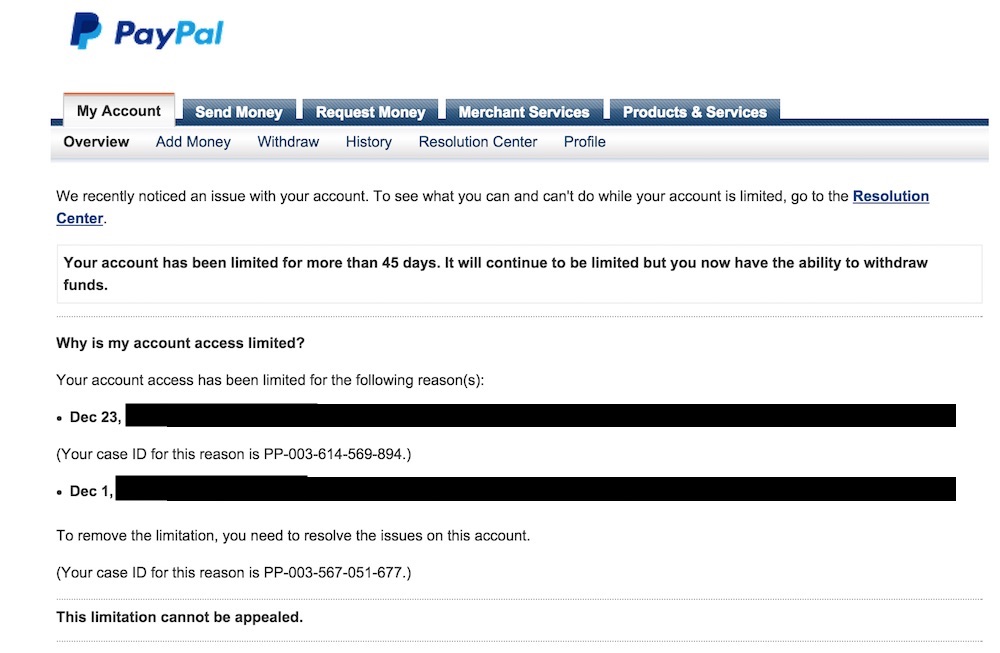

How To Withdraw Money From Limited Paypal Account Techwalls

How To Withdraw Money From Limited Paypal Account Techwalls

How Withdrawing Cash Can Totally Change Your Savings Game Living A Happyfull Life Saving Money Saving Start Saving Money

How Withdrawing Cash Can Totally Change Your Savings Game Living A Happyfull Life Saving Money Saving Start Saving Money

How To Withdraw Money From Fbs Bonus Account Latest Forex Tips Forex Books Financial Instrument Accounting

How To Withdraw Money From Fbs Bonus Account Latest Forex Tips Forex Books Financial Instrument Accounting

Tu Classic Personal Insurance Savings Account Free Dental

Tu Classic Personal Insurance Savings Account Free Dental

Photo 907607 Paypal Business Freelance Marketing Buy Things Online

Photo 907607 Paypal Business Freelance Marketing Buy Things Online

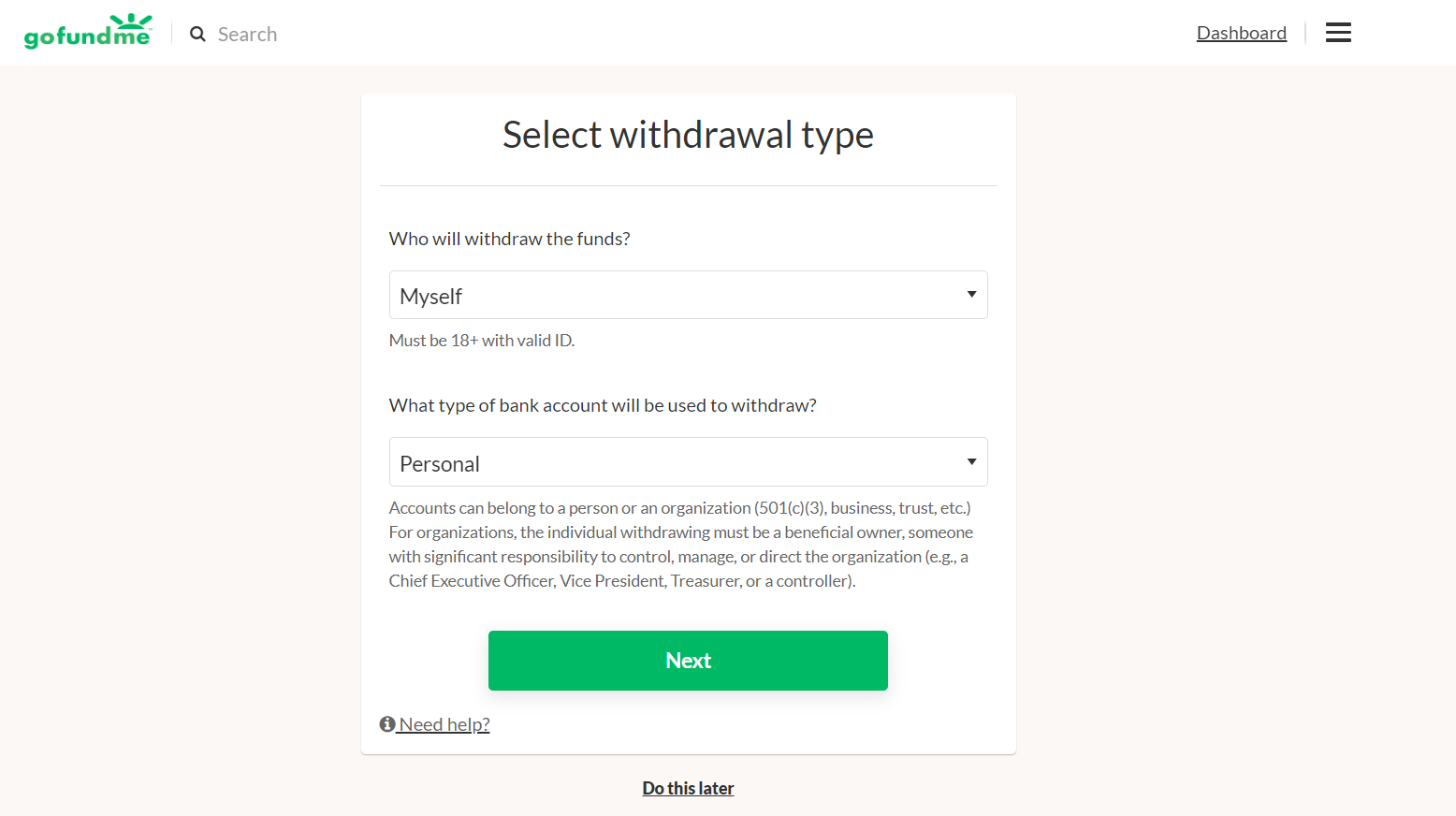

Withdraw Money To Your Personal Bank Account Gofundme Help Center

Withdraw Money To Your Personal Bank Account Gofundme Help Center

![]() What S The Most Cash You Can Withdraw From The Bank At Once Mybanktracker

What S The Most Cash You Can Withdraw From The Bank At Once Mybanktracker