The Legal Form Of Business Ownership In Which Profits And Losses Are Shared Equally Is A

Unlike in corporations and limited partnerships ownership interests are not automatically determined by the amount of capital each partner contributed to the business although the partnership agreement may provide otherwise. You should learn about the types of partnerships available and consider the advantages and disadvantages of a partnership before choosing or amending this business relationship.

The Llc Operating Agreement Sample Operating Agreement Nolo

The Llc Operating Agreement Sample Operating Agreement Nolo

A joint venture JV is a business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task.

The legal form of business ownership in which profits and losses are shared equally is a. What are the different types of partnerships. Most states also permit single-member LLCs those having only one owner. A general partnership is formed when two or more persons agree to share profits and losses in a joint business venture.

For tax reporting the partnership files a form 1065 with the IRS and issues each partner a K-1 allocating to that partner their share of the profits or losses. When ownership interests are equal the profits and losses of the business are also shared equally. Unless operating under the names of the partners a partnership must file for a trade name with the state.

Partnership is defined as two or less than 100 people running a business for sharing of profit and losses. In the general partnership the limited liability partnership the limited liability limited partnership and the limited partnership profits and losses are passed through to the partners as specified in the partnership agreement. Businesses are partnerships 2 and though the vast majority are small some are quite large.

Each involves a different approach to dealing with profits and losses Figure 910 Business Forms. By default an LLCs profits are allocated in proportion to ownership interests. There are three basic forms of business.

The partnership is a form of business where two or more person may pool their resources to run the business operations. A general partnership is not a separate legal entity and partners are jointly and severally liable for the partnerships debts including acts of malpractice by other partners. Here in the partnership the profit and.

Several legal forms of business are available to executives. Unlike shareholders in a corporation LLCs are not taxed as a separate business entity. Partners share profits and losses equally.

Changing the Method of LLC Profit Allocation. In a partnership the business passes through any profits or losses to its partners. A partnership is an association of two or more persons who carry on as co-owners and share profits.

There can be a contribution of money capital investment in the business project or services in return for a share of the profits. A partnership or general partnership is a business owned jointly by two or more people. The legal form a firm chooses to operate under is an important decision with implications for how a firm structures its resources and assets.

The advantages of partnership is easy to form. For example if two LLC members each own 50 percent of the LLC half of the profits is allocated to each owner. Instead all profits and losses are passed through the business to each member of the LLC.

Performance trust teamwork planning communication is some of the requirement for a partnership to be successful. For example the big four public accounting firms are partnerships. This task can be a new project or any.

Partners include their respective share of the partnerships income or loss on their personal tax returns. If an LLC does not specify an alternative method this is how the company must allocate its profits. Sole proprietorship partnership and corporation are the three legal forms of business ownership.

About 10 percent of US. A partnership is a business arrangement where two or more individuals share ownership in a company and agree to share in the profits and losses of their company. The second legal form of business ownership is partnership.

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Business Structures For Startups Founder S Guide

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg) Which Terms Should Be Included In A Partnership Agreement

Which Terms Should Be Included In A Partnership Agreement

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Difference Between General Partner And Limited Partner Difference Between

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

How Do Business Partnerships Work Lawsuit Org

How Do Business Partnerships Work Lawsuit Org

Free Partnership Agreement Template Create A Partnership Agreement

Free Partnership Agreement Template Create A Partnership Agreement

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

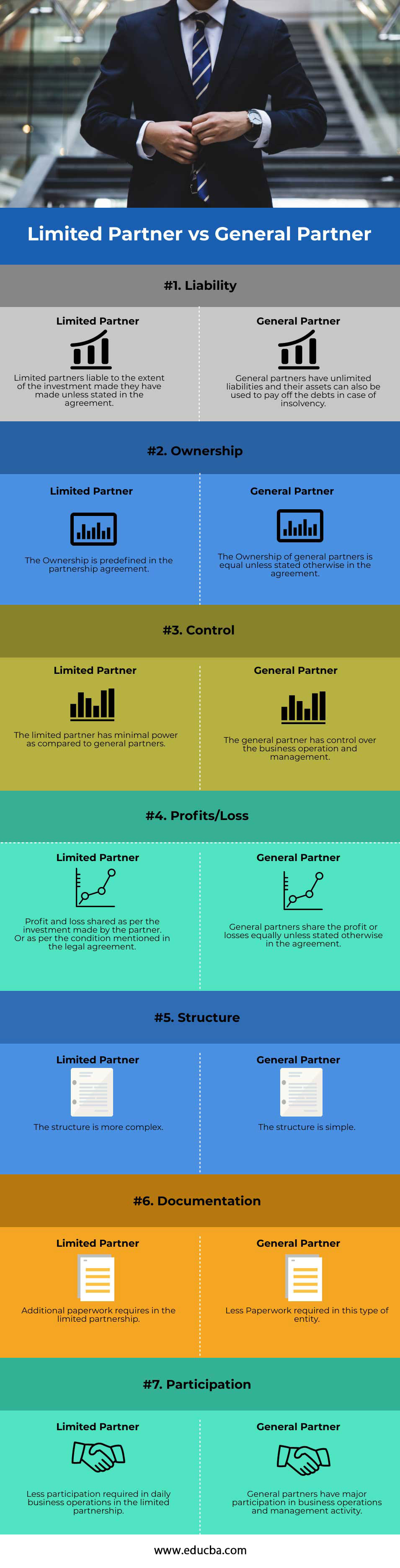

Limited Partner Vs General Partner Top 7 Differences You Should Know

Limited Partner Vs General Partner Top 7 Differences You Should Know

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

Form A Partnership The Complete Legal Guide Nolo

Form A Partnership The Complete Legal Guide Nolo